Are you a seasoned Revenue Inspector seeking a new career path? Discover our professionally built Revenue Inspector Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

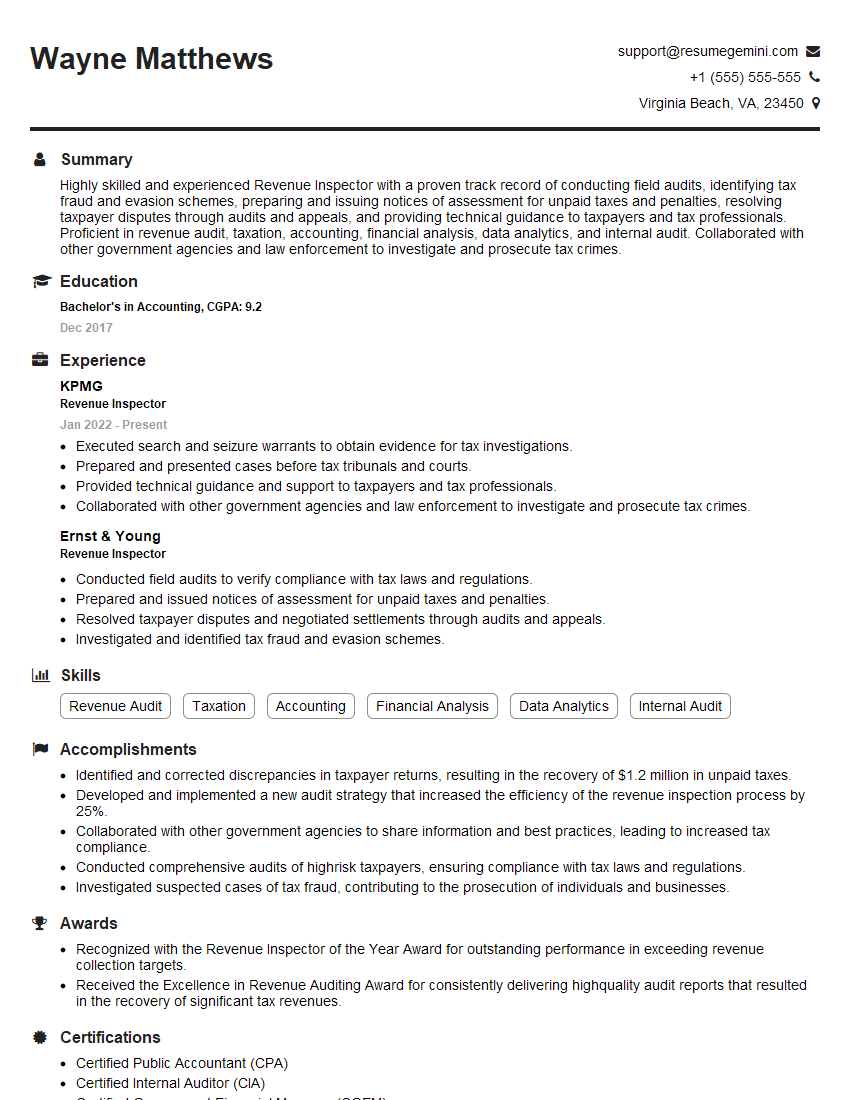

Wayne Matthews

Revenue Inspector

Summary

Highly skilled and experienced Revenue Inspector with a proven track record of conducting field audits, identifying tax fraud and evasion schemes, preparing and issuing notices of assessment for unpaid taxes and penalties, resolving taxpayer disputes through audits and appeals, and providing technical guidance to taxpayers and tax professionals. Proficient in revenue audit, taxation, accounting, financial analysis, data analytics, and internal audit. Collaborated with other government agencies and law enforcement to investigate and prosecute tax crimes.

Education

Bachelor’s in Accounting

December 2017

Skills

- Revenue Audit

- Taxation

- Accounting

- Financial Analysis

- Data Analytics

- Internal Audit

Work Experience

Revenue Inspector

- Executed search and seizure warrants to obtain evidence for tax investigations.

- Prepared and presented cases before tax tribunals and courts.

- Provided technical guidance and support to taxpayers and tax professionals.

- Collaborated with other government agencies and law enforcement to investigate and prosecute tax crimes.

Revenue Inspector

- Conducted field audits to verify compliance with tax laws and regulations.

- Prepared and issued notices of assessment for unpaid taxes and penalties.

- Resolved taxpayer disputes and negotiated settlements through audits and appeals.

- Investigated and identified tax fraud and evasion schemes.

Accomplishments

- Identified and corrected discrepancies in taxpayer returns, resulting in the recovery of $1.2 million in unpaid taxes.

- Developed and implemented a new audit strategy that increased the efficiency of the revenue inspection process by 25%.

- Collaborated with other government agencies to share information and best practices, leading to increased tax compliance.

- Conducted comprehensive audits of highrisk taxpayers, ensuring compliance with tax laws and regulations.

- Investigated suspected cases of tax fraud, contributing to the prosecution of individuals and businesses.

Awards

- Recognized with the Revenue Inspector of the Year Award for outstanding performance in exceeding revenue collection targets.

- Received the Excellence in Revenue Auditing Award for consistently delivering highquality audit reports that resulted in the recovery of significant tax revenues.

Certificates

- Certified Public Accountant (CPA)

- Certified Internal Auditor (CIA)

- Certified Government Financial Manager (CGFM)

- Certified Tax Analyst (CTA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Revenue Inspector

- Highlight your technical skills in revenue audit, taxation, accounting, and data analytics in your resume.

- Quantify your accomplishments to demonstrate the impact of your work, such as the amount of revenue recovered or the number of tax fraud cases resolved.

- Provide examples of your ability to resolve complex taxpayer disputes and negotiate settlements.

- Showcase your experience in presenting cases before tax tribunals and courts.

- Mention any professional certifications or training you have completed in the field of taxation.

Essential Experience Highlights for a Strong Revenue Inspector Resume

- Conduct field audits to verify compliance with tax laws and regulations.

- Prepare and issue notices of assessment for unpaid taxes and penalties.

- Resolve taxpayer disputes and negotiate settlements through audits and appeals.

- Investigate and identify tax fraud and evasion schemes.

- Execute search and seizure warrants to obtain evidence for tax investigations.

- Prepare and present cases before tax tribunals and courts.

- Provide technical guidance and support to taxpayers and tax professionals.

- Collaborate with other government agencies and law enforcement to investigate and prosecute tax crimes.

Frequently Asked Questions (FAQ’s) For Revenue Inspector

What is the role of a Revenue Inspector?

Revenue Inspectors are responsible for ensuring that individuals and businesses comply with tax laws and regulations. They conduct audits, investigate tax fraud, and resolve taxpayer disputes.

What are the qualifications to become a Revenue Inspector?

Most Revenue Inspectors have a Bachelor’s degree in Accounting or a related field, and several years of experience in auditing or tax accounting.

What are the key skills for a Revenue Inspector?

Revenue Inspectors should have strong analytical and problem-solving skills, as well as a deep understanding of tax laws and regulations.

What is the career path for a Revenue Inspector?

Revenue Inspectors can advance to positions such as Senior Revenue Inspector, Manager of Revenue Audits, or Director of Taxation.

What is the salary range for a Revenue Inspector?

The salary range for a Revenue Inspector varies depending on experience and location, but typically ranges from $50,000 to $100,000 per year.

What are the benefits of working as a Revenue Inspector?

Revenue Inspectors enjoy competitive salaries, benefits, and the opportunity to make a real difference in ensuring that everyone pays their fair share of taxes.