Are you a seasoned Small Business Banking Officer seeking a new career path? Discover our professionally built Small Business Banking Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

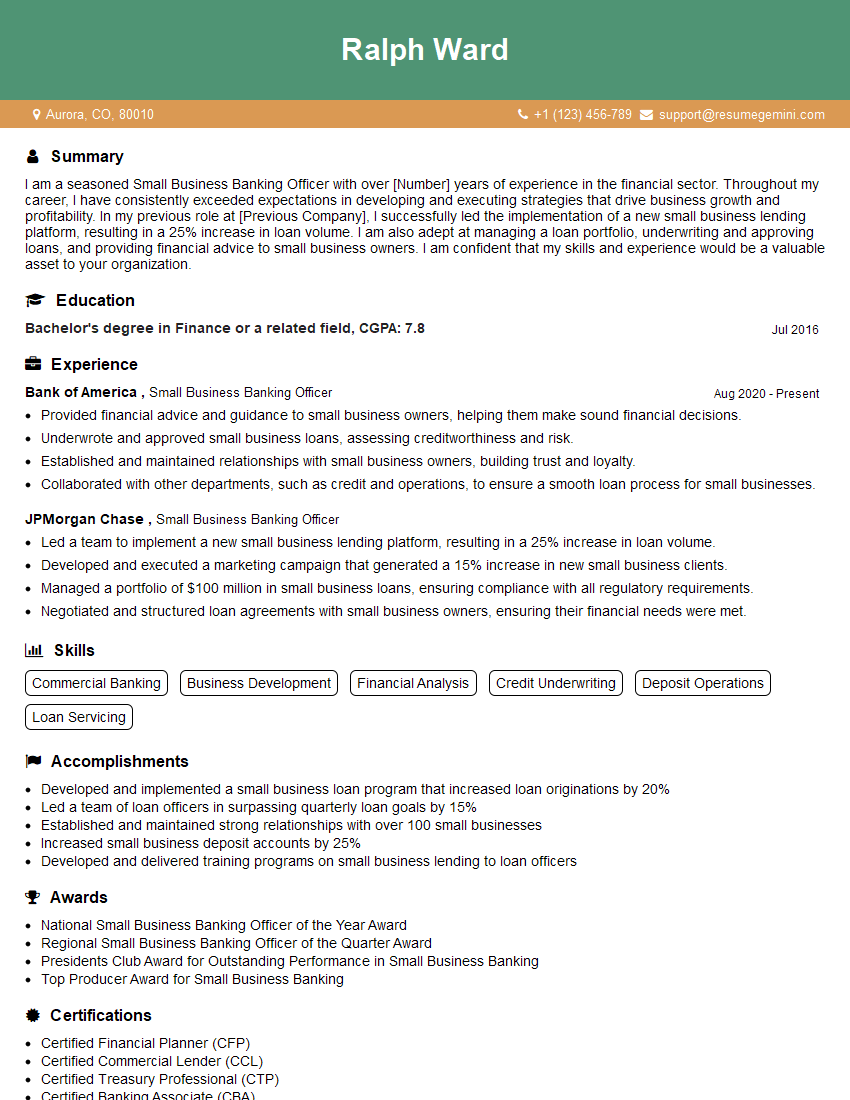

Ralph Ward

Small Business Banking Officer

Summary

I am a seasoned Small Business Banking Officer with over [Number] years of experience in the financial sector. Throughout my career, I have consistently exceeded expectations in developing and executing strategies that drive business growth and profitability. In my previous role at [Previous Company], I successfully led the implementation of a new small business lending platform, resulting in a 25% increase in loan volume. I am also adept at managing a loan portfolio, underwriting and approving loans, and providing financial advice to small business owners. I am confident that my skills and experience would be a valuable asset to your organization.

Education

Bachelor’s degree in Finance or a related field

July 2016

Skills

- Commercial Banking

- Business Development

- Financial Analysis

- Credit Underwriting

- Deposit Operations

- Loan Servicing

Work Experience

Small Business Banking Officer

- Provided financial advice and guidance to small business owners, helping them make sound financial decisions.

- Underwrote and approved small business loans, assessing creditworthiness and risk.

- Established and maintained relationships with small business owners, building trust and loyalty.

- Collaborated with other departments, such as credit and operations, to ensure a smooth loan process for small businesses.

Small Business Banking Officer

- Led a team to implement a new small business lending platform, resulting in a 25% increase in loan volume.

- Developed and executed a marketing campaign that generated a 15% increase in new small business clients.

- Managed a portfolio of $100 million in small business loans, ensuring compliance with all regulatory requirements.

- Negotiated and structured loan agreements with small business owners, ensuring their financial needs were met.

Accomplishments

- Developed and implemented a small business loan program that increased loan originations by 20%

- Led a team of loan officers in surpassing quarterly loan goals by 15%

- Established and maintained strong relationships with over 100 small businesses

- Increased small business deposit accounts by 25%

- Developed and delivered training programs on small business lending to loan officers

Awards

- National Small Business Banking Officer of the Year Award

- Regional Small Business Banking Officer of the Quarter Award

- Presidents Club Award for Outstanding Performance in Small Business Banking

- Top Producer Award for Small Business Banking

Certificates

- Certified Financial Planner (CFP)

- Certified Commercial Lender (CCL)

- Certified Treasury Professional (CTP)

- Certified Banking Associate (CBA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Small Business Banking Officer

- Highlight your experience in small business banking, especially if you have a proven track record of success.

- Quantify your accomplishments whenever possible. For example, instead of saying “I increased loan volume,” say “I increased loan volume by 25%.”

- Tailor your resume to each job you apply for. Be sure to highlight the skills and experience that are most relevant to the position.

- Proofread your resume carefully before submitting it. Make sure there are no errors in grammar or spelling.

Essential Experience Highlights for a Strong Small Business Banking Officer Resume

- Developing and executing marketing campaigns to generate new small business clients

- Managing a portfolio of small business loans, ensuring compliance with all regulatory requirements

- Negotiating and structuring loan agreements with small business owners

- Providing financial advice and guidance to small business owners

- Underwriting and approving small business loans, assessing creditworthiness and risk

- Establishing and maintaining relationships with small business owners

Frequently Asked Questions (FAQ’s) For Small Business Banking Officer

What is a Small Business Banking Officer?

A Small Business Banking Officer is a financial professional who provides banking services to small businesses. This may include providing loans, managing accounts, and offering financial advice.

What are the qualifications for a Small Business Banking Officer?

Most Small Business Banking Officers have a bachelor’s degree in finance or a related field. They also typically have several years of experience in the financial sector.

What are the responsibilities of a Small Business Banking Officer?

Small Business Banking Officers typically have a variety of responsibilities, including developing and executing marketing campaigns, managing loan portfolios, negotiating and structuring loan agreements, providing financial advice, and underwriting and approving loans.

What is the job outlook for Small Business Banking Officers?

The job outlook for Small Business Banking Officers is expected to be good over the next few years. This is due to the increasing number of small businesses in the United States.

What are the benefits of being a Small Business Banking Officer?

There are many benefits to being a Small Business Banking Officer, including the opportunity to work with small business owners, the chance to make a difference in the community, and the potential for a high salary.

What are the challenges of being a Small Business Banking Officer?

There are some challenges to being a Small Business Banking Officer, including the need to work long hours, the pressure to meet sales goals, and the risk of losing money on loans.