Are you a seasoned Securities Analyst seeking a new career path? Discover our professionally built Securities Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

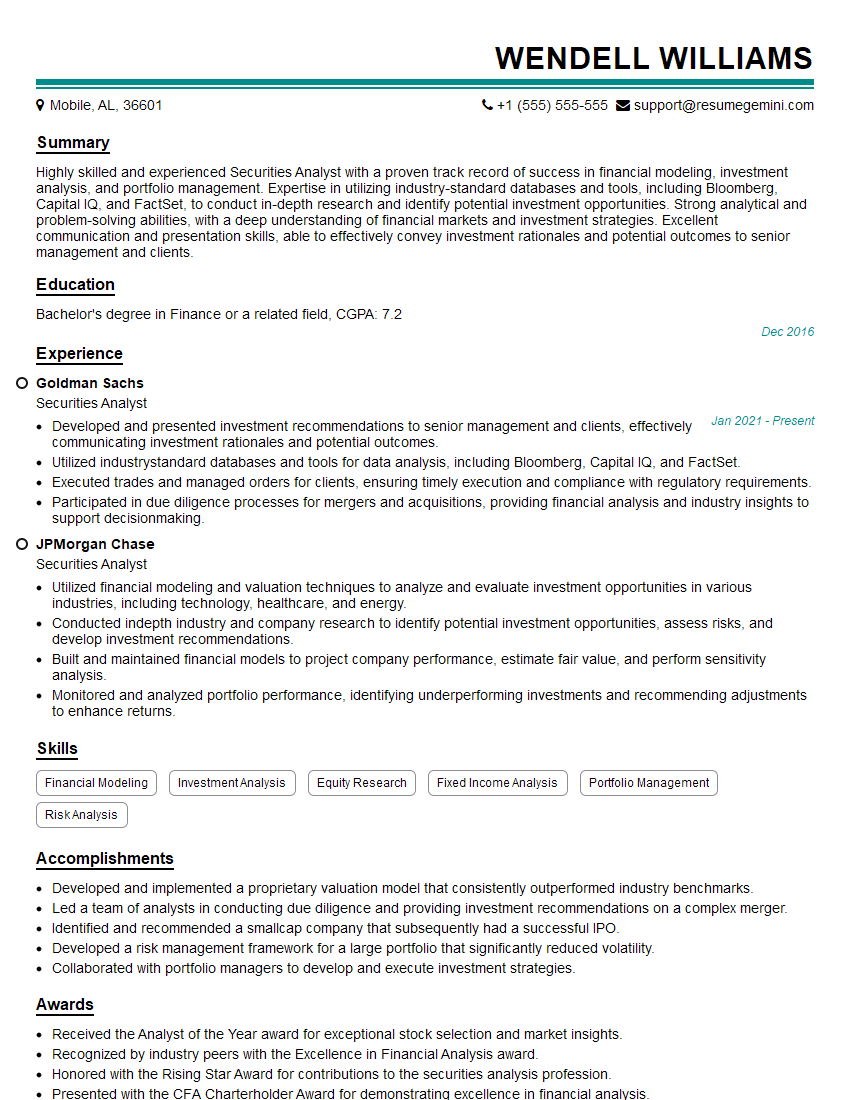

Wendell Williams

Securities Analyst

Summary

Highly skilled and experienced Securities Analyst with a proven track record of success in financial modeling, investment analysis, and portfolio management. Expertise in utilizing industry-standard databases and tools, including Bloomberg, Capital IQ, and FactSet, to conduct in-depth research and identify potential investment opportunities. Strong analytical and problem-solving abilities, with a deep understanding of financial markets and investment strategies. Excellent communication and presentation skills, able to effectively convey investment rationales and potential outcomes to senior management and clients.

Education

Bachelor’s degree in Finance or a related field

December 2016

Skills

- Financial Modeling

- Investment Analysis

- Equity Research

- Fixed Income Analysis

- Portfolio Management

- Risk Analysis

Work Experience

Securities Analyst

- Developed and presented investment recommendations to senior management and clients, effectively communicating investment rationales and potential outcomes.

- Utilized industrystandard databases and tools for data analysis, including Bloomberg, Capital IQ, and FactSet.

- Executed trades and managed orders for clients, ensuring timely execution and compliance with regulatory requirements.

- Participated in due diligence processes for mergers and acquisitions, providing financial analysis and industry insights to support decisionmaking.

Securities Analyst

- Utilized financial modeling and valuation techniques to analyze and evaluate investment opportunities in various industries, including technology, healthcare, and energy.

- Conducted indepth industry and company research to identify potential investment opportunities, assess risks, and develop investment recommendations.

- Built and maintained financial models to project company performance, estimate fair value, and perform sensitivity analysis.

- Monitored and analyzed portfolio performance, identifying underperforming investments and recommending adjustments to enhance returns.

Accomplishments

- Developed and implemented a proprietary valuation model that consistently outperformed industry benchmarks.

- Led a team of analysts in conducting due diligence and providing investment recommendations on a complex merger.

- Identified and recommended a smallcap company that subsequently had a successful IPO.

- Developed a risk management framework for a large portfolio that significantly reduced volatility.

- Collaborated with portfolio managers to develop and execute investment strategies.

Awards

- Received the Analyst of the Year award for exceptional stock selection and market insights.

- Recognized by industry peers with the Excellence in Financial Analysis award.

- Honored with the Rising Star Award for contributions to the securities analysis profession.

- Presented with the CFA Charterholder Award for demonstrating excellence in financial analysis.

Certificates

- Series 7

- Series 63

- GARP FRM

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Securities Analyst

- Highlight your financial modeling and valuation skills, as they are essential for this role.

- Showcase your investment analysis capabilities and experience in identifying potential investment opportunities.

- Emphasize your proficiency in industry research and your ability to assess risks and develop investment recommendations.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate the impact of your contributions.

Essential Experience Highlights for a Strong Securities Analyst Resume

- Utilize financial modeling and valuation techniques to analyze and evaluate investment opportunities in various industries.

- Conduct in-depth industry and company research to identify potential investment opportunities, assess risks, and develop investment recommendations.

- Build and maintain financial models to project company performance, estimate fair value, and perform sensitivity analysis.

- Monitor and analyze portfolio performance, identifying underperforming investments and recommending adjustments to enhance returns.

- Develop and present investment recommendations to senior management and clients, effectively communicating investment rationales and potential outcomes.

- Execute trades and manage orders for clients, ensuring timely execution and compliance with regulatory requirements.

- Participate in due diligence processes for mergers and acquisitions, providing financial analysis and industry insights to support decision-making.

Frequently Asked Questions (FAQ’s) For Securities Analyst

What are the key skills required to be a successful Securities Analyst?

The key skills required for a successful Securities Analyst include financial modeling, investment analysis, equity research, fixed income analysis, portfolio management, risk analysis, and strong communication and presentation skills.

What is the typical career path for a Securities Analyst?

The typical career path for a Securities Analyst involves starting as an Analyst, then progressing to Associate Analyst, Senior Analyst, and eventually Portfolio Manager or other senior-level positions.

What are the earning prospects for Securities Analysts?

The earning prospects for Securities Analysts are generally good, with experienced analysts earning substantial salaries and bonuses. The compensation can vary depending on factors such as experience, skills, and the size and performance of the firm.

What is the job outlook for Securities Analysts?

The job outlook for Securities Analysts is expected to be positive, as there is a growing demand for skilled analysts who can help investors make informed investment decisions.

What are the challenges faced by Securities Analysts?

The challenges faced by Securities Analysts include the need to stay up-to-date on market trends, the pressure to make accurate investment recommendations, and the potential for market volatility.

What are the educational requirements to become a Securities Analyst?

The educational requirements to become a Securities Analyst typically include a Bachelor’s degree in Finance or a related field, although some analysts may have a Master’s degree or an MBA.

What certifications are beneficial for Securities Analysts?

Beneficial certifications for Securities Analysts include the Chartered Financial Analyst (CFA) designation and the Financial Risk Manager (FRM) designation.