Are you a seasoned Special Tax Auditor seeking a new career path? Discover our professionally built Special Tax Auditor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

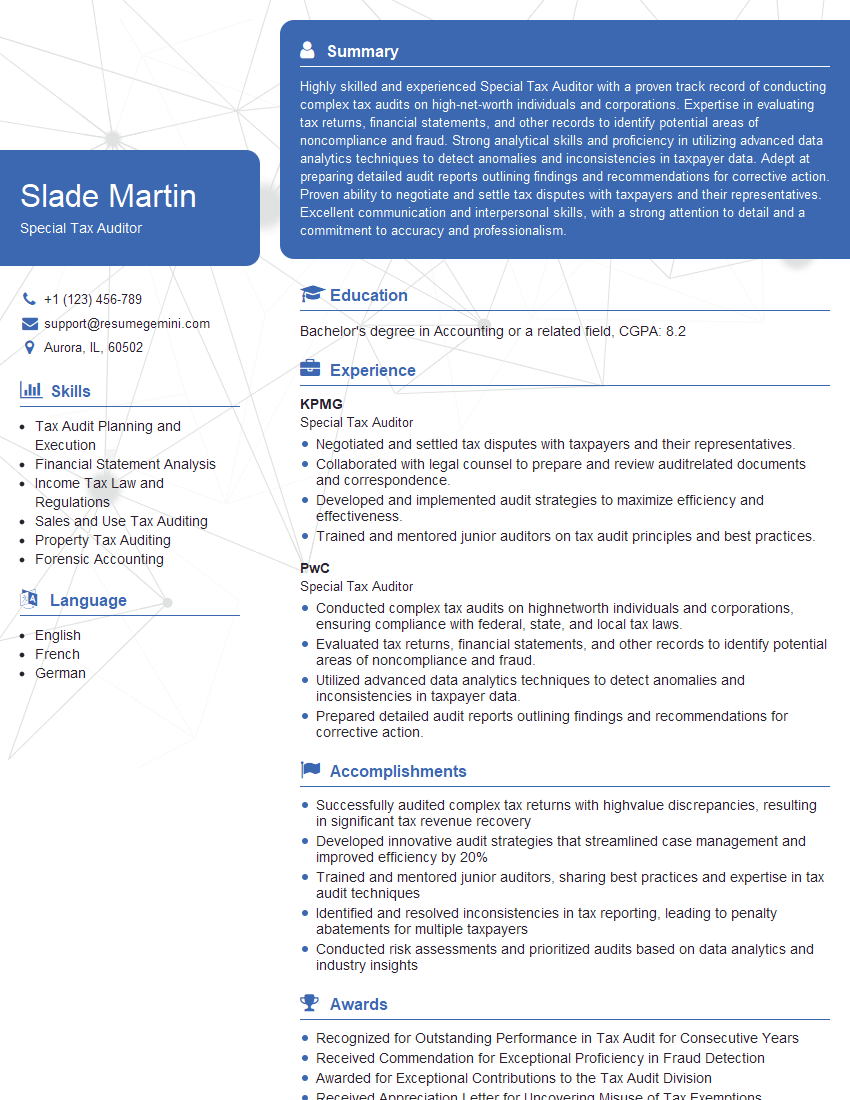

Slade Martin

Special Tax Auditor

Summary

Highly skilled and experienced Special Tax Auditor with a proven track record of conducting complex tax audits on high-net-worth individuals and corporations. Expertise in evaluating tax returns, financial statements, and other records to identify potential areas of noncompliance and fraud. Strong analytical skills and proficiency in utilizing advanced data analytics techniques to detect anomalies and inconsistencies in taxpayer data. Adept at preparing detailed audit reports outlining findings and recommendations for corrective action. Proven ability to negotiate and settle tax disputes with taxpayers and their representatives. Excellent communication and interpersonal skills, with a strong attention to detail and a commitment to accuracy and professionalism.

Education

Bachelor’s degree in Accounting or a related field

July 2018

Skills

- Tax Audit Planning and Execution

- Financial Statement Analysis

- Income Tax Law and Regulations

- Sales and Use Tax Auditing

- Property Tax Auditing

- Forensic Accounting

Work Experience

Special Tax Auditor

- Negotiated and settled tax disputes with taxpayers and their representatives.

- Collaborated with legal counsel to prepare and review auditrelated documents and correspondence.

- Developed and implemented audit strategies to maximize efficiency and effectiveness.

- Trained and mentored junior auditors on tax audit principles and best practices.

Special Tax Auditor

- Conducted complex tax audits on highnetworth individuals and corporations, ensuring compliance with federal, state, and local tax laws.

- Evaluated tax returns, financial statements, and other records to identify potential areas of noncompliance and fraud.

- Utilized advanced data analytics techniques to detect anomalies and inconsistencies in taxpayer data.

- Prepared detailed audit reports outlining findings and recommendations for corrective action.

Accomplishments

- Successfully audited complex tax returns with highvalue discrepancies, resulting in significant tax revenue recovery

- Developed innovative audit strategies that streamlined case management and improved efficiency by 20%

- Trained and mentored junior auditors, sharing best practices and expertise in tax audit techniques

- Identified and resolved inconsistencies in tax reporting, leading to penalty abatements for multiple taxpayers

- Conducted risk assessments and prioritized audits based on data analytics and industry insights

Awards

- Recognized for Outstanding Performance in Tax Audit for Consecutive Years

- Received Commendation for Exceptional Proficiency in Fraud Detection

- Awarded for Exceptional Contributions to the Tax Audit Division

- Received Appreciation Letter for Uncovering Misuse of Tax Exemptions

Certificates

- Certified Public Accountant (CPA)

- Enrolled Agent (EA)

- Certified Fraud Examiner (CFE)

- Certified Internal Auditor (CIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Special Tax Auditor

- Highlight your experience and expertise in tax auditing, financial statement analysis, and tax law.

- Showcase your analytical skills and proficiency in utilizing advanced data analytics techniques.

- Emphasize your ability to prepare clear and concise audit reports and negotiate effectively with taxpayers.

- Demonstrate your commitment to accuracy, professionalism, and ethical conduct.

Essential Experience Highlights for a Strong Special Tax Auditor Resume

- Plan and execute tax audits in accordance with established procedures and guidelines.

- Analyze financial statements and tax returns to identify potential areas of noncompliance.

- Utilize advanced data analytics techniques to detect anomalies and inconsistencies in taxpayer data.

- Prepare detailed audit reports outlining findings and recommendations for corrective action.

- Negotiate and settle tax disputes with taxpayers and their representatives.

- Collaborate with legal counsel to prepare and review audit-related documents and correspondence.

- Develop and implement audit strategies to maximize efficiency and effectiveness.

Frequently Asked Questions (FAQ’s) For Special Tax Auditor

What are the key responsibilities of a Special Tax Auditor?

Special Tax Auditors are responsible for planning and executing tax audits, analyzing financial statements and tax returns, identifying potential areas of noncompliance, preparing audit reports, negotiating and settling tax disputes, and collaborating with legal counsel.

What qualifications are required to become a Special Tax Auditor?

To become a Special Tax Auditor, a Bachelor’s degree in Accounting or a related field is typically required, along with strong analytical skills, proficiency in data analytics techniques, and a deep understanding of tax laws and regulations.

What are the career prospects for Special Tax Auditors?

Special Tax Auditors can advance to management positions within the field, such as Senior Tax Auditor or Tax Manager. They may also transition into roles in tax consulting, forensic accounting, or other related areas.

What are the challenges faced by Special Tax Auditors?

Special Tax Auditors face challenges such as the complexity of tax laws and regulations, the need to stay updated on changes in tax codes, and the potential for disputes with taxpayers.

What is the work environment like for Special Tax Auditors?

Special Tax Auditors typically work in office settings, often collaborating with other tax professionals and auditors. They may also travel to meet with taxpayers or attend conferences.