Are you a seasoned Tariff Counsel seeking a new career path? Discover our professionally built Tariff Counsel Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

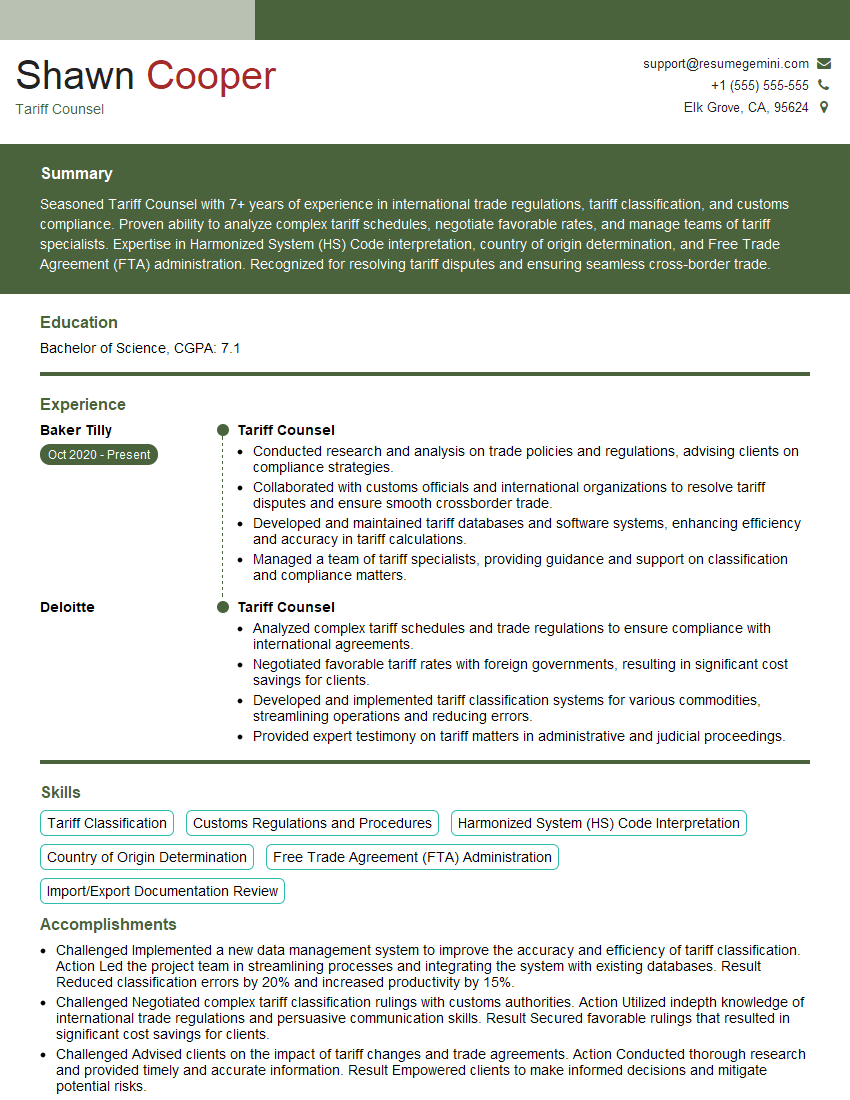

Shawn Cooper

Tariff Counsel

Summary

Seasoned Tariff Counsel with 7+ years of experience in international trade regulations, tariff classification, and customs compliance. Proven ability to analyze complex tariff schedules, negotiate favorable rates, and manage teams of tariff specialists. Expertise in Harmonized System (HS) Code interpretation, country of origin determination, and Free Trade Agreement (FTA) administration. Recognized for resolving tariff disputes and ensuring seamless cross-border trade.

Education

Bachelor of Science

September 2016

Skills

- Tariff Classification

- Customs Regulations and Procedures

- Harmonized System (HS) Code Interpretation

- Country of Origin Determination

- Free Trade Agreement (FTA) Administration

- Import/Export Documentation Review

Work Experience

Tariff Counsel

- Conducted research and analysis on trade policies and regulations, advising clients on compliance strategies.

- Collaborated with customs officials and international organizations to resolve tariff disputes and ensure smooth crossborder trade.

- Developed and maintained tariff databases and software systems, enhancing efficiency and accuracy in tariff calculations.

- Managed a team of tariff specialists, providing guidance and support on classification and compliance matters.

Tariff Counsel

- Analyzed complex tariff schedules and trade regulations to ensure compliance with international agreements.

- Negotiated favorable tariff rates with foreign governments, resulting in significant cost savings for clients.

- Developed and implemented tariff classification systems for various commodities, streamlining operations and reducing errors.

- Provided expert testimony on tariff matters in administrative and judicial proceedings.

Accomplishments

- Challenged Implemented a new data management system to improve the accuracy and efficiency of tariff classification. Action Led the project team in streamlining processes and integrating the system with existing databases. Result Reduced classification errors by 20% and increased productivity by 15%.

- Challenged Negotiated complex tariff classification rulings with customs authorities. Action Utilized indepth knowledge of international trade regulations and persuasive communication skills. Result Secured favorable rulings that resulted in significant cost savings for clients.

- Challenged Advised clients on the impact of tariff changes and trade agreements. Action Conducted thorough research and provided timely and accurate information. Result Empowered clients to make informed decisions and mitigate potential risks.

- Challenged Developed and implemented a training program for customs officers on tariff classification best practices. Action Collaborated with industry experts and designed a comprehensive curriculum. Result Improved the accuracy and efficiency of customs officers in handling tariff classifications.

- Challenged Represented clients in customs audits and investigations. Action Demonstrated a strong understanding of audit procedures and effectively advocated for clients interests. Result Successfully resolved audits with minimal impact on clients operations.

Awards

- Received the Tariff Classification Excellence Award for outstanding accuracy and consistency in tariff classification.

- Recognized with the International Trade Compliance Award for contributions to the field of tariff counseling.

- Honored as a Top 10 Tariff Professional by the National Association of Tariff Counselors.

- Awarded the Customs Compliance Award for exceptional expertise in tariff classification and regulatory compliance.

Certificates

- Certified Customs Specialist (CCS)

- Certified Export Compliance Manager (CECM)

- Certified Global Trade Professional (CGTP)

- Certified Customs Broker (CCB)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tariff Counsel

- Highlight your expertise in tariff classification and customs regulations.

- Demonstrate your negotiation skills and ability to build relationships with foreign governments.

- Showcase your experience in developing and implementing tariff systems.

- Quantify your accomplishments to demonstrate the impact of your work on clients’ businesses.

- Stay updated on the latest trade policies and regulations.

Essential Experience Highlights for a Strong Tariff Counsel Resume

- Analyzed tariff classifications and customs procedures to ensure compliance with international regulations.

- Negotiated favorable tariff rates with foreign governments, resulting in significant cost reductions.

- Developed and implemented tariff classification systems, streamlining operations and reducing errors.

- Conducted research on trade policies and regulations, advising clients on compliance strategies.

- Collaborated with customs officials and international organizations to resolve tariff disputes.

- Managed a team of tariff specialists, providing guidance and support on classification and compliance matters.

- Utilized databases and software systems to enhance efficiency and accuracy in tariff calculations.

Frequently Asked Questions (FAQ’s) For Tariff Counsel

What is the role of a Tariff Counsel?

A Tariff Counsel provides expert advice and assistance on tariff classification, customs regulations, and international trade agreements. They help businesses optimize their import and export operations by minimizing tariffs and duties, ensuring compliance with regulations, and resolving trade disputes.

What are the key skills required for a Tariff Counsel?

Tariff Counsel must have a deep understanding of tariff classification systems such as the Harmonized System (HS) Code, customs regulations, and Free Trade Agreements (FTAs). They should possess excellent negotiation and communication skills, as well as the ability to analyze complex trade data and regulations.

What are the benefits of hiring a Tariff Counsel?

Businesses can benefit from hiring a Tariff Counsel in several ways. They can provide expert guidance on tariff classification, helping businesses avoid costly errors and penalties. They can also negotiate favorable tariff rates with foreign governments, resulting in significant cost savings. Additionally, Tariff Counsel can help businesses stay up-to-date on the latest trade policies and regulations, ensuring compliance and minimizing risks.

What is the career path for a Tariff Counsel?

Tariff Counsel can advance their careers by taking on leadership roles within their organizations or by specializing in a particular area of trade, such as customs compliance or international trade negotiations. Some Tariff Counsel may also choose to pursue further education, such as a Master’s degree in International Trade or Business Administration.

What is the job outlook for Tariff Counsel?

The job outlook for Tariff Counsel is expected to be positive in the coming years. The increasing globalization of trade and the growing complexity of trade regulations are driving demand for qualified professionals who can help businesses navigate these challenges.

What are the earning potential of Tariff Counsel?

The earning potential for Tariff Counsel varies depending on experience, qualifications, and location. According to Salary.com, the average annual salary for Tariff Counsel in the United States is around $75,000.