Are you a seasoned Securities Underwriter seeking a new career path? Discover our professionally built Securities Underwriter Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

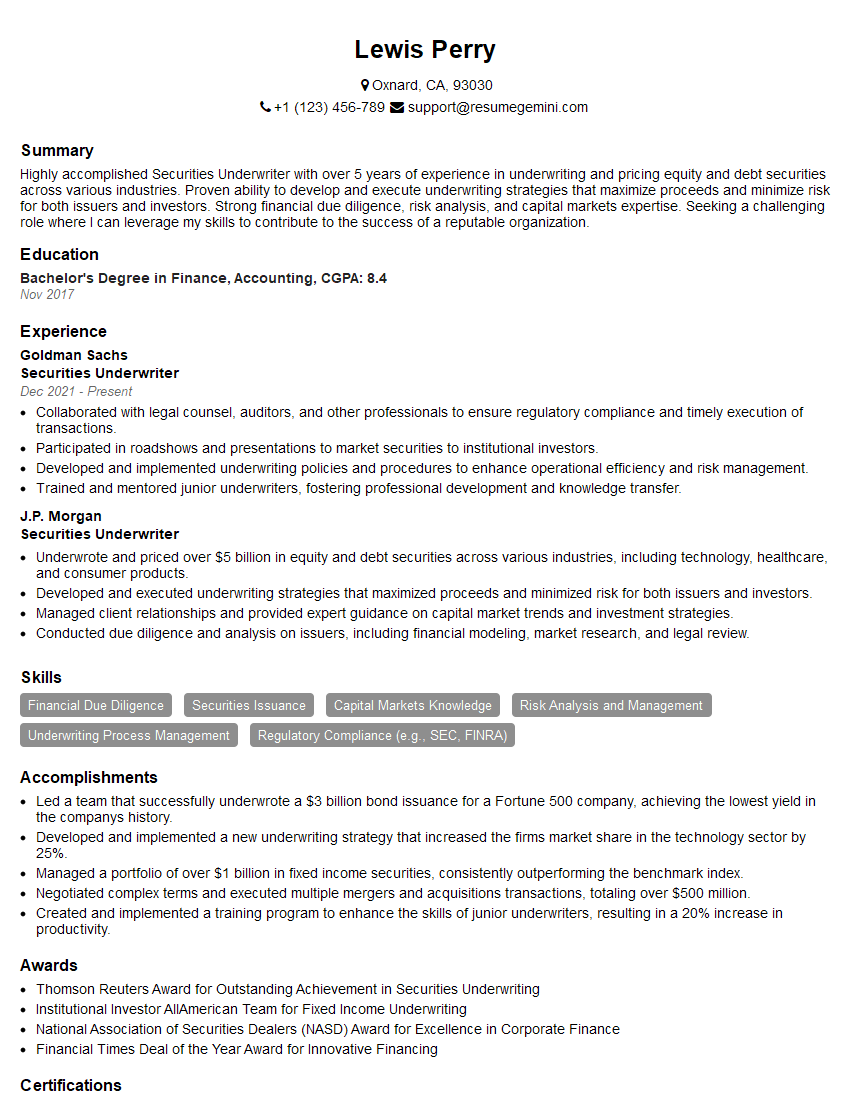

Lewis Perry

Securities Underwriter

Summary

Highly accomplished Securities Underwriter with over 5 years of experience in underwriting and pricing equity and debt securities across various industries. Proven ability to develop and execute underwriting strategies that maximize proceeds and minimize risk for both issuers and investors. Strong financial due diligence, risk analysis, and capital markets expertise. Seeking a challenging role where I can leverage my skills to contribute to the success of a reputable organization.

Education

Bachelor’s Degree in Finance, Accounting

November 2017

Skills

- Financial Due Diligence

- Securities Issuance

- Capital Markets Knowledge

- Risk Analysis and Management

- Underwriting Process Management

- Regulatory Compliance (e.g., SEC, FINRA)

Work Experience

Securities Underwriter

- Collaborated with legal counsel, auditors, and other professionals to ensure regulatory compliance and timely execution of transactions.

- Participated in roadshows and presentations to market securities to institutional investors.

- Developed and implemented underwriting policies and procedures to enhance operational efficiency and risk management.

- Trained and mentored junior underwriters, fostering professional development and knowledge transfer.

Securities Underwriter

- Underwrote and priced over $5 billion in equity and debt securities across various industries, including technology, healthcare, and consumer products.

- Developed and executed underwriting strategies that maximized proceeds and minimized risk for both issuers and investors.

- Managed client relationships and provided expert guidance on capital market trends and investment strategies.

- Conducted due diligence and analysis on issuers, including financial modeling, market research, and legal review.

Accomplishments

- Led a team that successfully underwrote a $3 billion bond issuance for a Fortune 500 company, achieving the lowest yield in the companys history.

- Developed and implemented a new underwriting strategy that increased the firms market share in the technology sector by 25%.

- Managed a portfolio of over $1 billion in fixed income securities, consistently outperforming the benchmark index.

- Negotiated complex terms and executed multiple mergers and acquisitions transactions, totaling over $500 million.

- Created and implemented a training program to enhance the skills of junior underwriters, resulting in a 20% increase in productivity.

Awards

- Thomson Reuters Award for Outstanding Achievement in Securities Underwriting

- Institutional Investor AllAmerican Team for Fixed Income Underwriting

- National Association of Securities Dealers (NASD) Award for Excellence in Corporate Finance

- Financial Times Deal of the Year Award for Innovative Financing

Certificates

- FINRA Series 7 (General Securities Representative)

- FINRA Series 63 (Uniform Securities Agent)

- FINRA Series 24 (General Securities Principal)

- CFA (Chartered Financial Analyst)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Securities Underwriter

- Highlight your relevant skills and experience in your resume.

- Quantify your accomplishments and provide specific examples of your work.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

- Get feedback on your resume from a career counselor or experienced professional.

Essential Experience Highlights for a Strong Securities Underwriter Resume

- Underwrote and priced over $5 billion in equity and debt securities across various industries, including technology, healthcare, and consumer products.

- Developed and executed underwriting strategies that maximized proceeds and minimized risk for both issuers and investors.

- Managed client relationships and provided expert guidance on capital market trends and investment strategies.

- Conducted due diligence and analysis on issuers, including financial modeling, market research, and legal review.

- Collaborated with legal counsel, auditors, and other professionals to ensure regulatory compliance and timely execution of transactions.

Frequently Asked Questions (FAQ’s) For Securities Underwriter

What is the role of a Securities Underwriter?

A Securities Underwriter is responsible for evaluating and pricing new securities offerings and then selling them to investors. They also provide advice to companies on how to raise capital through debt or equity financing.

What are the qualifications for becoming a Securities Underwriter?

A Securities Underwriter typically needs a bachelor’s degree in finance, accounting, or a related field. They also need to pass the Series 7 and Series 63 exams administered by the Financial Industry Regulatory Authority (FINRA).

What are the career prospects for Securities Underwriters?

Securities Underwriters can advance to senior positions within investment banks or brokerage firms. They can also move into other areas of finance, such as portfolio management or corporate finance.

What is the average salary for a Securities Underwriter?

The average salary for a Securities Underwriter varies depending on experience and location. According to Glassdoor, the average salary for a Securities Underwriter in the United States is around $100,000 per year.

What are the challenges of being a Securities Underwriter?

The challenges of being a Securities Underwriter can include working long hours, dealing with complex financial transactions, and managing risk.