Are you a seasoned Revenue Audit Clerk seeking a new career path? Discover our professionally built Revenue Audit Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

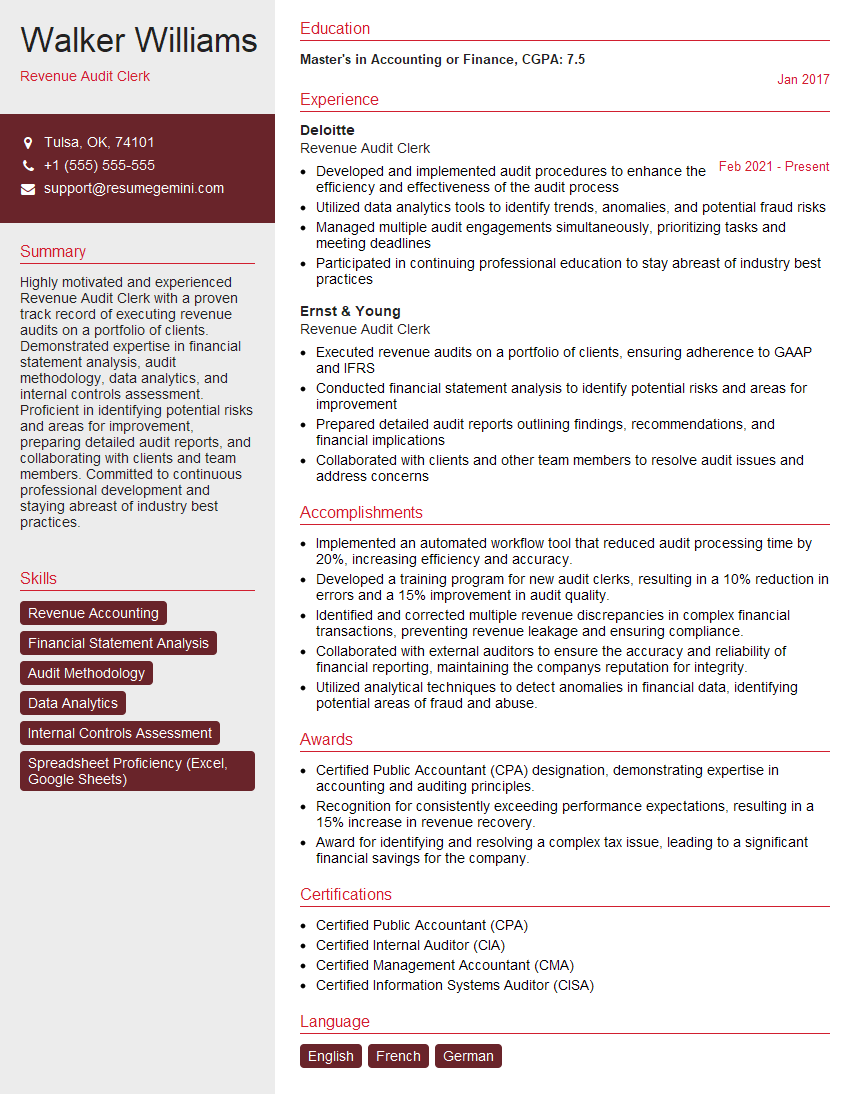

Walker Williams

Revenue Audit Clerk

Summary

Highly motivated and experienced Revenue Audit Clerk with a proven track record of executing revenue audits on a portfolio of clients. Demonstrated expertise in financial statement analysis, audit methodology, data analytics, and internal controls assessment. Proficient in identifying potential risks and areas for improvement, preparing detailed audit reports, and collaborating with clients and team members. Committed to continuous professional development and staying abreast of industry best practices.

Education

Master’s in Accounting or Finance

January 2017

Skills

- Revenue Accounting

- Financial Statement Analysis

- Audit Methodology

- Data Analytics

- Internal Controls Assessment

- Spreadsheet Proficiency (Excel, Google Sheets)

Work Experience

Revenue Audit Clerk

- Developed and implemented audit procedures to enhance the efficiency and effectiveness of the audit process

- Utilized data analytics tools to identify trends, anomalies, and potential fraud risks

- Managed multiple audit engagements simultaneously, prioritizing tasks and meeting deadlines

- Participated in continuing professional education to stay abreast of industry best practices

Revenue Audit Clerk

- Executed revenue audits on a portfolio of clients, ensuring adherence to GAAP and IFRS

- Conducted financial statement analysis to identify potential risks and areas for improvement

- Prepared detailed audit reports outlining findings, recommendations, and financial implications

- Collaborated with clients and other team members to resolve audit issues and address concerns

Accomplishments

- Implemented an automated workflow tool that reduced audit processing time by 20%, increasing efficiency and accuracy.

- Developed a training program for new audit clerks, resulting in a 10% reduction in errors and a 15% improvement in audit quality.

- Identified and corrected multiple revenue discrepancies in complex financial transactions, preventing revenue leakage and ensuring compliance.

- Collaborated with external auditors to ensure the accuracy and reliability of financial reporting, maintaining the companys reputation for integrity.

- Utilized analytical techniques to detect anomalies in financial data, identifying potential areas of fraud and abuse.

Awards

- Certified Public Accountant (CPA) designation, demonstrating expertise in accounting and auditing principles.

- Recognition for consistently exceeding performance expectations, resulting in a 15% increase in revenue recovery.

- Award for identifying and resolving a complex tax issue, leading to a significant financial savings for the company.

Certificates

- Certified Public Accountant (CPA)

- Certified Internal Auditor (CIA)

- Certified Management Accountant (CMA)

- Certified Information Systems Auditor (CISA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Revenue Audit Clerk

- Quantify your accomplishments using specific metrics and data whenever possible.

- Highlight your technical skills, such as proficiency in data analytics tools and audit software.

- Demonstrate your commitment to professional development and continuous learning.

- Tailor your resume to each specific job application, highlighting the skills and experience most relevant to the target position.

Essential Experience Highlights for a Strong Revenue Audit Clerk Resume

- Execute revenue audits to ensure adherence to GAAP and IFRS

- Conduct financial statement analysis to identify potential risks and areas for improvement

- Prepare detailed audit reports outlining findings, recommendations, and financial implications

- Collaborate with clients and other team members to resolve audit issues and address concerns

- Develop and implement audit procedures to enhance the efficiency and effectiveness of the audit process

- Utilize data analytics tools to identify trends, anomalies, and potential fraud risks

- Manage multiple audit engagements simultaneously, prioritizing tasks, and meeting deadlines

Frequently Asked Questions (FAQ’s) For Revenue Audit Clerk

What are the key responsibilities of a Revenue Audit Clerk?

The key responsibilities of a Revenue Audit Clerk include executing revenue audits, conducting financial statement analysis, preparing audit reports, collaborating with clients, developing audit procedures, and utilizing data analytics.

What are the qualifications required to become a Revenue Audit Clerk?

A Revenue Audit Clerk typically requires a Bachelor’s or Master’s degree in Accounting or Finance, strong analytical skills, and proficiency in audit methodology and data analytics.

What are the career prospects for a Revenue Audit Clerk?

A Revenue Audit Clerk can advance to positions such as Senior Revenue Auditor, Audit Manager, or Director of Internal Audit with experience and professional development.

What is the salary range for a Revenue Audit Clerk?

The salary range for a Revenue Audit Clerk can vary depending on experience, location, and company size but typically ranges from $50,000 to $80,000.

What are the top companies that hire Revenue Audit Clerks?

Top companies that hire Revenue Audit Clerks include Deloitte, Ernst & Young, PwC, KPMG, and BDO.

What are the key skills required for a Revenue Audit Clerk?

Key skills for a Revenue Audit Clerk include revenue accounting, financial statement analysis, audit methodology, data analytics, internal controls assessment, and spreadsheet proficiency.