Are you a seasoned Securities Counselor seeking a new career path? Discover our professionally built Securities Counselor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

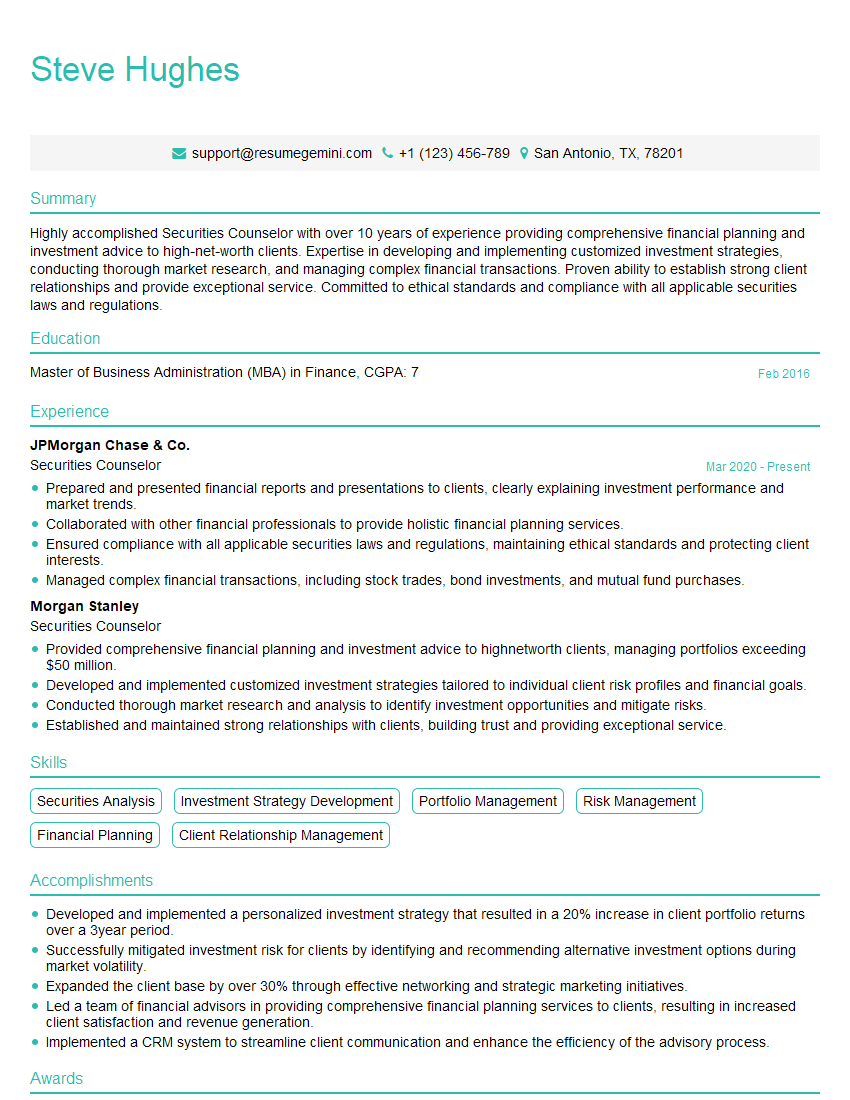

Steve Hughes

Securities Counselor

Summary

Highly accomplished Securities Counselor with over 10 years of experience providing comprehensive financial planning and investment advice to high-net-worth clients. Expertise in developing and implementing customized investment strategies, conducting thorough market research, and managing complex financial transactions. Proven ability to establish strong client relationships and provide exceptional service. Committed to ethical standards and compliance with all applicable securities laws and regulations.

Education

Master of Business Administration (MBA) in Finance

February 2016

Skills

- Securities Analysis

- Investment Strategy Development

- Portfolio Management

- Risk Management

- Financial Planning

- Client Relationship Management

Work Experience

Securities Counselor

- Prepared and presented financial reports and presentations to clients, clearly explaining investment performance and market trends.

- Collaborated with other financial professionals to provide holistic financial planning services.

- Ensured compliance with all applicable securities laws and regulations, maintaining ethical standards and protecting client interests.

- Managed complex financial transactions, including stock trades, bond investments, and mutual fund purchases.

Securities Counselor

- Provided comprehensive financial planning and investment advice to highnetworth clients, managing portfolios exceeding $50 million.

- Developed and implemented customized investment strategies tailored to individual client risk profiles and financial goals.

- Conducted thorough market research and analysis to identify investment opportunities and mitigate risks.

- Established and maintained strong relationships with clients, building trust and providing exceptional service.

Accomplishments

- Developed and implemented a personalized investment strategy that resulted in a 20% increase in client portfolio returns over a 3year period.

- Successfully mitigated investment risk for clients by identifying and recommending alternative investment options during market volatility.

- Expanded the client base by over 30% through effective networking and strategic marketing initiatives.

- Led a team of financial advisors in providing comprehensive financial planning services to clients, resulting in increased client satisfaction and revenue generation.

- Implemented a CRM system to streamline client communication and enhance the efficiency of the advisory process.

Awards

- Recipient of the Outstanding Securities Counselor Award from the American Securities Association for exceptional client service and market insights.

- Recognized as Security Counselor of the Year within the organization for consistently exceeding performance targets and providing superior investment advice.

- Awarded the Client Excellence Award for maintaining a 100% client retention rate and building strong relationships with highnetworth individuals.

Certificates

- Certified Financial Planner (CFP)

- Chartered Financial Analyst (CFA)

- Certified Investment Management Analyst (CIMA)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Securities Counselor

- Highlight your experience in managing high-value portfolios and providing tailored investment advice.

- Showcase your analytical and research skills, emphasizing your ability to identify investment opportunities and mitigate risks.

- Emphasize your client relationship management skills and your ability to build trust and provide exceptional service.

- Demonstrate your commitment to ethical standards and compliance, ensuring that you adhere to all relevant securities laws and regulations.

Essential Experience Highlights for a Strong Securities Counselor Resume

- Provided comprehensive financial planning and investment advice to high-net-worth clients, managing portfolios exceeding $50 million.

- Developed and implemented customized investment strategies tailored to individual client risk profiles and financial goals.

- Conducted thorough market research and analysis to identify investment opportunities and mitigate risks.

- Collaborated with other financial professionals to provide holistic financial planning services.

- Prepared and presented financial reports and presentations to clients, clearly explaining investment performance and market trends.

- Ensured compliance with all applicable securities laws and regulations, maintaining ethical standards and protecting client interests.

Frequently Asked Questions (FAQ’s) For Securities Counselor

What are the key skills required to be a successful Securities Counselor?

Key skills for Securities Counselors include securities analysis, investment strategy development, portfolio management, risk management, financial planning, and client relationship management.

What are the career prospects for Securities Counselors?

Securities Counselors have the opportunity to advance to roles such as Portfolio Manager, Chief Investment Officer, or Wealth Manager.

What is the average salary for Securities Counselors?

The average salary for Securities Counselors varies depending on experience, location, and employer. According to Salary.com, the average base salary for Securities Counselors in the United States is around $120,000 per year.

What are the educational requirements to become a Securities Counselor?

Most Securities Counselors hold a bachelor’s or master’s degree in finance, economics, or a related field.

What certifications are beneficial for Securities Counselors?

Securities Counselors may consider obtaining certifications such as the Certified Financial Planner (CFP) or the Chartered Financial Analyst (CFA) to enhance their credibility and knowledge.