Are you a seasoned Savings Teller seeking a new career path? Discover our professionally built Savings Teller Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

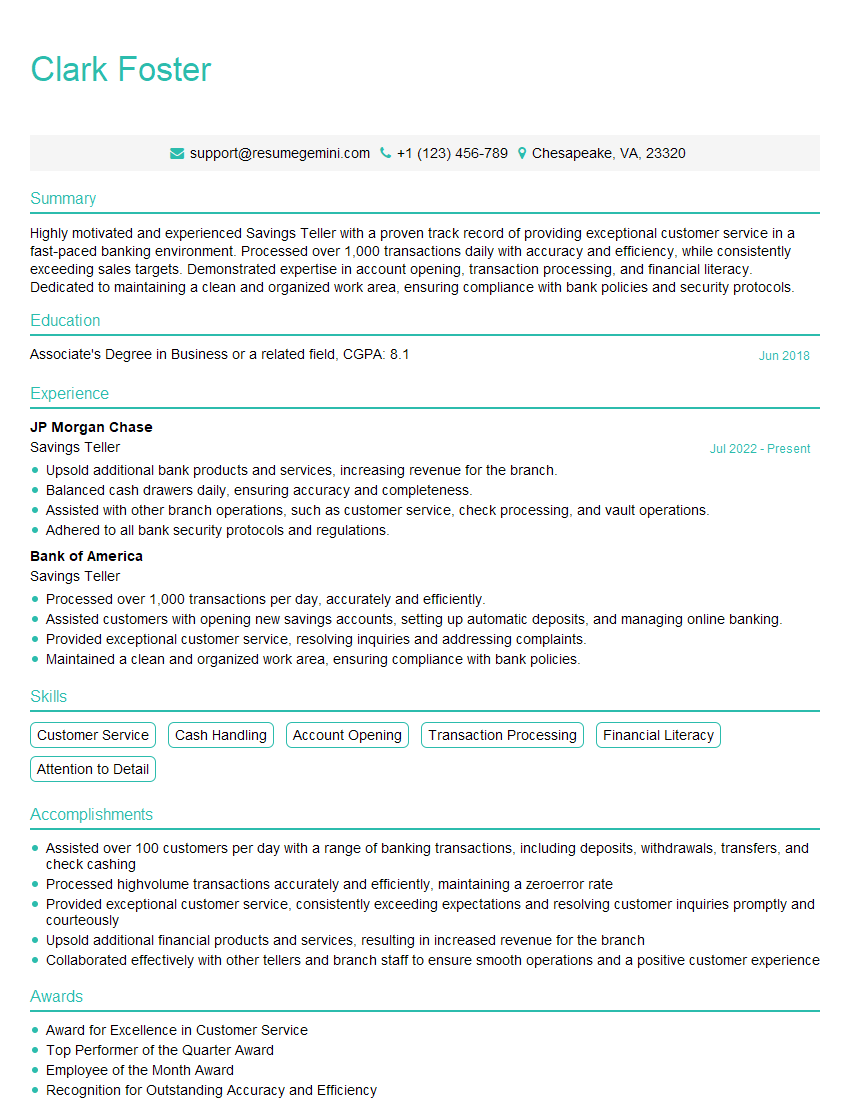

Clark Foster

Savings Teller

Summary

Highly motivated and experienced Savings Teller with a proven track record of providing exceptional customer service in a fast-paced banking environment. Processed over 1,000 transactions daily with accuracy and efficiency, while consistently exceeding sales targets. Demonstrated expertise in account opening, transaction processing, and financial literacy. Dedicated to maintaining a clean and organized work area, ensuring compliance with bank policies and security protocols.

Education

Associate’s Degree in Business or a related field

June 2018

Skills

- Customer Service

- Cash Handling

- Account Opening

- Transaction Processing

- Financial Literacy

- Attention to Detail

Work Experience

Savings Teller

- Upsold additional bank products and services, increasing revenue for the branch.

- Balanced cash drawers daily, ensuring accuracy and completeness.

- Assisted with other branch operations, such as customer service, check processing, and vault operations.

- Adhered to all bank security protocols and regulations.

Savings Teller

- Processed over 1,000 transactions per day, accurately and efficiently.

- Assisted customers with opening new savings accounts, setting up automatic deposits, and managing online banking.

- Provided exceptional customer service, resolving inquiries and addressing complaints.

- Maintained a clean and organized work area, ensuring compliance with bank policies.

Accomplishments

- Assisted over 100 customers per day with a range of banking transactions, including deposits, withdrawals, transfers, and check cashing

- Processed highvolume transactions accurately and efficiently, maintaining a zeroerror rate

- Provided exceptional customer service, consistently exceeding expectations and resolving customer inquiries promptly and courteously

- Upsold additional financial products and services, resulting in increased revenue for the branch

- Collaborated effectively with other tellers and branch staff to ensure smooth operations and a positive customer experience

Awards

- Award for Excellence in Customer Service

- Top Performer of the Quarter Award

- Employee of the Month Award

- Recognition for Outstanding Accuracy and Efficiency

Certificates

- Certified Bank Teller

- Certified Financial Services Professional

- Anti-Money Laundering Certification

- Bank Secrecy Act Certification

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Savings Teller

- Highlight your customer service skills and ability to build rapport with customers.

- Quantify your accomplishments whenever possible, using specific numbers and metrics.

- Proofread your resume carefully for any errors in grammar or spelling.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Savings Teller Resume

- Processed a high volume of customer transactions including deposits, withdrawals, transfers, and loan payments

- Assisted customers with opening new savings accounts, setting up automatic deposits, and managing online banking

- Provided exceptional customer service by resolving inquiries, addressing complaints, and building strong customer relationships

- Upsold additional bank products and services to increase revenue for the branch

- Balanced cash drawers daily, ensuring accuracy and completeness

- Assisted with other branch operations, such as customer service, check processing, and vault operations

- Adhered to all bank security protocols and regulations

Frequently Asked Questions (FAQ’s) For Savings Teller

What are the key skills and qualifications required to be a successful Savings Teller?

Key skills and qualifications include excellent customer service skills, strong attention to detail, accuracy, efficiency, and knowledge of banking products and services.

What are the growth opportunities for Savings Tellers?

With experience and additional training, Savings Tellers can advance to roles such as Teller Supervisor, Branch Manager, or Loan Officer.

What is the average salary for a Savings Teller?

The average salary for a Savings Teller in the United States is around $30,000 per year.

What are the working hours like for Savings Tellers?

Savings Tellers typically work during regular business hours, which may include weekends and holidays.

What is the job outlook for Savings Tellers?

The job outlook for Savings Tellers is expected to grow in the coming years as the banking industry continues to evolve.