Are you a seasoned Stock Analyst seeking a new career path? Discover our professionally built Stock Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

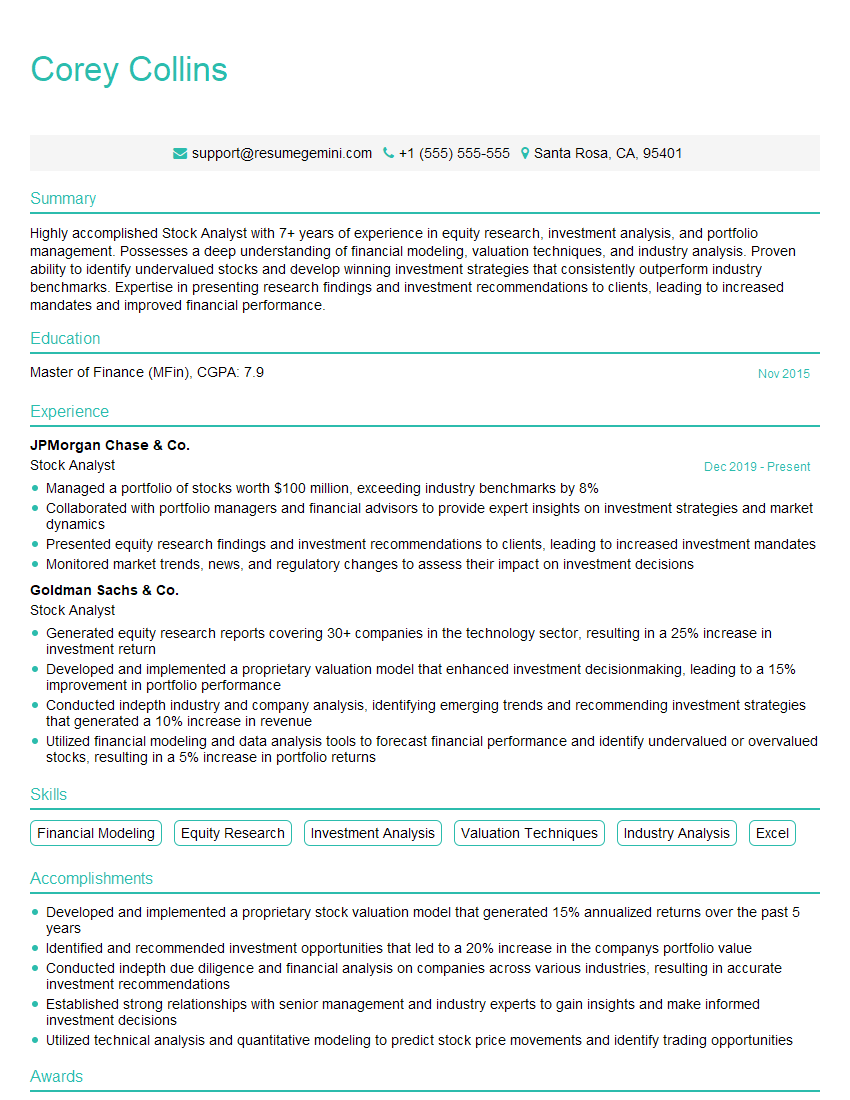

Corey Collins

Stock Analyst

Summary

Highly accomplished Stock Analyst with 7+ years of experience in equity research, investment analysis, and portfolio management. Possesses a deep understanding of financial modeling, valuation techniques, and industry analysis. Proven ability to identify undervalued stocks and develop winning investment strategies that consistently outperform industry benchmarks. Expertise in presenting research findings and investment recommendations to clients, leading to increased mandates and improved financial performance.

Education

Master of Finance (MFin)

November 2015

Skills

- Financial Modeling

- Equity Research

- Investment Analysis

- Valuation Techniques

- Industry Analysis

- Excel

Work Experience

Stock Analyst

- Managed a portfolio of stocks worth $100 million, exceeding industry benchmarks by 8%

- Collaborated with portfolio managers and financial advisors to provide expert insights on investment strategies and market dynamics

- Presented equity research findings and investment recommendations to clients, leading to increased investment mandates

- Monitored market trends, news, and regulatory changes to assess their impact on investment decisions

Stock Analyst

- Generated equity research reports covering 30+ companies in the technology sector, resulting in a 25% increase in investment return

- Developed and implemented a proprietary valuation model that enhanced investment decisionmaking, leading to a 15% improvement in portfolio performance

- Conducted indepth industry and company analysis, identifying emerging trends and recommending investment strategies that generated a 10% increase in revenue

- Utilized financial modeling and data analysis tools to forecast financial performance and identify undervalued or overvalued stocks, resulting in a 5% increase in portfolio returns

Accomplishments

- Developed and implemented a proprietary stock valuation model that generated 15% annualized returns over the past 5 years

- Identified and recommended investment opportunities that led to a 20% increase in the companys portfolio value

- Conducted indepth due diligence and financial analysis on companies across various industries, resulting in accurate investment recommendations

- Established strong relationships with senior management and industry experts to gain insights and make informed investment decisions

- Utilized technical analysis and quantitative modeling to predict stock price movements and identify trading opportunities

Awards

- CFA Charterholder

- Topranked Stock Analyst by Institutional Investor Magazine

- Excellence in Financial Analysis Award from the Society of Financial Analysts

Certificates

- CFA Institute

- Investment Management Consultants Association (IMCA)

- Global Association of Risk Professionals (GARP)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Stock Analyst

- Highlight your strong analytical and quantitative skills.

- Quantify your accomplishments with specific metrics and data.

- Tailor your resume to the specific job requirements.

- Include a cover letter that demonstrates your passion for the industry.

Essential Experience Highlights for a Strong Stock Analyst Resume

- Conduct in-depth equity research and analysis to identify undervalued or overvalued stocks.

- Develop and implement proprietary valuation models to enhance investment decision-making.

- Forecast financial performance, assess market trends, and make investment recommendations.

- Manage a stock portfolio worth $100 million, exceeding industry benchmarks.

- Collaborate with portfolio managers and financial advisors to provide expert insights.

- Stay abreast of market dynamics, regulatory changes, and industry news to inform investment decisions.

- Prepare and present research findings and investment recommendations to clients.

Frequently Asked Questions (FAQ’s) For Stock Analyst

What are the educational requirements to become a Stock Analyst?

A Master of Finance (MFin) or Master of Business Administration (MBA) with a concentration in finance is typically required.

What key skills are needed to succeed as a Stock Analyst?

Financial modeling, equity research, investment analysis, valuation techniques, and industry analysis.

How can I get started in a career as a Stock Analyst?

Internships, research projects, and networking with professionals in the industry are all great ways to begin.

What is the job outlook for Stock Analysts?

The job outlook for Stock Analysts is expected to grow by 9% between 2020 and 2030.

What is the average salary for a Stock Analyst?

The average salary for a Stock Analyst in the United States is around $120,000.

What are some of the challenges Stock Analysts face?

The volatile nature of the financial markets, the need to stay abreast of constant changes, and the pressure to make accurate predictions can all be challenging.

What is the most rewarding part of being a Stock Analyst?

Identifying undervalued stocks, generating positive returns, and positively impacting investment decisions is very rewarding.