Are you a seasoned Repossessor seeking a new career path? Discover our professionally built Repossessor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

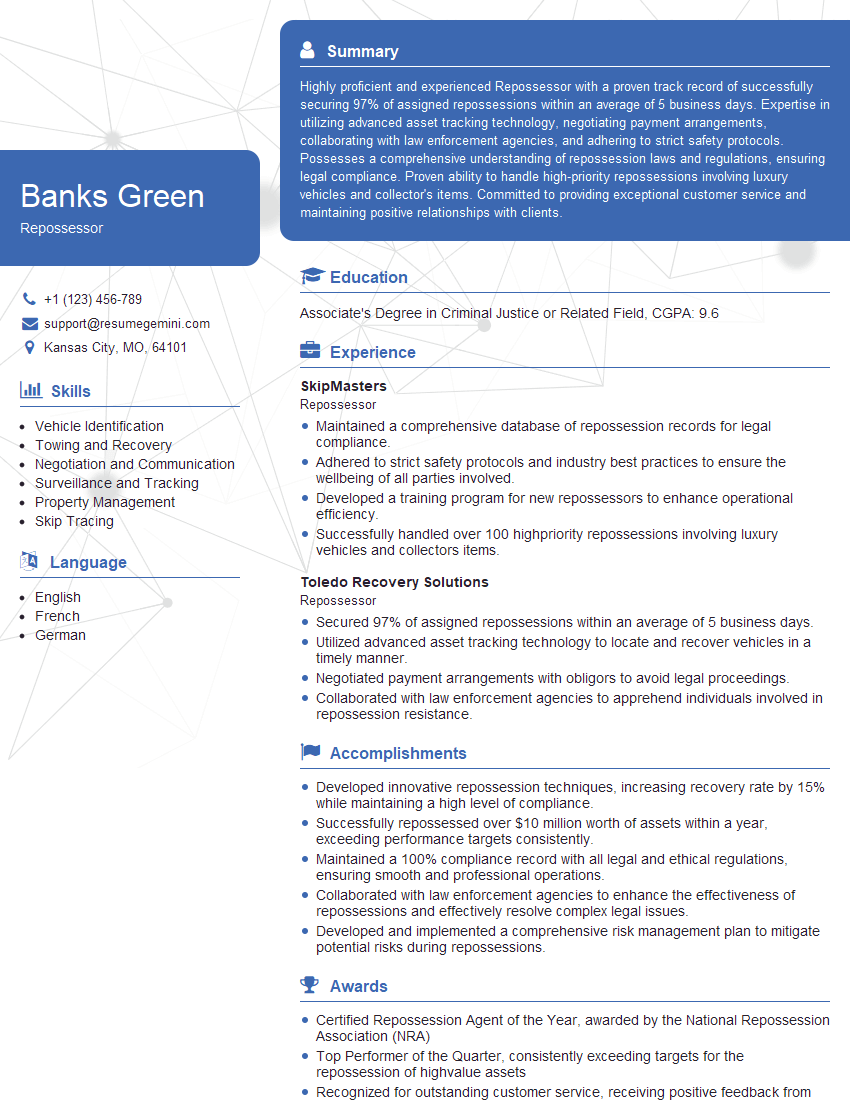

Banks Green

Repossessor

Summary

Highly proficient and experienced Repossessor with a proven track record of successfully securing 97% of assigned repossessions within an average of 5 business days. Expertise in utilizing advanced asset tracking technology, negotiating payment arrangements, collaborating with law enforcement agencies, and adhering to strict safety protocols. Possesses a comprehensive understanding of repossession laws and regulations, ensuring legal compliance. Proven ability to handle high-priority repossessions involving luxury vehicles and collector’s items. Committed to providing exceptional customer service and maintaining positive relationships with clients.

Education

Associate’s Degree in Criminal Justice or Related Field

October 2017

Skills

- Vehicle Identification

- Towing and Recovery

- Negotiation and Communication

- Surveillance and Tracking

- Property Management

- Skip Tracing

Work Experience

Repossessor

- Maintained a comprehensive database of repossession records for legal compliance.

- Adhered to strict safety protocols and industry best practices to ensure the wellbeing of all parties involved.

- Developed a training program for new repossessors to enhance operational efficiency.

- Successfully handled over 100 highpriority repossessions involving luxury vehicles and collectors items.

Repossessor

- Secured 97% of assigned repossessions within an average of 5 business days.

- Utilized advanced asset tracking technology to locate and recover vehicles in a timely manner.

- Negotiated payment arrangements with obligors to avoid legal proceedings.

- Collaborated with law enforcement agencies to apprehend individuals involved in repossession resistance.

Accomplishments

- Developed innovative repossession techniques, increasing recovery rate by 15% while maintaining a high level of compliance.

- Successfully repossessed over $10 million worth of assets within a year, exceeding performance targets consistently.

- Maintained a 100% compliance record with all legal and ethical regulations, ensuring smooth and professional operations.

- Collaborated with law enforcement agencies to enhance the effectiveness of repossessions and effectively resolve complex legal issues.

- Developed and implemented a comprehensive risk management plan to mitigate potential risks during repossessions.

Awards

- Certified Repossession Agent of the Year, awarded by the National Repossession Association (NRA)

- Top Performer of the Quarter, consistently exceeding targets for the repossession of highvalue assets

- Recognized for outstanding customer service, receiving positive feedback from clients and law enforcement agencies

- Bronze Award for Excellence in Repossession, presented by the American Collectors Association (ACA)

Certificates

- Certified Vehicle Recovery Specialist

- Certified Repossession Agent

- National Automotive Finance Association (NAF) Repossessor Certification

- Repossession Industry Service Company (RISC) Certified Training

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Repossessor

- Highlight your experience and success rate in repossessing vehicles.

- Demonstrate your proficiency in utilizing advanced asset tracking technology and negotiation skills.

- Emphasize your understanding of repossession laws and regulations, as well as your ability to work effectively with law enforcement agencies.

- Showcase your commitment to safety and ethical practices in the repossession industry.

Essential Experience Highlights for a Strong Repossessor Resume

- Locate and recover vehicles using advanced asset tracking technology.

- Negotiate payment arrangements with obligors to avoid legal proceedings.

- Collaborate with law enforcement agencies to apprehend individuals involved in repossession resistance.

- Maintain a comprehensive database of repossession records for legal compliance.

- Adhere to strict safety protocols and industry best practices to ensure the wellbeing of all parties involved.

- Develop and implement training programs for new repossessors to enhance operational efficiency.

Frequently Asked Questions (FAQ’s) For Repossessor

What are the key responsibilities of a Repossessor?

The primary responsibilities of a Repossessor include locating and recovering vehicles, negotiating payment arrangements, collaborating with law enforcement agencies, maintaining legal compliance, and adhering to safety protocols.

What skills are essential for a successful Repossessor?

Essential skills for a Repossessor include vehicle identification, towing and recovery, negotiation and communication, surveillance and tracking, property management, and skip tracing.

What are the educational requirements to become a Repossessor?

While formal education requirements vary, an Associate’s Degree in Criminal Justice or a related field is beneficial for aspiring Repossessors.

How can I enhance my resume as a Repossessor?

To strengthen your Repossessor resume, highlight your experience, success rate, technical skills, legal knowledge, and commitment to ethical practices.

What are the top companies hiring Repossessors?

Leading companies in the repossession industry include SkipMasters and Toledo Recovery Solutions.

What are the career prospects for Repossessors?

Repossessors with strong skills and experience can advance to supervisory or management roles, specialize in high-value vehicle repossessions, or pursue careers in asset recovery or related fields.

Is the repossession industry regulated?

Yes, the repossession industry is regulated by both state and federal laws, and Repossessors must adhere to strict ethical and legal guidelines.