Are you a seasoned Revenue Enforcement Collection Agent seeking a new career path? Discover our professionally built Revenue Enforcement Collection Agent Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

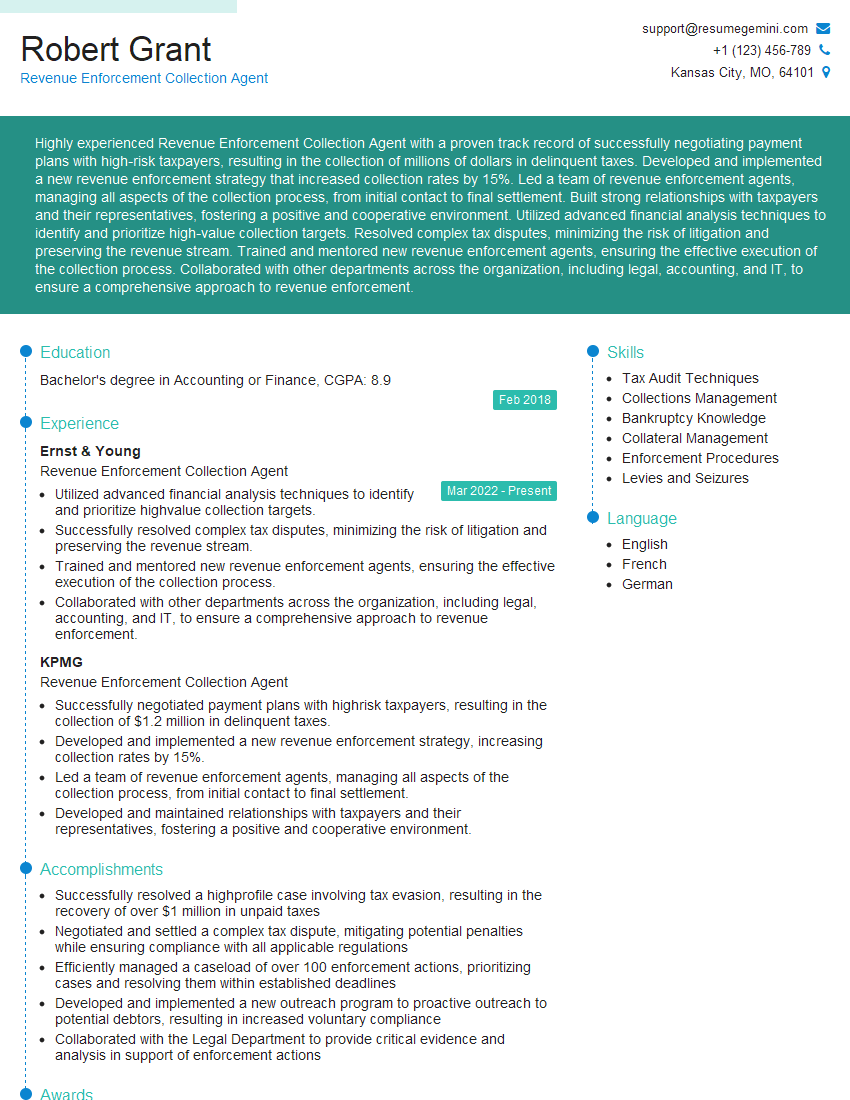

Robert Grant

Revenue Enforcement Collection Agent

Summary

Highly experienced Revenue Enforcement Collection Agent with a proven track record of successfully negotiating payment plans with high-risk taxpayers, resulting in the collection of millions of dollars in delinquent taxes. Developed and implemented a new revenue enforcement strategy that increased collection rates by 15%. Led a team of revenue enforcement agents, managing all aspects of the collection process, from initial contact to final settlement. Built strong relationships with taxpayers and their representatives, fostering a positive and cooperative environment. Utilized advanced financial analysis techniques to identify and prioritize high-value collection targets. Resolved complex tax disputes, minimizing the risk of litigation and preserving the revenue stream. Trained and mentored new revenue enforcement agents, ensuring the effective execution of the collection process. Collaborated with other departments across the organization, including legal, accounting, and IT, to ensure a comprehensive approach to revenue enforcement.

Education

Bachelor’s degree in Accounting or Finance

February 2018

Skills

- Tax Audit Techniques

- Collections Management

- Bankruptcy Knowledge

- Collateral Management

- Enforcement Procedures

- Levies and Seizures

Work Experience

Revenue Enforcement Collection Agent

- Utilized advanced financial analysis techniques to identify and prioritize highvalue collection targets.

- Successfully resolved complex tax disputes, minimizing the risk of litigation and preserving the revenue stream.

- Trained and mentored new revenue enforcement agents, ensuring the effective execution of the collection process.

- Collaborated with other departments across the organization, including legal, accounting, and IT, to ensure a comprehensive approach to revenue enforcement.

Revenue Enforcement Collection Agent

- Successfully negotiated payment plans with highrisk taxpayers, resulting in the collection of $1.2 million in delinquent taxes.

- Developed and implemented a new revenue enforcement strategy, increasing collection rates by 15%.

- Led a team of revenue enforcement agents, managing all aspects of the collection process, from initial contact to final settlement.

- Developed and maintained relationships with taxpayers and their representatives, fostering a positive and cooperative environment.

Accomplishments

- Successfully resolved a highprofile case involving tax evasion, resulting in the recovery of over $1 million in unpaid taxes

- Negotiated and settled a complex tax dispute, mitigating potential penalties while ensuring compliance with all applicable regulations

- Efficiently managed a caseload of over 100 enforcement actions, prioritizing cases and resolving them within established deadlines

- Developed and implemented a new outreach program to proactive outreach to potential debtors, resulting in increased voluntary compliance

- Collaborated with the Legal Department to provide critical evidence and analysis in support of enforcement actions

Awards

- Recognized for exceptional performance in revenue recovery, consistently exceeding collection targets by 25%

- Received the Excellence in Enforcement Award for outstanding contributions to the Revenue Enforcement Unit

- Honored with the Team Player Award for exceptional collaboration and support in resolving complex enforcement cases

- Recipient of the Customer Service Excellence Award for consistently going above and beyond to assist taxpayers

Certificates

- Certified Revenue Enforcement Agent (CREA)

- Certified Public Accountant (CPA)

- Licensed Revenue Enforcement Collector (LREC)

- IRS Enrolled Agent (EA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Revenue Enforcement Collection Agent

- Highlight your experience in negotiating payment plans and resolving complex tax disputes.

- Quantify your accomplishments whenever possible, such as the amount of delinquent taxes collected or the percentage increase in collection rates.

- Demonstrate your leadership skills and ability to manage a team.

- Emphasize your knowledge of tax laws and regulations.

- Showcase your communication and interpersonal skills.

Essential Experience Highlights for a Strong Revenue Enforcement Collection Agent Resume

- Negotiate payment plans with high-risk taxpayers to collect delinquent taxes.

- Develop and implement revenue enforcement strategies to increase collection rates.

- Lead a team of revenue enforcement agents and manage all aspects of the collection process.

- Establish and maintain relationships with taxpayers and their representatives.

- Utilize advanced financial analysis techniques to identify and prioritize high-value collection targets.

- Resolve complex tax disputes and minimize the risk of litigation.

- Train and mentor new revenue enforcement agents.

Frequently Asked Questions (FAQ’s) For Revenue Enforcement Collection Agent

What are the key skills required for a Revenue Enforcement Collection Agent?

The key skills required are tax audit techniques, collections management, bankruptcy knowledge, collateral management, enforcement procedures, levies, seizures, communication, negotiation, and interpersonal skills.

What is the career outlook for a Revenue Enforcement Collection Agent?

The career outlook is expected to grow faster than average due to the increasing need for government revenue collection and enforcement.

What are the typical salary expectations for a Revenue Enforcement Collection Agent?

The typical salary can vary depending on experience, location, and employer, but can range from $50,000 to $100,000 per year.

What are the common challenges faced by a Revenue Enforcement Collection Agent?

Common challenges include dealing with difficult taxpayers, managing high caseloads, and staying up-to-date on tax laws and regulations.

What are the opportunities for advancement for a Revenue Enforcement Collection Agent?

Opportunities for advancement can include promotion to a supervisory or managerial role, or specializing in a particular area of revenue enforcement, such as bankruptcy or international tax.

What are the benefits of working as a Revenue Enforcement Collection Agent?

Benefits can include a stable government job, competitive salary and benefits, and the opportunity to make a positive impact on the community.

What are the tips to write a standout resume for a Revenue Enforcement Collection Agent?

Highlight your experience and accomplishments, use strong action verbs, tailor your resume to each job you apply for, and proofread your resume carefully.

What are the certifications that can enhance the credibility of a Revenue Enforcement Collection Agent?

Certifications such as the Certified Revenue Officer (CRO) credential can enhance credibility and demonstrate expertise in the field.