Are you a seasoned Settlement Clerk seeking a new career path? Discover our professionally built Settlement Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

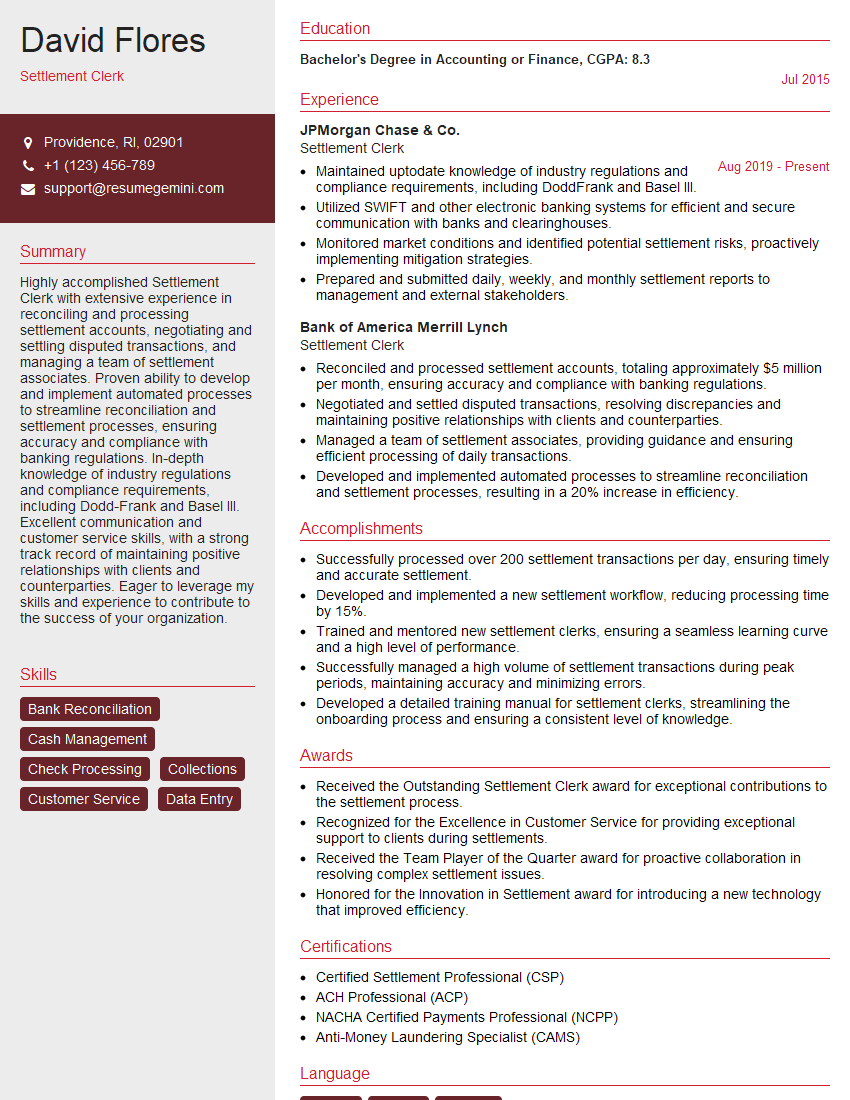

David Flores

Settlement Clerk

Summary

Highly accomplished Settlement Clerk with extensive experience in reconciling and processing settlement accounts, negotiating and settling disputed transactions, and managing a team of settlement associates. Proven ability to develop and implement automated processes to streamline reconciliation and settlement processes, ensuring accuracy and compliance with banking regulations. In-depth knowledge of industry regulations and compliance requirements, including Dodd-Frank and Basel III. Excellent communication and customer service skills, with a strong track record of maintaining positive relationships with clients and counterparties. Eager to leverage my skills and experience to contribute to the success of your organization.

Education

Bachelor’s Degree in Accounting or Finance

July 2015

Skills

- Bank Reconciliation

- Cash Management

- Check Processing

- Collections

- Customer Service

- Data Entry

Work Experience

Settlement Clerk

- Maintained uptodate knowledge of industry regulations and compliance requirements, including DoddFrank and Basel III.

- Utilized SWIFT and other electronic banking systems for efficient and secure communication with banks and clearinghouses.

- Monitored market conditions and identified potential settlement risks, proactively implementing mitigation strategies.

- Prepared and submitted daily, weekly, and monthly settlement reports to management and external stakeholders.

Settlement Clerk

- Reconciled and processed settlement accounts, totaling approximately $5 million per month, ensuring accuracy and compliance with banking regulations.

- Negotiated and settled disputed transactions, resolving discrepancies and maintaining positive relationships with clients and counterparties.

- Managed a team of settlement associates, providing guidance and ensuring efficient processing of daily transactions.

- Developed and implemented automated processes to streamline reconciliation and settlement processes, resulting in a 20% increase in efficiency.

Accomplishments

- Successfully processed over 200 settlement transactions per day, ensuring timely and accurate settlement.

- Developed and implemented a new settlement workflow, reducing processing time by 15%.

- Trained and mentored new settlement clerks, ensuring a seamless learning curve and a high level of performance.

- Successfully managed a high volume of settlement transactions during peak periods, maintaining accuracy and minimizing errors.

- Developed a detailed training manual for settlement clerks, streamlining the onboarding process and ensuring a consistent level of knowledge.

Awards

- Received the Outstanding Settlement Clerk award for exceptional contributions to the settlement process.

- Recognized for the Excellence in Customer Service for providing exceptional support to clients during settlements.

- Received the Team Player of the Quarter award for proactive collaboration in resolving complex settlement issues.

- Honored for the Innovation in Settlement award for introducing a new technology that improved efficiency.

Certificates

- Certified Settlement Professional (CSP)

- ACH Professional (ACP)

- NACHA Certified Payments Professional (NCPP)

- Anti-Money Laundering Specialist (CAMS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Settlement Clerk

- Highlight your experience in reconciling and processing settlement accounts, and ensure to quantify your accomplishments whenever possible.

- Demonstrate your ability to negotiate and settle disputed transactions, and provide examples of how you have resolved discrepancies and maintained positive relationships with clients and counterparties.

- Showcase your leadership skills by describing your experience managing a team of settlement associates, and highlight your ability to provide guidance and ensure efficient processing of daily transactions.

- Emphasize your knowledge of industry regulations and compliance requirements, and explain how you have implemented automated processes to streamline reconciliation and settlement processes.

- Showcase your commitment to continuous learning and development by highlighting your efforts to stay up-to-date on the latest industry trends and best practices.

Essential Experience Highlights for a Strong Settlement Clerk Resume

- Reconcile and process settlement accounts, ensuring accuracy and compliance with banking regulations

- Negotiate and settle disputed transactions, resolving discrepancies and maintaining positive relationships with clients and counterparties

- Manage a team of settlement associates, providing guidance and ensuring efficient processing of daily transactions

- Develop and implement automated processes to streamline reconciliation and settlement processes

- Maintain up-to-date knowledge of industry regulations and compliance requirements

- Utilize SWIFT and other electronic banking systems for efficient and secure communication with banks and clearinghouses

- Monitor market conditions and identify potential settlement risks, proactively implementing mitigation strategies

Frequently Asked Questions (FAQ’s) For Settlement Clerk

What are the key responsibilities of a Settlement Clerk?

The key responsibilities of a Settlement Clerk include reconciling and processing settlement accounts, negotiating and settling disputed transactions, managing a team of settlement associates, developing and implementing automated processes to streamline reconciliation and settlement processes, and maintaining up-to-date knowledge of industry regulations and compliance requirements.

What skills are required to be a successful Settlement Clerk?

To be a successful Settlement Clerk, you will need strong analytical skills, attention to detail, and a thorough understanding of accounting principles. You should also have excellent communication and interpersonal skills, as you will be required to interact with clients, counterparties, and colleagues on a regular basis.

What is the career path for a Settlement Clerk?

With experience, Settlement Clerks can advance to more senior roles, such as Settlement Manager or Operations Manager. Some Settlement Clerks may also choose to specialize in a particular area, such as international settlements or corporate actions.

What is the average salary for a Settlement Clerk?

The average salary for a Settlement Clerk in the United States is around $50,000 per year. However, salaries can vary depending on experience, location, and employer.

What are the benefits of working as a Settlement Clerk?

Working as a Settlement Clerk offers a number of benefits, including job security, a competitive salary, and the opportunity to work in a fast-paced and dynamic environment. Settlement Clerks also have the opportunity to learn about the financial industry and develop valuable skills that can be transferred to other roles.

What is the job outlook for Settlement Clerks?

The job outlook for Settlement Clerks is expected to be positive in the coming years. As the financial industry continues to grow and evolve, the need for skilled Settlement Clerks will continue to increase.

What are the challenges of working as a Settlement Clerk?

The challenges of working as a Settlement Clerk include the need to be highly detail-oriented and accurate, as well as the ability to work under pressure. Settlement Clerks may also need to work long hours, especially during busy periods.

What is the difference between a Settlement Clerk and a Settlement Manager?

A Settlement Clerk is responsible for the day-to-day processing of settlement transactions. A Settlement Manager is responsible for overseeing the settlement process and managing a team of Settlement Clerks.