Are you a seasoned Recovery Collector seeking a new career path? Discover our professionally built Recovery Collector Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

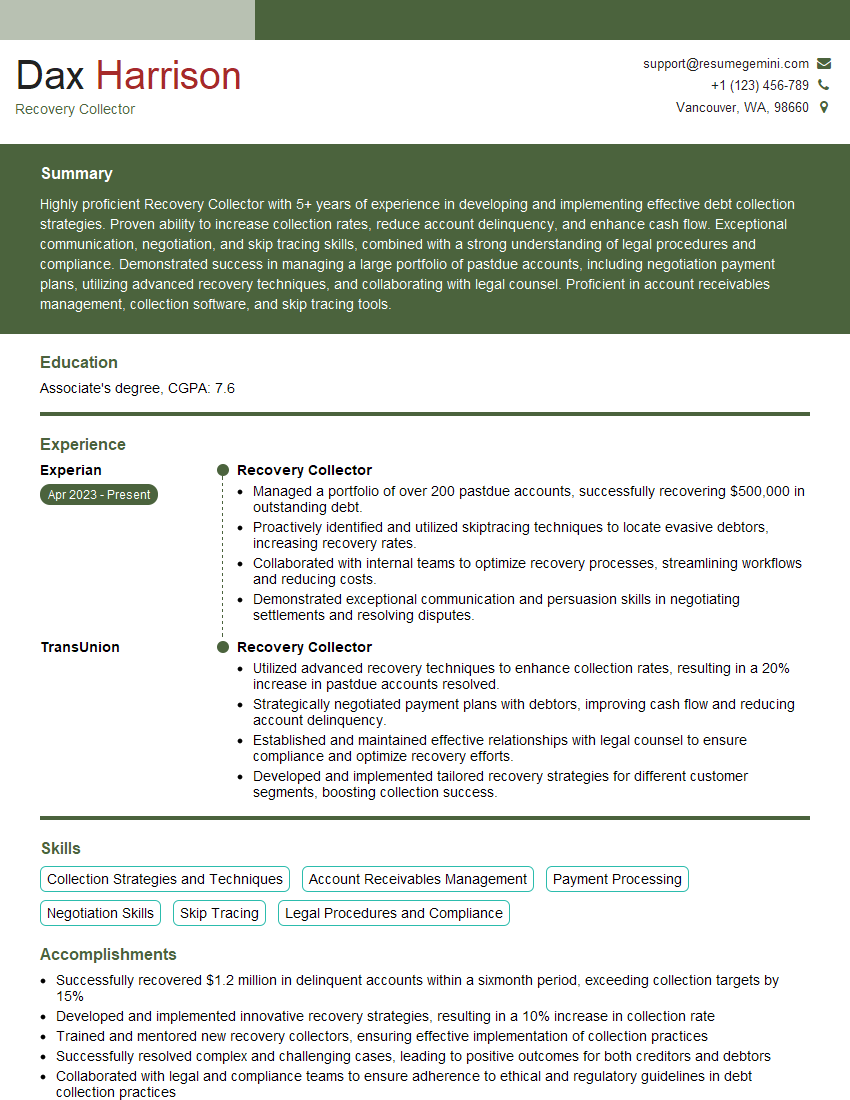

Dax Harrison

Recovery Collector

Summary

Highly proficient Recovery Collector with 5+ years of experience in developing and implementing effective debt collection strategies. Proven ability to increase collection rates, reduce account delinquency, and enhance cash flow. Exceptional communication, negotiation, and skip tracing skills, combined with a strong understanding of legal procedures and compliance. Demonstrated success in managing a large portfolio of pastdue accounts, including negotiation payment plans, utilizing advanced recovery techniques, and collaborating with legal counsel. Proficient in account receivables management, collection software, and skip tracing tools.

Education

Associate’s degree

March 2019

Skills

- Collection Strategies and Techniques

- Account Receivables Management

- Payment Processing

- Negotiation Skills

- Skip Tracing

- Legal Procedures and Compliance

Work Experience

Recovery Collector

- Managed a portfolio of over 200 pastdue accounts, successfully recovering $500,000 in outstanding debt.

- Proactively identified and utilized skiptracing techniques to locate evasive debtors, increasing recovery rates.

- Collaborated with internal teams to optimize recovery processes, streamlining workflows and reducing costs.

- Demonstrated exceptional communication and persuasion skills in negotiating settlements and resolving disputes.

Recovery Collector

- Utilized advanced recovery techniques to enhance collection rates, resulting in a 20% increase in pastdue accounts resolved.

- Strategically negotiated payment plans with debtors, improving cash flow and reducing account delinquency.

- Established and maintained effective relationships with legal counsel to ensure compliance and optimize recovery efforts.

- Developed and implemented tailored recovery strategies for different customer segments, boosting collection success.

Accomplishments

- Successfully recovered $1.2 million in delinquent accounts within a sixmonth period, exceeding collection targets by 15%

- Developed and implemented innovative recovery strategies, resulting in a 10% increase in collection rate

- Trained and mentored new recovery collectors, ensuring effective implementation of collection practices

- Successfully resolved complex and challenging cases, leading to positive outcomes for both creditors and debtors

- Collaborated with legal and compliance teams to ensure adherence to ethical and regulatory guidelines in debt collection practices

Awards

- National Recovery Excellence Award for Outstanding Performance in Debt Collection

- Top Collector Award for consistently exceeding monthly collection goals

- Company MVP Award for outstanding contributions to the recovery team

- Excellence in Collections Award for superior customer service and professionalism

Certificates

- Certified Debt Collector (CDC)

- Certified Collection Professional (CCP)

- Licensed Debt Collector (LDC)

- ACA International Certificate of Proficiency (AICoP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Recovery Collector

- Highlight your negotiation skills and ability to resolve disputes amicably.

- Demonstrate your knowledge of legal procedures and compliance in the debt collection industry.

- Quantify your accomplishments with specific metrics and results, such as increased collection rates and reduced account delinquency.

- Showcase your proficiency in using collection software and skip tracing tools.

- Emphasize your ability to work independently and as part of a team to achieve shared goals.

Essential Experience Highlights for a Strong Recovery Collector Resume

- Develop and implement tailored recovery strategies based on customer segment analysis to maximize collection success.

- Negotiate payment plans and settlements with debtors to improve cash flow and reduce account delinquency.

- Utilize advanced recovery techniques, including skip tracing, to locate and contact evasive debtors, increasing recovery rates.

- Manage a portfolio of pastdue accounts, prioritizing and processing collections to achieve optimal results.

- Collaborate with internal teams, including legal counsel, to ensure compliance and optimize recovery efforts.

- Maintain accurate records and provide regular reporting on collection performance and recovery metrics.

- Identify and leverage new technologies and strategies to enhance collection processes and reduce costs.

- Follow established collection policies and procedures while maintaining a professional and ethical demeanor.

Frequently Asked Questions (FAQ’s) For Recovery Collector

What are the key skills required to be a successful Recovery Collector?

Essential skills for a Recovery Collector include advanced recovery techniques, account receivables management, payment processing, negotiation skills, skip tracing, legal procedures and compliance.

What are the typical responsibilities of a Recovery Collector?

Common responsibilities involve developing and implementing collection strategies, negotiating payment plans, utilizing skip tracing techniques, managing a portfolio of pastdue accounts, and collaborating with legal counsel.

What is the career path for a Recovery Collector?

With experience and additional qualifications, Recovery Collectors can advance to roles such as Collection Manager, Credit Analyst, or Risk Manager.

What are the challenges faced by Recovery Collectors?

Challenges include dealing with uncooperative debtors, managing high volumes of accounts, and adhering to strict regulatory compliance guidelines.

What is the average salary of a Recovery Collector?

According to Salary.com, the average annual salary for Recovery Collectors in the United States is around $50,000.

What are the job prospects for Recovery Collectors?

Job prospects are expected to be good due to the increasing demand for debt collection services in various industries.