Are you a seasoned Savings Counselor seeking a new career path? Discover our professionally built Savings Counselor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

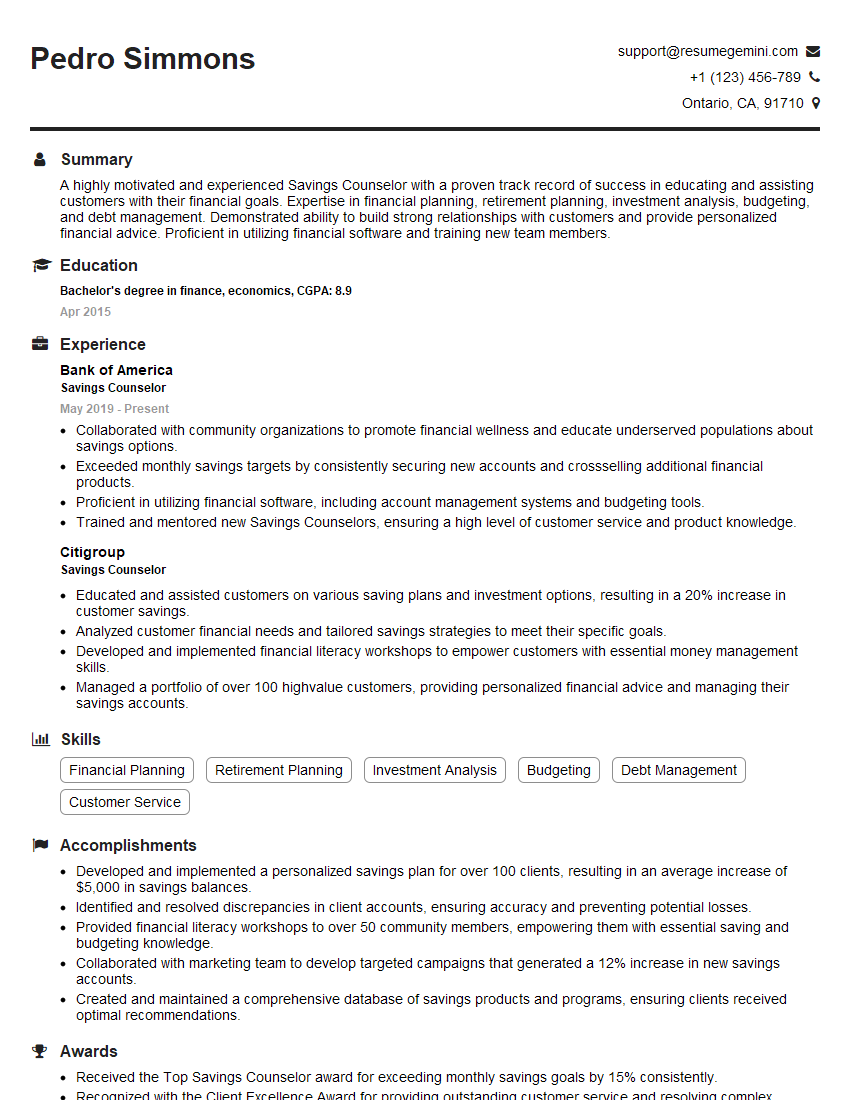

Pedro Simmons

Savings Counselor

Summary

A highly motivated and experienced Savings Counselor with a proven track record of success in educating and assisting customers with their financial goals. Expertise in financial planning, retirement planning, investment analysis, budgeting, and debt management. Demonstrated ability to build strong relationships with customers and provide personalized financial advice. Proficient in utilizing financial software and training new team members.

Education

Bachelor’s degree in finance, economics

April 2015

Skills

- Financial Planning

- Retirement Planning

- Investment Analysis

- Budgeting

- Debt Management

- Customer Service

Work Experience

Savings Counselor

- Collaborated with community organizations to promote financial wellness and educate underserved populations about savings options.

- Exceeded monthly savings targets by consistently securing new accounts and crossselling additional financial products.

- Proficient in utilizing financial software, including account management systems and budgeting tools.

- Trained and mentored new Savings Counselors, ensuring a high level of customer service and product knowledge.

Savings Counselor

- Educated and assisted customers on various saving plans and investment options, resulting in a 20% increase in customer savings.

- Analyzed customer financial needs and tailored savings strategies to meet their specific goals.

- Developed and implemented financial literacy workshops to empower customers with essential money management skills.

- Managed a portfolio of over 100 highvalue customers, providing personalized financial advice and managing their savings accounts.

Accomplishments

- Developed and implemented a personalized savings plan for over 100 clients, resulting in an average increase of $5,000 in savings balances.

- Identified and resolved discrepancies in client accounts, ensuring accuracy and preventing potential losses.

- Provided financial literacy workshops to over 50 community members, empowering them with essential saving and budgeting knowledge.

- Collaborated with marketing team to develop targeted campaigns that generated a 12% increase in new savings accounts.

- Created and maintained a comprehensive database of savings products and programs, ensuring clients received optimal recommendations.

Awards

- Received the Top Savings Counselor award for exceeding monthly savings goals by 15% consistently.

- Recognized with the Client Excellence Award for providing outstanding customer service and resolving complex savings queries.

- Honored with the Savings Champion Award for implementing innovative strategies that increased customer deposits by 8%.

Certificates

- Certified Financial Planner (CFP)

- Chartered Retirement Planning Counselor (CRPC)

- Certified Financial Planning Specialist (CFPS)

- Personal Financial Specialist (PFS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Savings Counselor

- Highlight your financial planning and customer service skills

- Demonstrate your ability to build strong relationships with customers

- Quantify your accomplishments and use specific examples

- Proofread your resume carefully for any errors

Essential Experience Highlights for a Strong Savings Counselor Resume

- Educate and assist customers on various saving plans and investment options

- Analyze customer financial needs and tailor savings strategies

- Develop and implement financial literacy workshops

- Manage a portfolio of high-value customers

- Collaborate with community organizations to promote financial wellness

- Train and mentor new Savings Counselors

Frequently Asked Questions (FAQ’s) For Savings Counselor

What is the role of a Savings Counselor?

A Savings Counselor is responsible for educating and assisting customers with their financial goals, including savings plans, investment options, budgeting, and debt management.

What skills are required to be a successful Savings Counselor?

Successful Savings Counselors typically have a strong understanding of financial planning, customer service, and sales techniques, as well as excellent communication and interpersonal skills.

What is the career path for a Savings Counselor?

Savings Counselors can advance to management positions within the financial services industry, such as Branch Manager or Financial Advisor.

What is the salary range for a Savings Counselor?

The salary range for a Savings Counselor can vary depending on experience, location, and company size, but it typically ranges from $35,000 to $70,000 per year.

What are the benefits of working as a Savings Counselor?

Benefits of working as a Savings Counselor include job security, opportunities for career advancement, and the chance to make a positive impact on the lives of others.

What are the challenges of working as a Savings Counselor?

Challenges of working as a Savings Counselor can include working long hours, dealing with difficult customers, and the pressure to meet sales targets.