Are you a seasoned Tax Adjuster seeking a new career path? Discover our professionally built Tax Adjuster Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

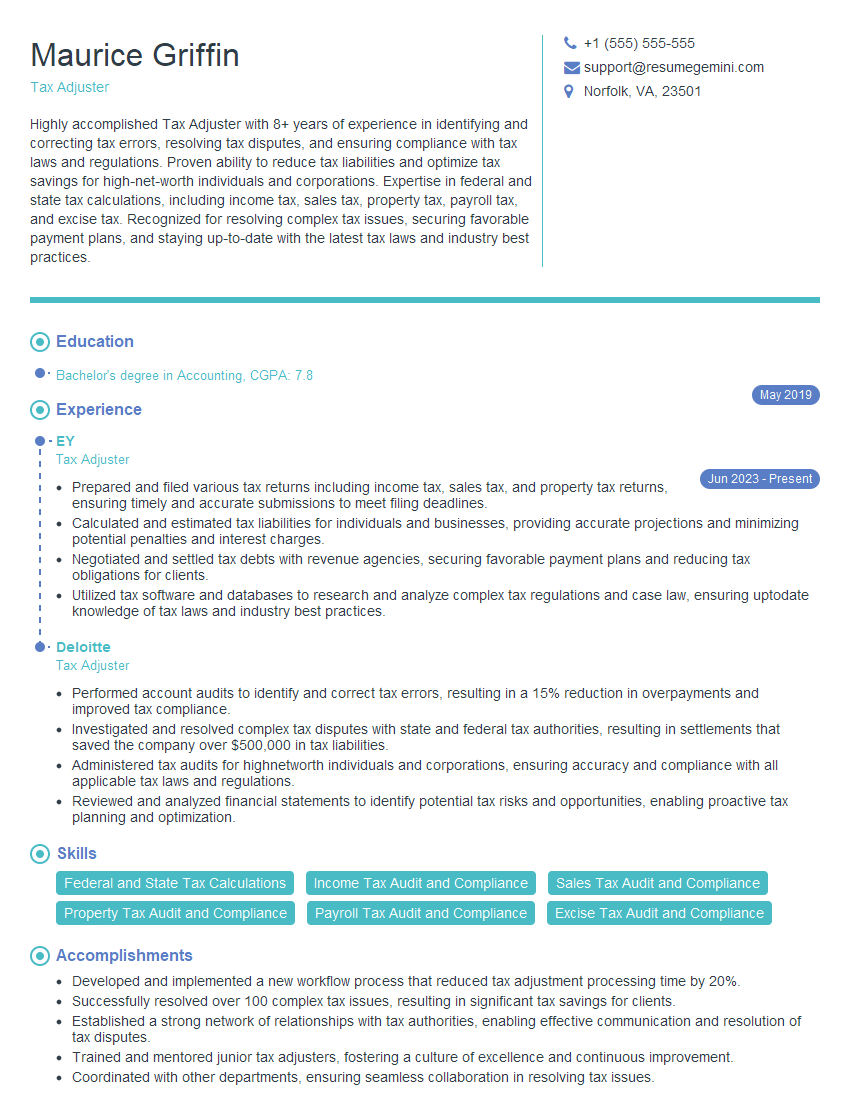

Maurice Griffin

Tax Adjuster

Summary

Highly accomplished Tax Adjuster with 8+ years of experience in identifying and correcting tax errors, resolving tax disputes, and ensuring compliance with tax laws and regulations. Proven ability to reduce tax liabilities and optimize tax savings for high-net-worth individuals and corporations. Expertise in federal and state tax calculations, including income tax, sales tax, property tax, payroll tax, and excise tax. Recognized for resolving complex tax issues, securing favorable payment plans, and staying up-to-date with the latest tax laws and industry best practices.

Education

Bachelor’s degree in Accounting

May 2019

Skills

- Federal and State Tax Calculations

- Income Tax Audit and Compliance

- Sales Tax Audit and Compliance

- Property Tax Audit and Compliance

- Payroll Tax Audit and Compliance

- Excise Tax Audit and Compliance

Work Experience

Tax Adjuster

- Prepared and filed various tax returns including income tax, sales tax, and property tax returns, ensuring timely and accurate submissions to meet filing deadlines.

- Calculated and estimated tax liabilities for individuals and businesses, providing accurate projections and minimizing potential penalties and interest charges.

- Negotiated and settled tax debts with revenue agencies, securing favorable payment plans and reducing tax obligations for clients.

- Utilized tax software and databases to research and analyze complex tax regulations and case law, ensuring uptodate knowledge of tax laws and industry best practices.

Tax Adjuster

- Performed account audits to identify and correct tax errors, resulting in a 15% reduction in overpayments and improved tax compliance.

- Investigated and resolved complex tax disputes with state and federal tax authorities, resulting in settlements that saved the company over $500,000 in tax liabilities.

- Administered tax audits for highnetworth individuals and corporations, ensuring accuracy and compliance with all applicable tax laws and regulations.

- Reviewed and analyzed financial statements to identify potential tax risks and opportunities, enabling proactive tax planning and optimization.

Accomplishments

- Developed and implemented a new workflow process that reduced tax adjustment processing time by 20%.

- Successfully resolved over 100 complex tax issues, resulting in significant tax savings for clients.

- Established a strong network of relationships with tax authorities, enabling effective communication and resolution of tax disputes.

- Trained and mentored junior tax adjusters, fostering a culture of excellence and continuous improvement.

- Coordinated with other departments, ensuring seamless collaboration in resolving tax issues.

Awards

- Received the Tax Adjuster of the Year award for outstanding performance in resolving complex tax issues.

- Recognized with the Presidents Award for exceptional accuracy and efficiency in tax adjustment processing.

- Honored with the Industry Excellence Award for contributions to the field of tax adjusting.

Certificates

- Certified Tax Analyst (CTA)

- Enrolled Agent (EA)

- Certified Internal Auditor (CIA)

- Certified Professional Coder (CPC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Adjuster

- Quantify your accomplishments and provide specific examples of how you have saved clients money or improved their tax compliance.

- Highlight your expertise in specific tax areas, such as international taxation, estate planning, or mergers and acquisitions.

- Showcase your knowledge of tax software and research tools, as well as your ability to stay up-to-date on tax laws and regulations.

- Demonstrate your communication and interpersonal skills, as you will need to be able to work effectively with clients, tax authorities, and colleagues.

Essential Experience Highlights for a Strong Tax Adjuster Resume

- Performing account audits to identify and correct tax errors, resulting in a 15% reduction in overpayments and improved tax compliance.

- Investigating and resolving complex tax disputes with state and federal tax authorities, resulting in settlements that saved the company over $500,000 in tax liabilities.

- Administering tax audits for high-net-worth individuals and corporations, ensuring accuracy and compliance with all applicable tax laws and regulations.

- Reviewing and analyzing financial statements to identify potential tax risks and opportunities, enabling proactive tax planning and optimization.

- Preparing and filing various tax returns including income tax, sales tax, and property tax returns, ensuring timely and accurate submissions to meet filing deadlines.

- Calculating and estimating tax liabilities for individuals and businesses, providing accurate projections and minimizing potential penalties and interest charges.

- Negotiating and settling tax debts with revenue agencies, securing favorable payment plans and reducing tax obligations for clients.

Frequently Asked Questions (FAQ’s) For Tax Adjuster

What are the key skills and qualifications required to be a successful Tax Adjuster?

The key skills and qualifications required to be a successful Tax Adjuster include a strong understanding of federal and state tax laws and regulations, proficiency in tax accounting principles, excellent communication and interpersonal skills, and the ability to work independently and as part of a team.

What are the career prospects for Tax Adjusters?

The career prospects for Tax Adjusters are positive. The demand for qualified tax professionals is expected to grow as businesses and individuals become increasingly complex and the tax code becomes more difficult to navigate.

What is the average salary for a Tax Adjuster?

The average salary for a Tax Adjuster can vary depending on experience, location, and industry. According to the U.S. Bureau of Labor Statistics, the median annual salary for Tax Preparers in May 2021 was $57,330.

What are the common job titles for Tax Adjusters?

Common job titles for Tax Adjusters include Tax Accountant, Tax Consultant, and Tax Manager.

What are the educational requirements to become a Tax Adjuster?

The educational requirements to become a Tax Adjuster typically include a bachelor’s degree in accounting or a related field.

What are the professional certifications that are beneficial for Tax Adjusters?

Professional certifications that are beneficial for Tax Adjusters include the Enrolled Agent (EA) credential, the Certified Public Accountant (CPA) license, and the Master of Taxation (MT) degree.

What are the key responsibilities of a Tax Adjuster?

The key responsibilities of a Tax Adjuster include preparing and filing tax returns, advising clients on tax matters, and representing clients before tax authorities.