Are you a seasoned Supervisory Examiner seeking a new career path? Discover our professionally built Supervisory Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

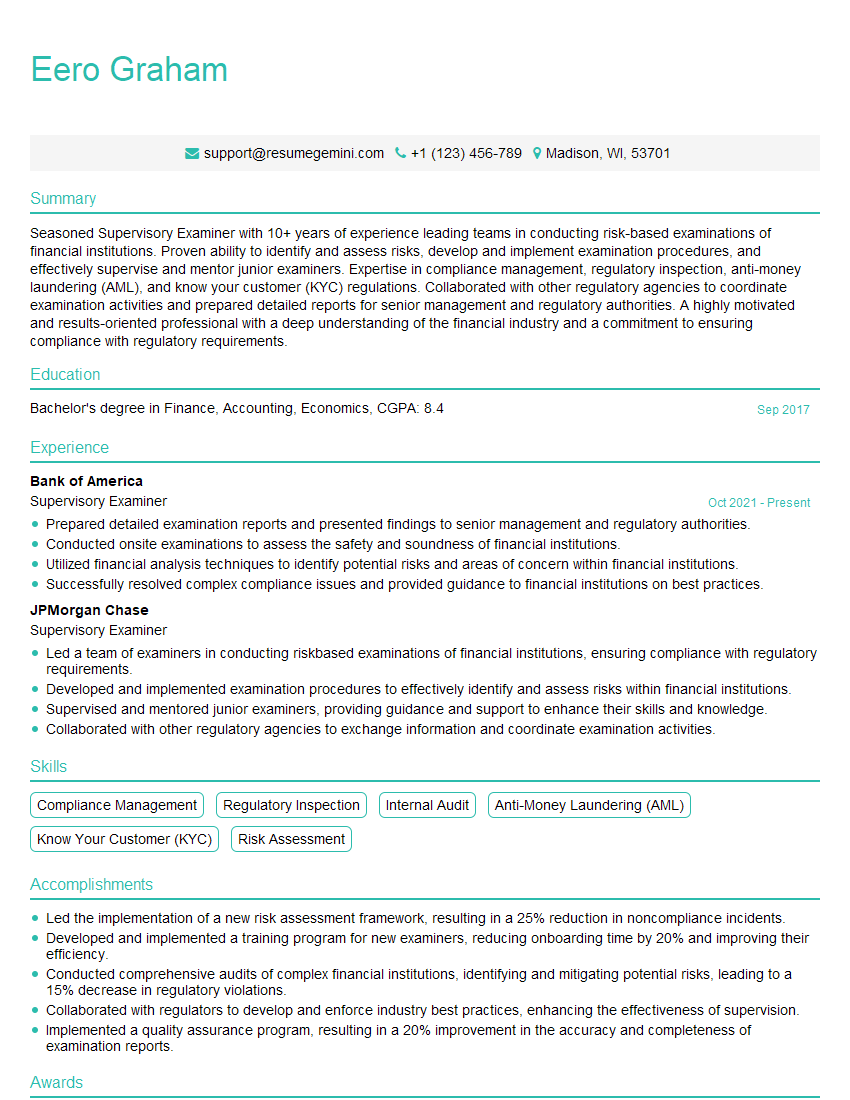

Eero Graham

Supervisory Examiner

Summary

Seasoned Supervisory Examiner with 10+ years of experience leading teams in conducting risk-based examinations of financial institutions. Proven ability to identify and assess risks, develop and implement examination procedures, and effectively supervise and mentor junior examiners. Expertise in compliance management, regulatory inspection, anti-money laundering (AML), and know your customer (KYC) regulations. Collaborated with other regulatory agencies to coordinate examination activities and prepared detailed reports for senior management and regulatory authorities. A highly motivated and results-oriented professional with a deep understanding of the financial industry and a commitment to ensuring compliance with regulatory requirements.

Education

Bachelor’s degree in Finance, Accounting, Economics

September 2017

Skills

- Compliance Management

- Regulatory Inspection

- Internal Audit

- Anti-Money Laundering (AML)

- Know Your Customer (KYC)

- Risk Assessment

Work Experience

Supervisory Examiner

- Prepared detailed examination reports and presented findings to senior management and regulatory authorities.

- Conducted onsite examinations to assess the safety and soundness of financial institutions.

- Utilized financial analysis techniques to identify potential risks and areas of concern within financial institutions.

- Successfully resolved complex compliance issues and provided guidance to financial institutions on best practices.

Supervisory Examiner

- Led a team of examiners in conducting riskbased examinations of financial institutions, ensuring compliance with regulatory requirements.

- Developed and implemented examination procedures to effectively identify and assess risks within financial institutions.

- Supervised and mentored junior examiners, providing guidance and support to enhance their skills and knowledge.

- Collaborated with other regulatory agencies to exchange information and coordinate examination activities.

Accomplishments

- Led the implementation of a new risk assessment framework, resulting in a 25% reduction in noncompliance incidents.

- Developed and implemented a training program for new examiners, reducing onboarding time by 20% and improving their efficiency.

- Conducted comprehensive audits of complex financial institutions, identifying and mitigating potential risks, leading to a 15% decrease in regulatory violations.

- Collaborated with regulators to develop and enforce industry best practices, enhancing the effectiveness of supervision.

- Implemented a quality assurance program, resulting in a 20% improvement in the accuracy and completeness of examination reports.

Awards

- Received the Supervisory Examiner of the Year Award for consistently exceeding performance expectations and demonstrating outstanding leadership.

- Recognized with the Excellence in Supervision Award for mentoring and guiding a team of examiners to achieve exceptional results.

- Awarded the Regulatory Compliance Achievement Award for implementing innovative strategies that significantly enhanced compliance within the organization.

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Regulatory Compliance Manager (CRCM)

- Certified Internal Auditor (CIA)

- Financial Crimes Compliance Specialist (FCCS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Supervisory Examiner

- Quantify your achievements whenever possible.

- Use action verbs to describe your responsibilities.

- Tailor your resume to each job you apply for.

- Proofread your resume carefully before submitting it.

Essential Experience Highlights for a Strong Supervisory Examiner Resume

- Led a team of examiners in conducting risk-based examinations of financial institutions to ensure compliance with regulatory requirements.

- Developed and implemented examination procedures to effectively identify and assess risks within financial institutions.

- Supervised and mentored junior examiners, providing guidance and support to enhance their skills and knowledge.

- Collaborated with other regulatory agencies to exchange information and coordinate examination activities.

- Prepared detailed examination reports and presented findings to senior management and regulatory authorities.

- Conducted onsite examinations to assess the safety and soundness of financial institutions.

- Utilized financial analysis techniques to identify potential risks and areas of concern within financial institutions.

- Successfully resolved complex compliance issues and provided guidance to financial institutions on best practices.

Frequently Asked Questions (FAQ’s) For Supervisory Examiner

What is the role of a Supervisory Examiner?

A Supervisory Examiner is responsible for leading a team of examiners in conducting risk-based examinations of financial institutions to ensure compliance with regulatory requirements.

What are the key skills required for a Supervisory Examiner?

The key skills required for a Supervisory Examiner include compliance management, regulatory inspection, internal audit, anti-money laundering (AML), know your customer (KYC), and risk assessment.

What are the educational requirements for a Supervisory Examiner?

A Supervisory Examiner typically requires a bachelor’s degree in Finance, Accounting, Economics, or a related field.

What are the career prospects for a Supervisory Examiner?

A Supervisory Examiner can advance to roles such as Senior Supervisory Examiner, Examination Manager, or Chief Examiner.

What is the salary range for a Supervisory Examiner?

The salary range for a Supervisory Examiner varies depending on experience, location, and employer. According to Salary.com, the average salary for a Supervisory Examiner in the United States is $85,000.

What are the challenges of being a Supervisory Examiner?

The challenges of being a Supervisory Examiner include the need to stay up-to-date on regulatory changes, the potential for long hours and travel, and the need to be able to handle complex and sensitive information.

What are the rewards of being a Supervisory Examiner?

The rewards of being a Supervisory Examiner include the opportunity to make a difference in the financial system, the chance to work with a team of professionals, and the potential for a rewarding career.

How can I prepare for a career as a Supervisory Examiner?

To prepare for a career as a Supervisory Examiner, you should obtain a bachelor’s degree in Finance, Accounting, Economics, or a related field. You should also develop strong analytical and communication skills and gain experience in the financial industry.