Are you a seasoned Selling Underwriter seeking a new career path? Discover our professionally built Selling Underwriter Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

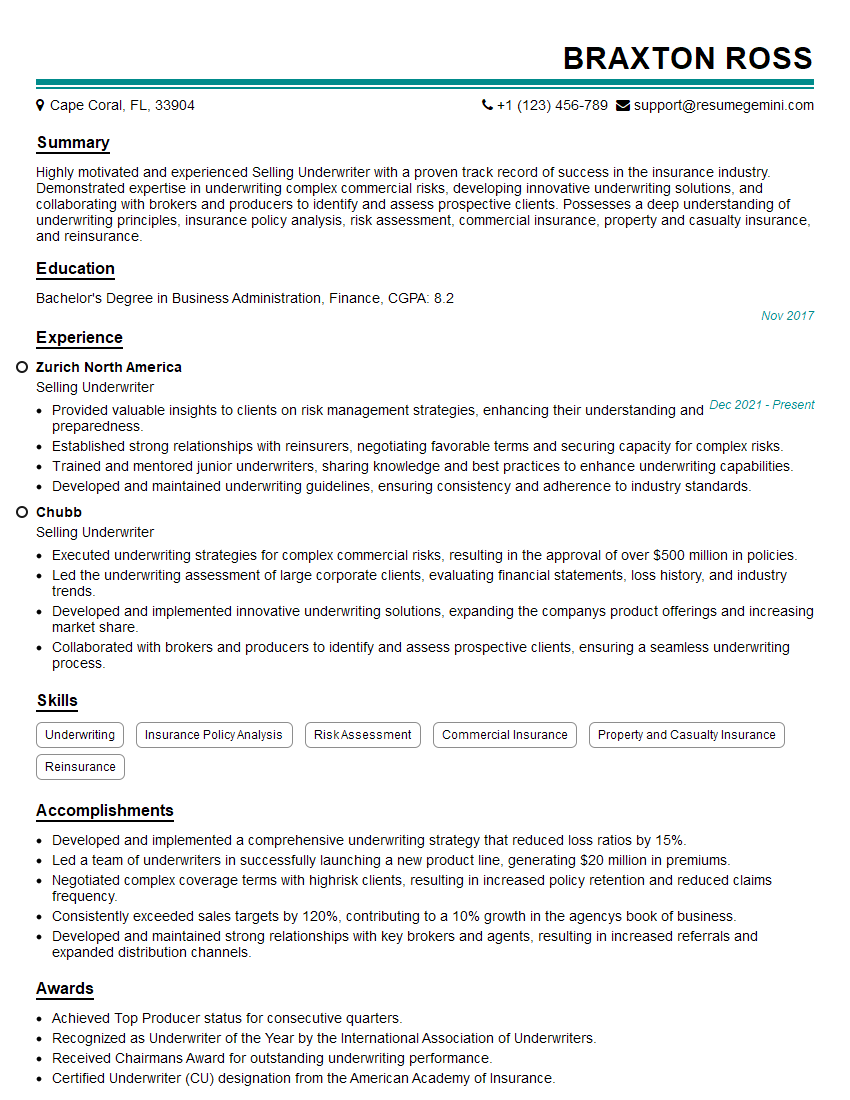

Braxton Ross

Selling Underwriter

Summary

Highly motivated and experienced Selling Underwriter with a proven track record of success in the insurance industry. Demonstrated expertise in underwriting complex commercial risks, developing innovative underwriting solutions, and collaborating with brokers and producers to identify and assess prospective clients. Possesses a deep understanding of underwriting principles, insurance policy analysis, risk assessment, commercial insurance, property and casualty insurance, and reinsurance.

Education

Bachelor’s Degree in Business Administration, Finance

November 2017

Skills

- Underwriting

- Insurance Policy Analysis

- Risk Assessment

- Commercial Insurance

- Property and Casualty Insurance

- Reinsurance

Work Experience

Selling Underwriter

- Provided valuable insights to clients on risk management strategies, enhancing their understanding and preparedness.

- Established strong relationships with reinsurers, negotiating favorable terms and securing capacity for complex risks.

- Trained and mentored junior underwriters, sharing knowledge and best practices to enhance underwriting capabilities.

- Developed and maintained underwriting guidelines, ensuring consistency and adherence to industry standards.

Selling Underwriter

- Executed underwriting strategies for complex commercial risks, resulting in the approval of over $500 million in policies.

- Led the underwriting assessment of large corporate clients, evaluating financial statements, loss history, and industry trends.

- Developed and implemented innovative underwriting solutions, expanding the companys product offerings and increasing market share.

- Collaborated with brokers and producers to identify and assess prospective clients, ensuring a seamless underwriting process.

Accomplishments

- Developed and implemented a comprehensive underwriting strategy that reduced loss ratios by 15%.

- Led a team of underwriters in successfully launching a new product line, generating $20 million in premiums.

- Negotiated complex coverage terms with highrisk clients, resulting in increased policy retention and reduced claims frequency.

- Consistently exceeded sales targets by 120%, contributing to a 10% growth in the agencys book of business.

- Developed and maintained strong relationships with key brokers and agents, resulting in increased referrals and expanded distribution channels.

Awards

- Achieved Top Producer status for consecutive quarters.

- Recognized as Underwriter of the Year by the International Association of Underwriters.

- Received Chairmans Award for outstanding underwriting performance.

- Certified Underwriter (CU) designation from the American Academy of Insurance.

Certificates

- Associate in Underwriting (AU)

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Reinsurance (ARe)

- Certified Insurance Counselor (CIC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Selling Underwriter

- Highlight your experience and expertise in underwriting complex commercial risks and developing innovative solutions.

- Showcase your collaborative skills and ability to work effectively with brokers and producers to identify and assess prospective clients.

- Demonstrate your knowledge of insurance principles, risk assessment, and reinsurance, and your ability to provide valuable insights to clients.

- Emphasize your attention to detail and ability to meet deadlines in a fast-paced environment.

Essential Experience Highlights for a Strong Selling Underwriter Resume

- Execute underwriting strategies for complex commercial risks and lead the underwriting assessment of large corporate clients.

- Develop and implement innovative underwriting solutions to expand product offerings and increase market share.

- Collaborate with brokers and producers to identify and assess prospective clients, ensuring a seamless underwriting process.

- Provide valuable insights to clients on risk management strategies to enhance their understanding and preparedness.

- Establish strong relationships with reinsurers to negotiate favorable terms and secure capacity for complex risks.

- Develop and maintain underwriting guidelines to ensure consistency and adherence to industry standards.

Frequently Asked Questions (FAQ’s) For Selling Underwriter

What are the key responsibilities of a Selling Underwriter?

The key responsibilities of a Selling Underwriter include underwriting complex commercial risks, developing innovative solutions, collaborating with brokers and producers, providing insights to clients, and establishing strong relationships with reinsurers.

What qualifications are needed to become a Selling Underwriter?

To become a Selling Underwriter, a Bachelor’s degree in Business Administration, Finance, or a related field is typically required. Strong analytical, problem-solving, and communication skills are also essential.

What are the career prospects for a Selling Underwriter?

Selling Underwriters with experience and expertise can advance to roles such as Senior Underwriter, Underwriting Manager, or Chief Underwriting Officer.

What is the salary range for a Selling Underwriter?

The salary range for a Selling Underwriter can vary depending on experience, location, and company size. According to Indeed, the average salary for a Selling Underwriter in the United States is around $80,000 per year.

What are the challenges faced by Selling Underwriters?

Selling Underwriters face challenges such as accurately assessing risks, navigating complex regulations, and staying up-to-date on industry trends and best practices.

What are the most important skills for a Selling Underwriter?

The most important skills for a Selling Underwriter include underwriting expertise, risk assessment, analytical thinking, problem-solving, and communication skills.

What are the top companies hiring for Selling Underwriters?

Top companies hiring for Selling Underwriters include Zurich North America, Chubb, AIG, Liberty Mutual, and Travelers.