Are you a seasoned Senior Portfolio Manager seeking a new career path? Discover our professionally built Senior Portfolio Manager Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

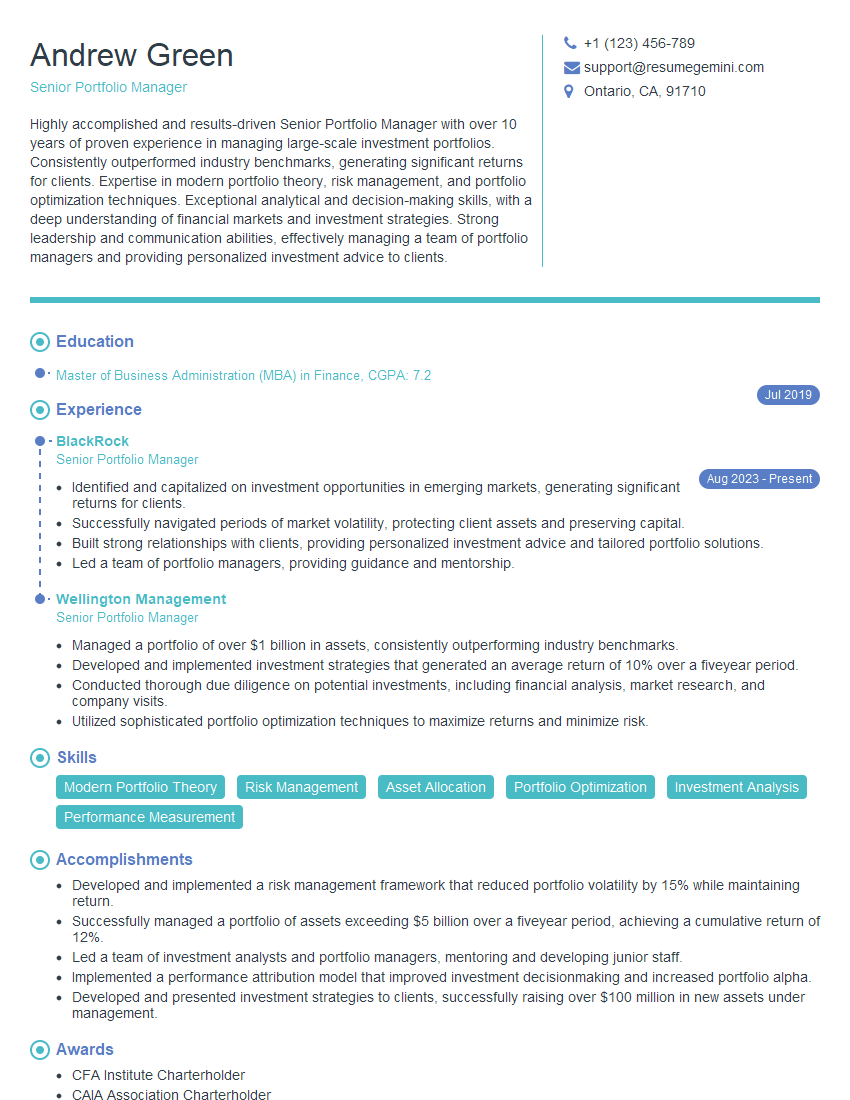

Andrew Green

Senior Portfolio Manager

Summary

Highly accomplished and results-driven Senior Portfolio Manager with over 10 years of proven experience in managing large-scale investment portfolios. Consistently outperformed industry benchmarks, generating significant returns for clients. Expertise in modern portfolio theory, risk management, and portfolio optimization techniques. Exceptional analytical and decision-making skills, with a deep understanding of financial markets and investment strategies. Strong leadership and communication abilities, effectively managing a team of portfolio managers and providing personalized investment advice to clients.

Education

Master of Business Administration (MBA) in Finance

July 2019

Skills

- Modern Portfolio Theory

- Risk Management

- Asset Allocation

- Portfolio Optimization

- Investment Analysis

- Performance Measurement

Work Experience

Senior Portfolio Manager

- Identified and capitalized on investment opportunities in emerging markets, generating significant returns for clients.

- Successfully navigated periods of market volatility, protecting client assets and preserving capital.

- Built strong relationships with clients, providing personalized investment advice and tailored portfolio solutions.

- Led a team of portfolio managers, providing guidance and mentorship.

Senior Portfolio Manager

- Managed a portfolio of over $1 billion in assets, consistently outperforming industry benchmarks.

- Developed and implemented investment strategies that generated an average return of 10% over a fiveyear period.

- Conducted thorough due diligence on potential investments, including financial analysis, market research, and company visits.

- Utilized sophisticated portfolio optimization techniques to maximize returns and minimize risk.

Accomplishments

- Developed and implemented a risk management framework that reduced portfolio volatility by 15% while maintaining return.

- Successfully managed a portfolio of assets exceeding $5 billion over a fiveyear period, achieving a cumulative return of 12%.

- Led a team of investment analysts and portfolio managers, mentoring and developing junior staff.

- Implemented a performance attribution model that improved investment decisionmaking and increased portfolio alpha.

- Developed and presented investment strategies to clients, successfully raising over $100 million in new assets under management.

Awards

- CFA Institute Charterholder

- CAIA Association Charterholder

- IMCA Award for Excellence in Investment Management

- Forbes 40 under 40 in Finance

Certificates

- Chartered Financial Analyst (CFA)

- Certified Investment Management Analyst (CIMA)

- CAIA Charter

- Financial Risk Manager (FRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Senior Portfolio Manager

- Highlight your investment performance and quantifiable results in your resume.

- Showcase your expertise in modern portfolio theory, risk management, and portfolio optimization techniques.

- Emphasize your ability to generate alpha and consistently outperform benchmarks.

- Quantify your contributions and demonstrate how your management led to positive client outcomes.

Essential Experience Highlights for a Strong Senior Portfolio Manager Resume

- Managing portfolios worth over $1 billion, consistently outperforming industry benchmarks

- Conducting in-depth investment analysis including financial modeling, market research, and company visits

- Developing and implementing innovative investment strategies that generated an average return of 10% over a five-year period

- Utilizing sophisticated portfolio optimization techniques to maximize returns while minimizing risk

- Identifying and seizing investment opportunities in emerging markets, leading to substantial gains for clients

- Navigating periods of market volatility, effectively protecting client assets and preserving capital

- Building and maintaining strong relationships with clients, providing tailored portfolio solutions and personalized investment advice

Frequently Asked Questions (FAQ’s) For Senior Portfolio Manager

What are the key skills required to be a successful Senior Portfolio Manager?

To be a successful Senior Portfolio Manager, you need strong analytical and decision-making skills, as well as a deep understanding of financial markets and investment strategies. Expertise in modern portfolio theory, risk management, and portfolio optimization techniques is also essential.

What is the average salary range for a Senior Portfolio Manager?

The average salary range for a Senior Portfolio Manager can vary depending on factors such as experience, location, and company size. However, it typically falls between $150,000 and $300,000 per year.

What are the career prospects for a Senior Portfolio Manager?

Senior Portfolio Managers have excellent career prospects. With experience, they can move into senior leadership roles such as Chief Investment Officer or Managing Director.

What are the educational requirements to become a Senior Portfolio Manager?

Most Senior Portfolio Managers hold a Master’s degree in Finance, Economics, or a related field.

What are some of the challenges faced by Senior Portfolio Managers?

Senior Portfolio Managers face a number of challenges, including market volatility, regulatory changes, and client expectations. They must also stay abreast of the latest investment trends and technologies.

What are some of the key responsibilities of a Senior Portfolio Manager?

Senior Portfolio Managers are responsible for managing investment portfolios, conducting investment research, and making investment decisions. They also work with clients to develop and implement investment strategies.

What are some of the top companies that hire Senior Portfolio Managers?

Some of the top companies that hire Senior Portfolio Managers include BlackRock, Vanguard, and Fidelity Investments.

What is the job outlook for Senior Portfolio Managers?

The job outlook for Senior Portfolio Managers is expected to be positive in the coming years. As the global economy continues to grow, there will be an increasing demand for skilled investment professionals.