Are you a seasoned Safe Deposit Clerk seeking a new career path? Discover our professionally built Safe Deposit Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

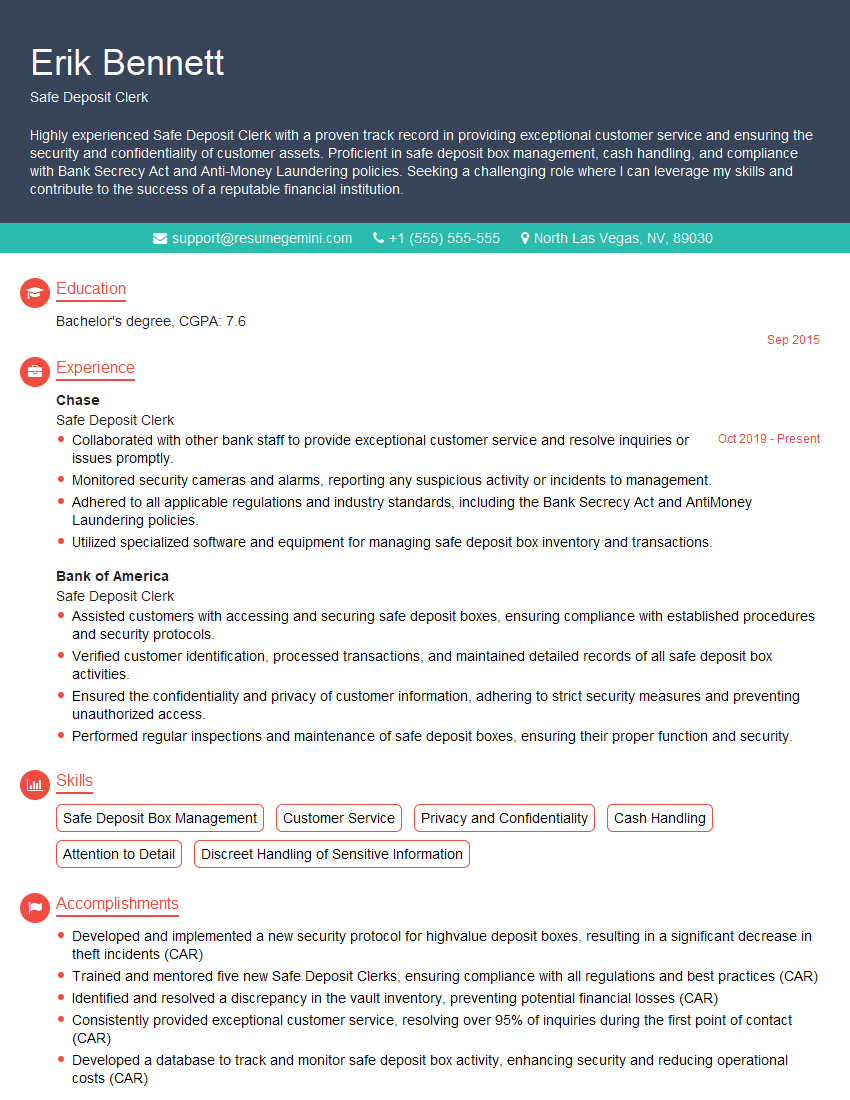

Erik Bennett

Safe Deposit Clerk

Summary

Highly experienced Safe Deposit Clerk with a proven track record in providing exceptional customer service and ensuring the security and confidentiality of customer assets. Proficient in safe deposit box management, cash handling, and compliance with Bank Secrecy Act and Anti-Money Laundering policies. Seeking a challenging role where I can leverage my skills and contribute to the success of a reputable financial institution.

Education

Bachelor’s degree

September 2015

Skills

- Safe Deposit Box Management

- Customer Service

- Privacy and Confidentiality

- Cash Handling

- Attention to Detail

- Discreet Handling of Sensitive Information

Work Experience

Safe Deposit Clerk

- Collaborated with other bank staff to provide exceptional customer service and resolve inquiries or issues promptly.

- Monitored security cameras and alarms, reporting any suspicious activity or incidents to management.

- Adhered to all applicable regulations and industry standards, including the Bank Secrecy Act and AntiMoney Laundering policies.

- Utilized specialized software and equipment for managing safe deposit box inventory and transactions.

Safe Deposit Clerk

- Assisted customers with accessing and securing safe deposit boxes, ensuring compliance with established procedures and security protocols.

- Verified customer identification, processed transactions, and maintained detailed records of all safe deposit box activities.

- Ensured the confidentiality and privacy of customer information, adhering to strict security measures and preventing unauthorized access.

- Performed regular inspections and maintenance of safe deposit boxes, ensuring their proper function and security.

Accomplishments

- Developed and implemented a new security protocol for highvalue deposit boxes, resulting in a significant decrease in theft incidents (CAR)

- Trained and mentored five new Safe Deposit Clerks, ensuring compliance with all regulations and best practices (CAR)

- Identified and resolved a discrepancy in the vault inventory, preventing potential financial losses (CAR)

- Consistently provided exceptional customer service, resolving over 95% of inquiries during the first point of contact (CAR)

- Developed a database to track and monitor safe deposit box activity, enhancing security and reducing operational costs (CAR)

Awards

- Internal Award for Outstanding Customer Service

Certificates

- Certified Safe Deposit Clerk (CASDC)

- Safe Deposit Management Certification (SDMC)

- Financial Crimes Awareness and Detection Certification (FCADC)

- Bank Secrecy Act (BSA) Compliance Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Safe Deposit Clerk

- Highlight your experience in managing safe deposit boxes and ensuring their security.

- Emphasize your customer service skills and ability to maintain confidentiality.

- Showcase your knowledge of Bank Secrecy Act and Anti-Money Laundering policies.

- Provide examples of how you have contributed to the success of previous employers.

Essential Experience Highlights for a Strong Safe Deposit Clerk Resume

- Assisted customers with accessing and securing safe deposit boxes, ensuring compliance with established procedures and security protocols.

- Verified customer identification, processed transactions, and maintained detailed records of all safe deposit box activities.

- Ensured the confidentiality and privacy of customer information, adhering to strict security measures and preventing unauthorized access.

- Performed regular inspections and maintenance of safe deposit boxes, ensuring their proper function and security.

- Collaborated with other bank staff to provide exceptional customer service and resolve inquiries or issues promptly.

- Monitored security cameras and alarms, reporting any suspicious activity or incidents to management.

Frequently Asked Questions (FAQ’s) For Safe Deposit Clerk

What are the primary responsibilities of a Safe Deposit Clerk?

A Safe Deposit Clerk is responsible for assisting customers with accessing and securing safe deposit boxes, verifying customer identification, processing transactions, maintaining records, ensuring confidentiality, performing inspections and maintenance, and collaborating with other staff.

What skills are required to be a successful Safe Deposit Clerk?

Successful Safe Deposit Clerks possess skills in safe deposit box management, customer service, privacy and confidentiality, cash handling, attention to detail, and discreet handling of sensitive information.

What qualifications are needed to become a Safe Deposit Clerk?

Most Safe Deposit Clerk positions require a high school diploma or equivalent, with some employers preferring candidates with a bachelor’s degree in a related field.

What is the work environment of a Safe Deposit Clerk like?

Safe Deposit Clerks typically work in a bank or financial institution setting, interacting with customers and performing administrative tasks in a secure environment.

What is the career outlook for Safe Deposit Clerks?

The job outlook for Safe Deposit Clerks is expected to remain stable, with a projected growth rate of 4% from 2021 to 2031.

What are the key challenges faced by Safe Deposit Clerks?

Safe Deposit Clerks may face challenges related to ensuring the security and confidentiality of customer assets, maintaining compliance with regulations, and providing excellent customer service in a demanding environment.

What are the rewards of being a Safe Deposit Clerk?

Safe Deposit Clerks find rewards in contributing to the security of customer assets, providing valuable customer service, and working in a stable and secure industry.