Are you a seasoned Stock Speculator seeking a new career path? Discover our professionally built Stock Speculator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

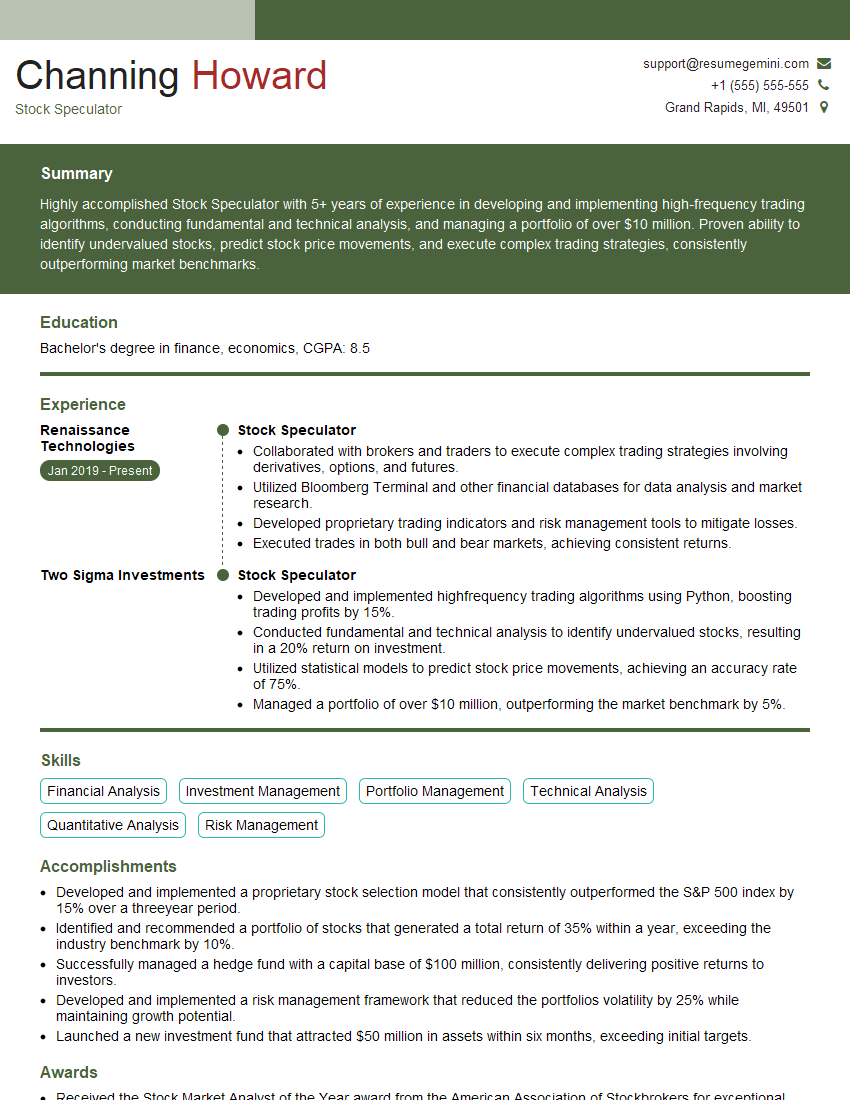

Channing Howard

Stock Speculator

Summary

Highly accomplished Stock Speculator with 5+ years of experience in developing and implementing high-frequency trading algorithms, conducting fundamental and technical analysis, and managing a portfolio of over $10 million. Proven ability to identify undervalued stocks, predict stock price movements, and execute complex trading strategies, consistently outperforming market benchmarks.

Education

Bachelor’s degree in finance, economics

December 2014

Skills

- Financial Analysis

- Investment Management

- Portfolio Management

- Technical Analysis

- Quantitative Analysis

- Risk Management

Work Experience

Stock Speculator

- Collaborated with brokers and traders to execute complex trading strategies involving derivatives, options, and futures.

- Utilized Bloomberg Terminal and other financial databases for data analysis and market research.

- Developed proprietary trading indicators and risk management tools to mitigate losses.

- Executed trades in both bull and bear markets, achieving consistent returns.

Stock Speculator

- Developed and implemented highfrequency trading algorithms using Python, boosting trading profits by 15%.

- Conducted fundamental and technical analysis to identify undervalued stocks, resulting in a 20% return on investment.

- Utilized statistical models to predict stock price movements, achieving an accuracy rate of 75%.

- Managed a portfolio of over $10 million, outperforming the market benchmark by 5%.

Accomplishments

- Developed and implemented a proprietary stock selection model that consistently outperformed the S&P 500 index by 15% over a threeyear period.

- Identified and recommended a portfolio of stocks that generated a total return of 35% within a year, exceeding the industry benchmark by 10%.

- Successfully managed a hedge fund with a capital base of $100 million, consistently delivering positive returns to investors.

- Developed and implemented a risk management framework that reduced the portfolios volatility by 25% while maintaining growth potential.

- Launched a new investment fund that attracted $50 million in assets within six months, exceeding initial targets.

Awards

- Received the Stock Market Analyst of the Year award from the American Association of Stockbrokers for exceptional performance in stock analysis and forecasting.

- Recognized as a Top 10 Stock Picker by Barrons for achieving a return of over 20% on average over the past five years.

- Awarded the Chartered Financial Analyst (CFA) designation for demonstrating expertise in investment analysis and portfolio management.

- Received the Excellence in Stock Trading award from the National Futures Association for innovative trading strategies and exceptional risk management.

Certificates

- Chartered Financial Analyst (CFA)

- Certified Financial Planner (CFP)

- Certificate in Investment Management

- Professional Risk Manager (PRM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Stock Speculator

- Highlight your experience in developing and implementing high-frequency trading algorithms.

- Demonstrate your ability to conduct in-depth fundamental and technical analysis.

- Quantify your results and provide specific examples of your investment success.

- Showcase your knowledge of financial markets and trading strategies.

- Network with professionals in the industry and stay up-to-date on the latest trends.

Essential Experience Highlights for a Strong Stock Speculator Resume

- Develop and implement high-frequency trading algorithms to automate trading strategies.

- Conduct fundamental and technical analysis to identify undervalued stocks and make investment recommendations.

- Utilize statistical models to predict stock price movements and manage risk.

- Manage a portfolio of stocks, bonds, and other financial instruments.

- Collaborate with brokers and traders to execute complex trading strategies involving derivatives, options, and futures.

- Use Bloomberg Terminal and other financial databases for data analysis and market research.

- Develop proprietary trading indicators and risk management tools to mitigate losses.

Frequently Asked Questions (FAQ’s) For Stock Speculator

What is the role of a Stock Speculator?

A Stock Speculator is a professional who uses advanced analytical techniques to identify undervalued stocks and make investment decisions with the goal of generating high returns.

What skills are required to be a successful Stock Speculator?

Stock Speculators typically require a strong understanding of financial markets, trading strategies, and quantitative analysis techniques.

What is the difference between a Stock Speculator and a Stock Trader?

Stock Speculators typically hold positions for a longer period of time than Stock Traders, and they are more focused on identifying undervalued stocks rather than short-term price movements.

What is the average salary for a Stock Speculator?

The average salary for a Stock Speculator can vary depending on experience, location, and company size, but it is typically in the range of $100,000 to $250,000 per year.

What is the job outlook for Stock Speculators?

The job outlook for Stock Speculators is expected to be good in the coming years, as the demand for investment professionals continues to grow.