Are you a seasoned Tariff Clerk seeking a new career path? Discover our professionally built Tariff Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

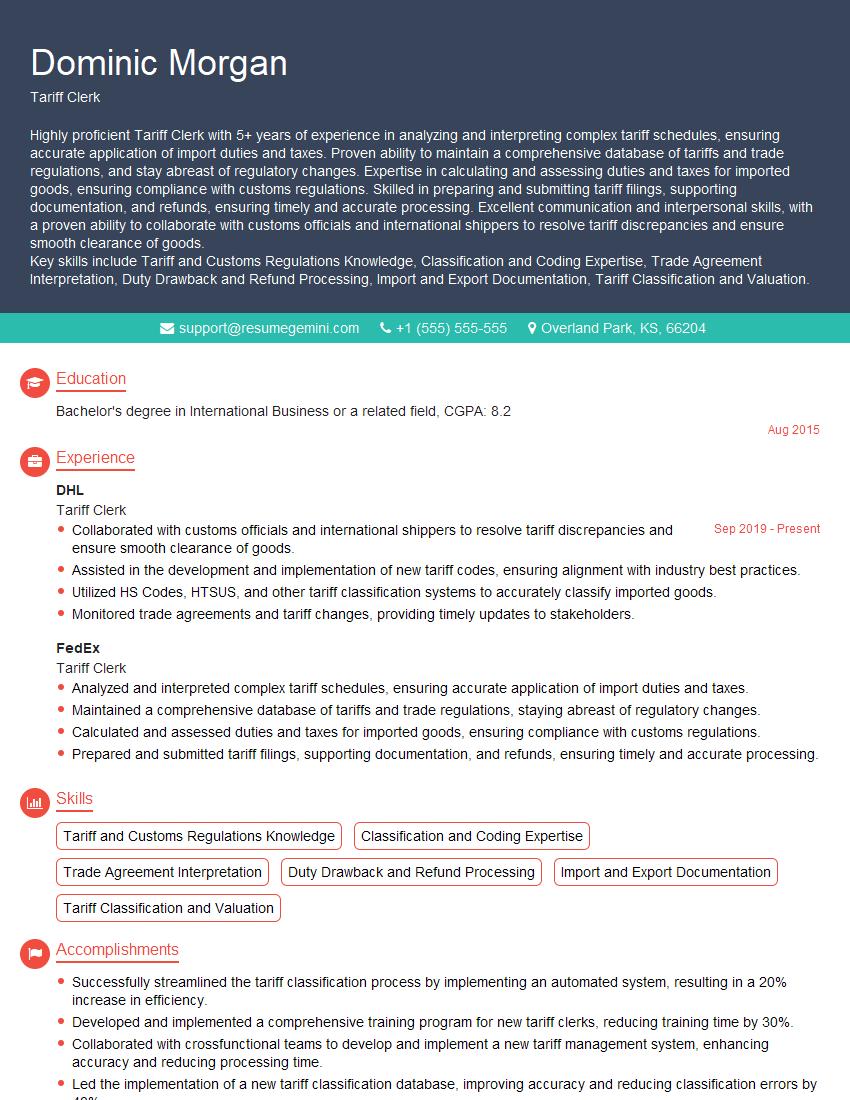

Dominic Morgan

Tariff Clerk

Summary

Highly proficient Tariff Clerk with 5+ years of experience in analyzing and interpreting complex tariff schedules, ensuring accurate application of import duties and taxes. Proven ability to maintain a comprehensive database of tariffs and trade regulations, and stay abreast of regulatory changes. Expertise in calculating and assessing duties and taxes for imported goods, ensuring compliance with customs regulations. Skilled in preparing and submitting tariff filings, supporting documentation, and refunds, ensuring timely and accurate processing. Excellent communication and interpersonal skills, with a proven ability to collaborate with customs officials and international shippers to resolve tariff discrepancies and ensure smooth clearance of goods.

Key skills include Tariff and Customs Regulations Knowledge, Classification and Coding Expertise, Trade Agreement Interpretation, Duty Drawback and Refund Processing, Import and Export Documentation, Tariff Classification and Valuation.

Education

Bachelor’s degree in International Business or a related field

August 2015

Skills

- Tariff and Customs Regulations Knowledge

- Classification and Coding Expertise

- Trade Agreement Interpretation

- Duty Drawback and Refund Processing

- Import and Export Documentation

- Tariff Classification and Valuation

Work Experience

Tariff Clerk

- Collaborated with customs officials and international shippers to resolve tariff discrepancies and ensure smooth clearance of goods.

- Assisted in the development and implementation of new tariff codes, ensuring alignment with industry best practices.

- Utilized HS Codes, HTSUS, and other tariff classification systems to accurately classify imported goods.

- Monitored trade agreements and tariff changes, providing timely updates to stakeholders.

Tariff Clerk

- Analyzed and interpreted complex tariff schedules, ensuring accurate application of import duties and taxes.

- Maintained a comprehensive database of tariffs and trade regulations, staying abreast of regulatory changes.

- Calculated and assessed duties and taxes for imported goods, ensuring compliance with customs regulations.

- Prepared and submitted tariff filings, supporting documentation, and refunds, ensuring timely and accurate processing.

Accomplishments

- Successfully streamlined the tariff classification process by implementing an automated system, resulting in a 20% increase in efficiency.

- Developed and implemented a comprehensive training program for new tariff clerks, reducing training time by 30%.

- Collaborated with crossfunctional teams to develop and implement a new tariff management system, enhancing accuracy and reducing processing time.

- Led the implementation of a new tariff classification database, improving accuracy and reducing classification errors by 40%.

- Streamlined the tariff exemption process by modifying internal procedures, reducing processing time by 25%.

Awards

- Recipient of Tariff Clerk of the Year award for consistently exceeding performance targets and ensuring compliance with industry regulations.

- Recognized by the International Trade Association for exceptional contributions to the field of tariff management.

- Received Excellence in Service award for consistently providing exceptional customer support and resolving complex tariff issues.

- Honored by the company for maintaining a flawless record of tariff compliance, ensuring significant cost savings and mitigating legal risks.

Certificates

- Certified Customs Specialist (CCS)

- Licensed Customs Broker (LCB)

- Certified Global Trade Professional (CGTP)

- Certified Import Specialist (CIS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tariff Clerk

Highlight your expertise in tariff and customs regulations.

This is a critical skill for Tariff Clerks, so be sure to emphasize it in your resume.Showcase your experience in import and export documentation.

This is another important skill for Tariff Clerks, so be sure to highlight any relevant experience you have.Quantify your accomplishments.

When possible, use numbers to quantify your accomplishments as a Tariff Clerk. This will help your resume stand out.Get certified.

There are several certifications available for Tariff Clerks. Getting certified can help you demonstrate your expertise and knowledge of the industry.

Essential Experience Highlights for a Strong Tariff Clerk Resume

- Analyzed and interpreted complex tariff schedules, ensuring accurate application of import duties and taxes.

- Maintained a comprehensive database of tariffs and trade regulations, staying abreast of regulatory changes.

- Calculated and assessed duties and taxes for imported goods, ensuring compliance with customs regulations.

- Prepared and submitted tariff filings, supporting documentation, and refunds, ensuring timely and accurate processing.

- Collaborated with customs officials and international shippers to resolve tariff discrepancies and ensure smooth clearance of goods.

- Assisted in the development and implementation of new tariff codes, ensuring alignment with industry best practices.

- Utilized HS Codes, HTSUS, and other tariff classification systems to accurately classify imported goods.

Frequently Asked Questions (FAQ’s) For Tariff Clerk

What is a Tariff Clerk?

A Tariff Clerk is responsible for analyzing and interpreting tariff schedules, ensuring accurate application of import duties and taxes. They also maintain a comprehensive database of tariffs and trade regulations, and stay abreast of regulatory changes.

What are the duties and responsibilities of a Tariff Clerk?

Tariff Clerks are responsible for a variety of duties and responsibilities, including analyzing and interpreting tariff schedules, calculating and assessing duties and taxes for imported goods, preparing and submitting tariff filings, and collaborating with customs officials and international shippers.

What are the qualifications for a Tariff Clerk?

Tariff Clerks typically have a bachelor’s degree in international business or a related field. They also have experience in import and export documentation, tariff classification, and customs regulations.

What are the career prospects for a Tariff Clerk?

Tariff Clerks can advance to positions such as Import/Export Manager, Customs Broker, or International Trade Specialist.

What is the salary range for a Tariff Clerk?

The salary range for a Tariff Clerk varies depending on experience and location. According to Salary.com, the average salary for a Tariff Clerk in the United States is $62,000.

What are the top companies that hire Tariff Clerks?

Some of the top companies that hire Tariff Clerks include DHL, FedEx, and UPS.