Are you a seasoned Retirement Officer seeking a new career path? Discover our professionally built Retirement Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

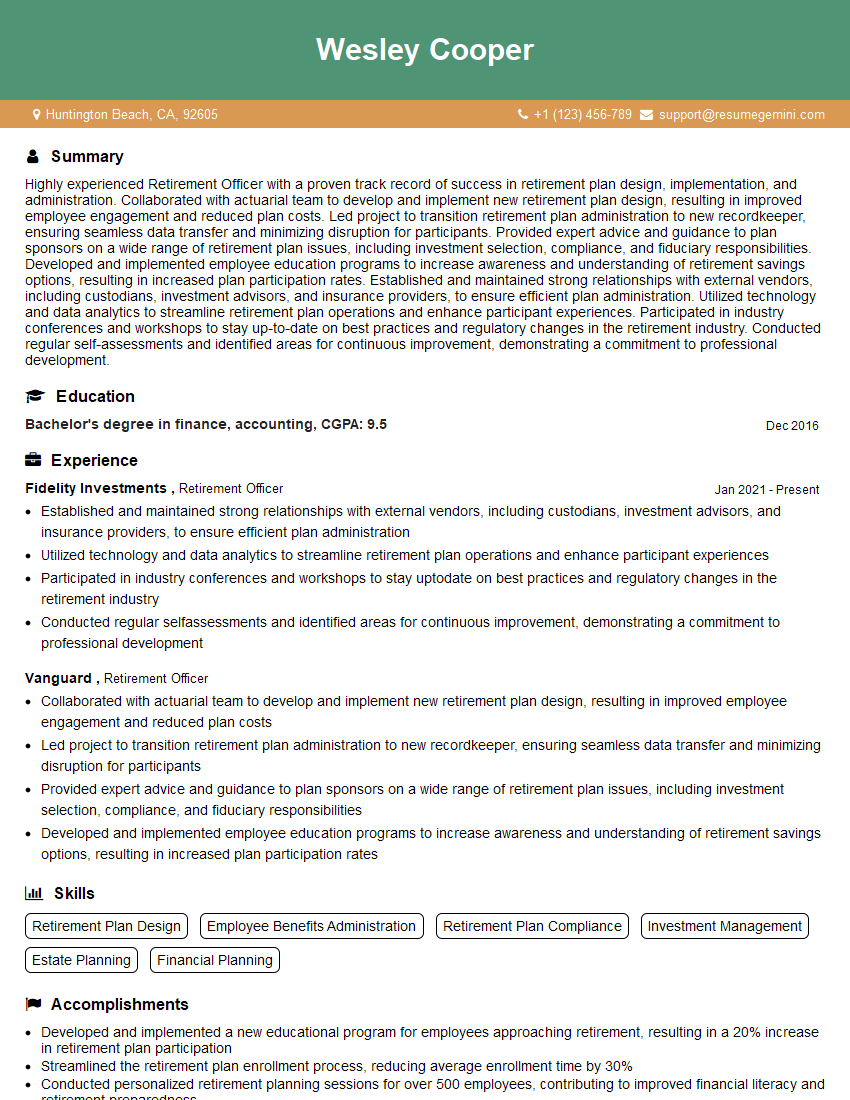

Wesley Cooper

Retirement Officer

Summary

Highly experienced Retirement Officer with a proven track record of success in retirement plan design, implementation, and administration. Collaborated with actuarial team to develop and implement new retirement plan design, resulting in improved employee engagement and reduced plan costs. Led project to transition retirement plan administration to new recordkeeper, ensuring seamless data transfer and minimizing disruption for participants. Provided expert advice and guidance to plan sponsors on a wide range of retirement plan issues, including investment selection, compliance, and fiduciary responsibilities. Developed and implemented employee education programs to increase awareness and understanding of retirement savings options, resulting in increased plan participation rates. Established and maintained strong relationships with external vendors, including custodians, investment advisors, and insurance providers, to ensure efficient plan administration. Utilized technology and data analytics to streamline retirement plan operations and enhance participant experiences. Participated in industry conferences and workshops to stay up-to-date on best practices and regulatory changes in the retirement industry. Conducted regular self-assessments and identified areas for continuous improvement, demonstrating a commitment to professional development.

Education

Bachelor’s degree in finance, accounting

December 2016

Skills

- Retirement Plan Design

- Employee Benefits Administration

- Retirement Plan Compliance

- Investment Management

- Estate Planning

- Financial Planning

Work Experience

Retirement Officer

- Established and maintained strong relationships with external vendors, including custodians, investment advisors, and insurance providers, to ensure efficient plan administration

- Utilized technology and data analytics to streamline retirement plan operations and enhance participant experiences

- Participated in industry conferences and workshops to stay uptodate on best practices and regulatory changes in the retirement industry

- Conducted regular selfassessments and identified areas for continuous improvement, demonstrating a commitment to professional development

Retirement Officer

- Collaborated with actuarial team to develop and implement new retirement plan design, resulting in improved employee engagement and reduced plan costs

- Led project to transition retirement plan administration to new recordkeeper, ensuring seamless data transfer and minimizing disruption for participants

- Provided expert advice and guidance to plan sponsors on a wide range of retirement plan issues, including investment selection, compliance, and fiduciary responsibilities

- Developed and implemented employee education programs to increase awareness and understanding of retirement savings options, resulting in increased plan participation rates

Accomplishments

- Developed and implemented a new educational program for employees approaching retirement, resulting in a 20% increase in retirement plan participation

- Streamlined the retirement plan enrollment process, reducing average enrollment time by 30%

- Conducted personalized retirement planning sessions for over 500 employees, contributing to improved financial literacy and retirement preparedness

- Oversaw the implementation of a new retirement savings platform, leading to a 15% increase in total savings

- Implemented a social media campaign to promote retirement planning awareness, reaching over 10,000 potential participants

Awards

- Certified Retirement Counselor (CRC), awarded by the International Foundation for Retirement Education (IFRE)

- Excellence in Retirement Planning Award, presented by the National Association of Retirement Planners (NARP)

- Retirement Planning Professional (RPP), accredited by the American Society of Pension Professionals and Actuaries (ASPPA)

- 401(k) Specialist, certified by the National Institute of Retirement Administrators (NIRA)

Certificates

- Certified Financial Planner (CFP)

- Chartered Retirement Planning Counselor (CRPC)

- Retirement Benefits Specialist (RBS)

- Certified Employee Benefits Specialist (CEBS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Retirement Officer

- Highlight your experience in retirement plan design, implementation, and administration.

- Quantify your accomplishments with specific metrics whenever possible.

- Showcase your knowledge of retirement plan regulations and best practices.

- Demonstrate your ability to communicate effectively with plan sponsors and participants.

- Emphasize your commitment to continuous learning and professional development.

Essential Experience Highlights for a Strong Retirement Officer Resume

- Collaborating with actuarial team to develop and implement new retirement plan design, resulting in improved employee engagement and reduced plan costs.

- Leading project to transition retirement plan administration to new recordkeeper, ensuring seamless data transfer and minimizing disruption for participants.

- Providing expert advice and guidance to plan sponsors on a wide range of retirement plan issues, including investment selection, compliance, and fiduciary responsibilities.

- Developing and implementing employee education programs to increase awareness and understanding of retirement savings options, resulting in increased plan participation rates.

- Establishing and maintaining strong relationships with external vendors, including custodians, investment advisors, and insurance providers, to ensure efficient plan administration.

- Utilizing technology and data analytics to streamline retirement plan operations and enhance participant experiences.

- Participating in industry conferences and workshops to stay up-to-date on best practices and regulatory changes in the retirement industry.

Frequently Asked Questions (FAQ’s) For Retirement Officer

What is the role of a Retirement Officer?

A Retirement Officer is responsible for the design, implementation, and administration of retirement plans. This includes working with actuaries to develop plan designs, selecting and monitoring investments, providing advice to plan sponsors and participants, and ensuring compliance with all applicable laws and regulations.

What are the qualifications for a Retirement Officer?

Retirement Officers typically have a bachelor’s degree in finance, accounting, or a related field. They also typically have several years of experience in retirement plan administration, investment management, or a related field.

What are the responsibilities of a Retirement Officer?

Retirement Officers are responsible for a variety of tasks, including designing and implementing retirement plans, selecting and monitoring investments, providing advice to plan sponsors and participants, and ensuring compliance with all applicable laws and regulations.

What are the skills required for a Retirement Officer?

Retirement Officers need a variety of skills, including knowledge of retirement plan regulations, investment management, and financial planning. They also need strong communication and interpersonal skills.

What is the salary range for a Retirement Officer?

The salary range for a Retirement Officer can vary depending on experience, location, and company size. According to Salary.com, the median salary for a Retirement Officer is around $85,000 per year.

What is the job outlook for Retirement Officers?

The job outlook for Retirement Officers is expected to be good over the next few years. As the population ages, there will be an increasing need for professionals who can help people plan for their retirement.

What are the benefits of working as a Retirement Officer?

There are a number of benefits to working as a Retirement Officer, including a competitive salary, good benefits, and the opportunity to make a difference in the lives of others.