Are you a seasoned Tax Advisor seeking a new career path? Discover our professionally built Tax Advisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

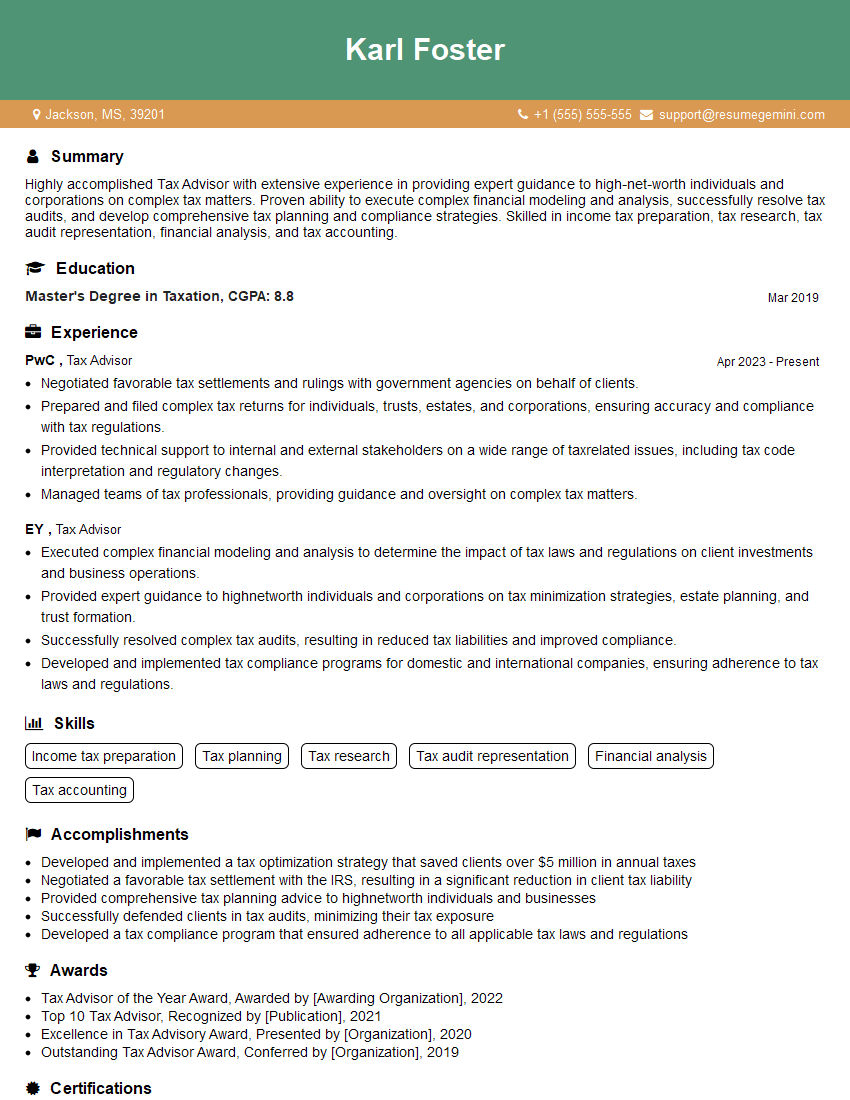

Karl Foster

Tax Advisor

Summary

Highly accomplished Tax Advisor with extensive experience in providing expert guidance to high-net-worth individuals and corporations on complex tax matters. Proven ability to execute complex financial modeling and analysis, successfully resolve tax audits, and develop comprehensive tax planning and compliance strategies. Skilled in income tax preparation, tax research, tax audit representation, financial analysis, and tax accounting.

Education

Master’s Degree in Taxation

March 2019

Skills

- Income tax preparation

- Tax planning

- Tax research

- Tax audit representation

- Financial analysis

- Tax accounting

Work Experience

Tax Advisor

- Negotiated favorable tax settlements and rulings with government agencies on behalf of clients.

- Prepared and filed complex tax returns for individuals, trusts, estates, and corporations, ensuring accuracy and compliance with tax regulations.

- Provided technical support to internal and external stakeholders on a wide range of taxrelated issues, including tax code interpretation and regulatory changes.

- Managed teams of tax professionals, providing guidance and oversight on complex tax matters.

Tax Advisor

- Executed complex financial modeling and analysis to determine the impact of tax laws and regulations on client investments and business operations.

- Provided expert guidance to highnetworth individuals and corporations on tax minimization strategies, estate planning, and trust formation.

- Successfully resolved complex tax audits, resulting in reduced tax liabilities and improved compliance.

- Developed and implemented tax compliance programs for domestic and international companies, ensuring adherence to tax laws and regulations.

Accomplishments

- Developed and implemented a tax optimization strategy that saved clients over $5 million in annual taxes

- Negotiated a favorable tax settlement with the IRS, resulting in a significant reduction in client tax liability

- Provided comprehensive tax planning advice to highnetworth individuals and businesses

- Successfully defended clients in tax audits, minimizing their tax exposure

- Developed a tax compliance program that ensured adherence to all applicable tax laws and regulations

Awards

- Tax Advisor of the Year Award, Awarded by [Awarding Organization], 2022

- Top 10 Tax Advisor, Recognized by [Publication], 2021

- Excellence in Tax Advisory Award, Presented by [Organization], 2020

- Outstanding Tax Advisor Award, Conferred by [Organization], 2019

Certificates

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Master of Science in Taxation (MST)

- Certified Tax Advisor (CTA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Advisor

- Showcase your technical skills and knowledge of tax laws and regulations.

- Highlight your experience in resolving complex tax audits and negotiating favorable settlements.

- Emphasize your ability to provide strategic tax planning and compliance advice to clients.

- Demonstrate your communication and interpersonal skills, as you will be working closely with clients and other professionals.

- Consider obtaining professional certifications, such as the Enrolled Agent (EA) or Certified Public Accountant (CPA), to enhance your credibility.

Essential Experience Highlights for a Strong Tax Advisor Resume

- Executed complex financial modeling and analysis to determine the impact of tax laws and regulations on client investments and business operations.

- Provided expert guidance to high-net-worth individuals and corporations on tax minimization strategies, estate planning, and trust formation.

- Successfully resolved complex tax audits, resulting in reduced tax liabilities and improved compliance.

- Developed and implemented tax compliance programs for domestic and international companies, ensuring adherence to tax laws and regulations.

- Negotiated favorable tax settlements and rulings with government agencies on behalf of clients.

- Prepared and filed complex tax returns for individuals, trusts, estates, and corporations, ensuring accuracy and compliance with tax regulations.

- Provided technical support to internal and external stakeholders on a wide range of tax-related issues, including tax code interpretation and regulatory changes.

Frequently Asked Questions (FAQ’s) For Tax Advisor

What is the role of a Tax Advisor?

A Tax Advisor provides expert guidance on tax laws and regulations, helping individuals and businesses minimize their tax liabilities and ensure compliance.

What are the key skills required for a Tax Advisor?

Key skills include income tax preparation, tax planning, tax research, tax audit representation, financial analysis, and tax accounting.

What is the career path for a Tax Advisor?

With experience, Tax Advisors can advance to senior positions, such as Tax Manager or Tax Director, or specialize in a particular area of taxation, such as international taxation or estate planning.

What is the job outlook for Tax Advisors?

The job outlook for Tax Advisors is projected to grow faster than average due to increasing tax complexity and globalization.

What is the average salary for a Tax Advisor?

The average salary for a Tax Advisor varies depending on experience, location, and industry, but it is typically higher than the national average.

What are the challenges faced by Tax Advisors?

Tax Advisors face challenges such as keeping up with constantly changing tax laws and regulations and dealing with complex tax audits.

What is the difference between a Tax Advisor and a Tax Accountant?

Tax Advisors provide strategic tax planning and advice, while Tax Accountants focus on preparing and filing tax returns and providing accounting services.

What are the ethical considerations for Tax Advisors?

Tax Advisors must maintain confidentiality, avoid conflicts of interest, and comply with professional standards and ethical guidelines.