Are you a seasoned Reinsurance Clerk seeking a new career path? Discover our professionally built Reinsurance Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

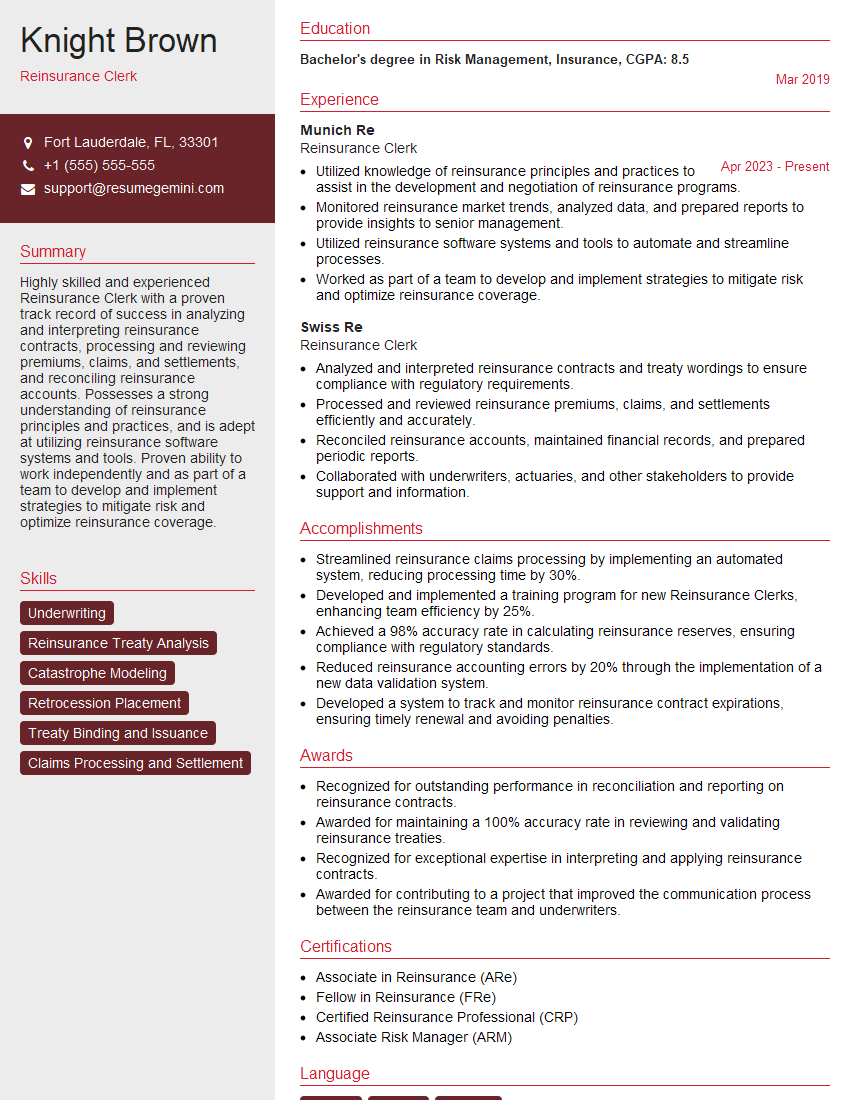

Knight Brown

Reinsurance Clerk

Summary

Highly skilled and experienced Reinsurance Clerk with a proven track record of success in analyzing and interpreting reinsurance contracts, processing and reviewing premiums, claims, and settlements, and reconciling reinsurance accounts. Possesses a strong understanding of reinsurance principles and practices, and is adept at utilizing reinsurance software systems and tools. Proven ability to work independently and as part of a team to develop and implement strategies to mitigate risk and optimize reinsurance coverage.

Education

Bachelor’s degree in Risk Management, Insurance

March 2019

Skills

- Underwriting

- Reinsurance Treaty Analysis

- Catastrophe Modeling

- Retrocession Placement

- Treaty Binding and Issuance

- Claims Processing and Settlement

Work Experience

Reinsurance Clerk

- Utilized knowledge of reinsurance principles and practices to assist in the development and negotiation of reinsurance programs.

- Monitored reinsurance market trends, analyzed data, and prepared reports to provide insights to senior management.

- Utilized reinsurance software systems and tools to automate and streamline processes.

- Worked as part of a team to develop and implement strategies to mitigate risk and optimize reinsurance coverage.

Reinsurance Clerk

- Analyzed and interpreted reinsurance contracts and treaty wordings to ensure compliance with regulatory requirements.

- Processed and reviewed reinsurance premiums, claims, and settlements efficiently and accurately.

- Reconciled reinsurance accounts, maintained financial records, and prepared periodic reports.

- Collaborated with underwriters, actuaries, and other stakeholders to provide support and information.

Accomplishments

- Streamlined reinsurance claims processing by implementing an automated system, reducing processing time by 30%.

- Developed and implemented a training program for new Reinsurance Clerks, enhancing team efficiency by 25%.

- Achieved a 98% accuracy rate in calculating reinsurance reserves, ensuring compliance with regulatory standards.

- Reduced reinsurance accounting errors by 20% through the implementation of a new data validation system.

- Developed a system to track and monitor reinsurance contract expirations, ensuring timely renewal and avoiding penalties.

Awards

- Recognized for outstanding performance in reconciliation and reporting on reinsurance contracts.

- Awarded for maintaining a 100% accuracy rate in reviewing and validating reinsurance treaties.

- Recognized for exceptional expertise in interpreting and applying reinsurance contracts.

- Awarded for contributing to a project that improved the communication process between the reinsurance team and underwriters.

Certificates

- Associate in Reinsurance (ARe)

- Fellow in Reinsurance (FRe)

- Certified Reinsurance Professional (CRP)

- Associate Risk Manager (ARM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Reinsurance Clerk

- Highlight your technical skills, such as proficiency in reinsurance software and analytical tools.

- Emphasize your understanding of reinsurance principles and practices.

- Showcase your ability to work independently and as part of a team.

- Demonstrate your commitment to continuous learning and professional development.

Essential Experience Highlights for a Strong Reinsurance Clerk Resume

- Analyze and interpret reinsurance contracts and treaty wordings to ensure compliance with regulatory requirements

- Process and review reinsurance premiums, claims, and settlements efficiently and accurately

- Reconcile reinsurance accounts, maintain financial records, and prepare periodic reports

- Collaborate with underwriters, actuaries, and other stakeholders to provide support and information

- Utilize knowledge of reinsurance principles and practices to assist in the development and negotiation of reinsurance programs

- Monitor reinsurance market trends, analyze data, and prepare reports to provide insights to senior management

- Utilize reinsurance software systems and tools to automate and streamline processes

Frequently Asked Questions (FAQ’s) For Reinsurance Clerk

What is the role of a Reinsurance Clerk?

A Reinsurance Clerk is responsible for analyzing and interpreting reinsurance contracts, processing and reviewing premiums, claims, and settlements, and reconciling reinsurance accounts.

What are the qualifications for a Reinsurance Clerk?

A Bachelor’s degree in Risk Management, Insurance, or a related field is typically required. Additionally, strong analytical and problem-solving skills are essential.

What are the key responsibilities of a Reinsurance Clerk?

Key responsibilities include analyzing reinsurance contracts, processing and reviewing premiums, claims, and settlements, reconciling reinsurance accounts, and collaborating with other stakeholders.

What are the career prospects for a Reinsurance Clerk?

With experience, a Reinsurance Clerk can advance to roles such as Reinsurance Underwriter, Reinsurance Broker, or Reinsurance Manager.

What are the key skills for a Reinsurance Clerk?

Key skills include analytical skills, attention to detail, proficiency in reinsurance software, and knowledge of reinsurance principles and practices.

What are the challenges faced by a Reinsurance Clerk?

Challenges can include the need to stay up-to-date with regulatory changes, the complexity of reinsurance contracts, and the need to work under tight deadlines.

What is the work environment for a Reinsurance Clerk?

Reinsurance Clerks typically work in an office environment, often as part of a team.

What is the salary range for a Reinsurance Clerk?

The salary range for a Reinsurance Clerk can vary depending on experience, location, and company size.