Are you a seasoned Tax Analyst seeking a new career path? Discover our professionally built Tax Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

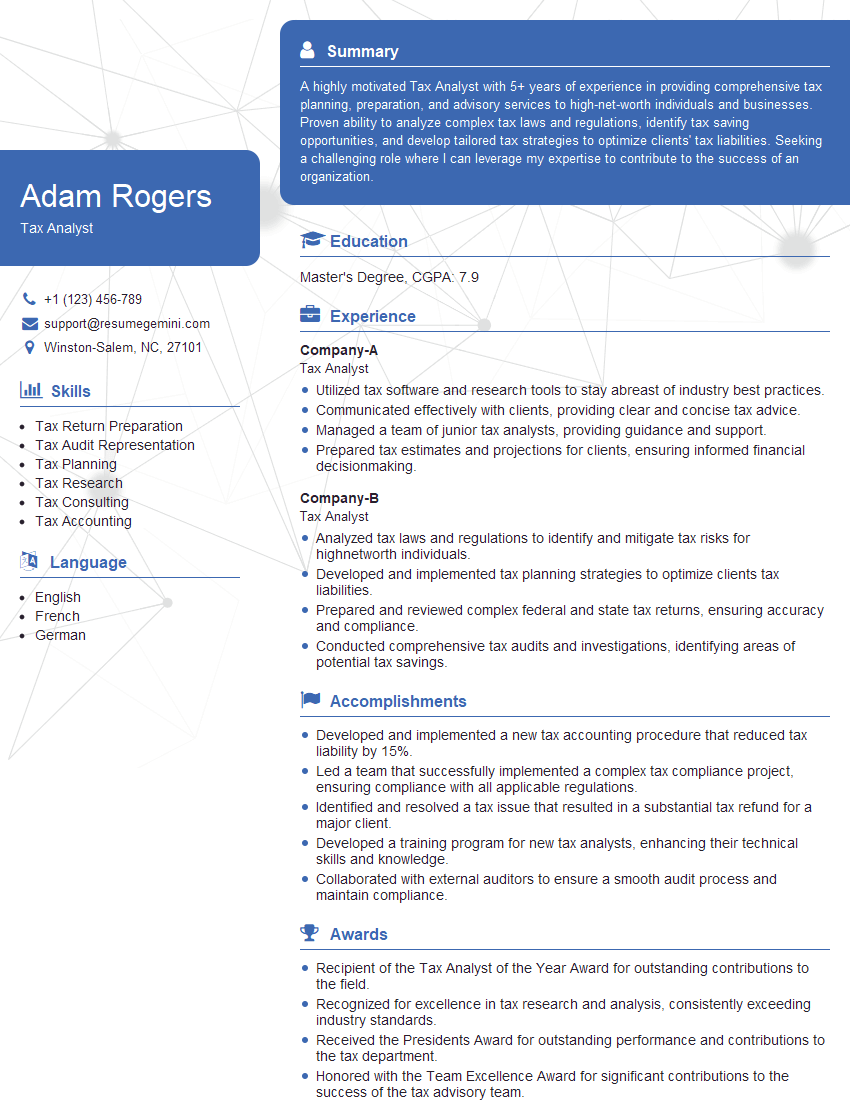

Adam Rogers

Tax Analyst

Summary

A highly motivated Tax Analyst with 5+ years of experience in providing comprehensive tax planning, preparation, and advisory services to high-net-worth individuals and businesses. Proven ability to analyze complex tax laws and regulations, identify tax saving opportunities, and develop tailored tax strategies to optimize clients’ tax liabilities. Seeking a challenging role where I can leverage my expertise to contribute to the success of an organization.

Education

Master’s Degree

November 2018

Skills

- Tax Return Preparation

- Tax Audit Representation

- Tax Planning

- Tax Research

- Tax Consulting

- Tax Accounting

Work Experience

Tax Analyst

- Utilized tax software and research tools to stay abreast of industry best practices.

- Communicated effectively with clients, providing clear and concise tax advice.

- Managed a team of junior tax analysts, providing guidance and support.

- Prepared tax estimates and projections for clients, ensuring informed financial decisionmaking.

Tax Analyst

- Analyzed tax laws and regulations to identify and mitigate tax risks for highnetworth individuals.

- Developed and implemented tax planning strategies to optimize clients tax liabilities.

- Prepared and reviewed complex federal and state tax returns, ensuring accuracy and compliance.

- Conducted comprehensive tax audits and investigations, identifying areas of potential tax savings.

Accomplishments

- Developed and implemented a new tax accounting procedure that reduced tax liability by 15%.

- Led a team that successfully implemented a complex tax compliance project, ensuring compliance with all applicable regulations.

- Identified and resolved a tax issue that resulted in a substantial tax refund for a major client.

- Developed a training program for new tax analysts, enhancing their technical skills and knowledge.

- Collaborated with external auditors to ensure a smooth audit process and maintain compliance.

Awards

- Recipient of the Tax Analyst of the Year Award for outstanding contributions to the field.

- Recognized for excellence in tax research and analysis, consistently exceeding industry standards.

- Received the Presidents Award for outstanding performance and contributions to the tax department.

- Honored with the Team Excellence Award for significant contributions to the success of the tax advisory team.

Certificates

- Certified Public Accountant (CPA)

- Enrolled Agent (EA)

- Certified Tax Specialist (CTS)

- Certified Information Systems Auditor (CISA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Analyst

- Highlight your technical skills: Quantify your accomplishments with specific examples of how you have used your tax knowledge to save clients money or improve their tax position.

- Showcase your communication skills: Emphasize your ability to explain complex tax concepts to clients in a clear and understandable manner.

- Tailor your resume to the job description: Carefully review the job description and highlight the skills and experience that are most relevant to the position.

- Proofread carefully: Ensure that your resume is free of errors and inconsistencies. A well-polished resume demonstrates your attention to detail and professionalism.

Essential Experience Highlights for a Strong Tax Analyst Resume

- Analyze tax laws, regulations, and rulings to identify potential tax risks and opportunities for clients.

- Develop and implement comprehensive tax planning strategies to minimize clients’ tax liabilities.

- Prepare and review complex individual, corporate, and fiduciary tax returns, ensuring accuracy and compliance with IRS regulations.

- Conduct thorough tax audits and investigations, identifying areas for potential tax savings and recommending corrective actions.

- Stay abreast of industry best practices and tax law changes through continuing education and research.

- Communicate effectively with clients, providing clear and concise tax advice and guidance.

Frequently Asked Questions (FAQ’s) For Tax Analyst

What are the key responsibilities of a Tax Analyst?

Tax Analysts are responsible for analyzing tax laws and regulations, preparing tax returns, conducting tax audits, and providing tax advice to clients. They must stay abreast of changes in tax laws and regulations and be able to communicate effectively with clients.

What are the educational requirements for becoming a Tax Analyst?

Most Tax Analysts have a bachelor’s degree in accounting, finance, or a related field. Some employers may require a master’s degree in taxation or a related field.

What are the career prospects for Tax Analysts?

Tax Analysts can advance to positions such as Tax Manager, Tax Director, or Chief Financial Officer. With experience, they may also be able to start their own tax practice.

What are the challenges faced by Tax Analysts?

Tax Analysts face challenges such as keeping up with changes in tax laws and regulations, dealing with complex tax issues, and meeting deadlines. They must also be able to work independently and as part of a team.

What are the rewards of being a Tax Analyst?

Tax Analysts can enjoy a rewarding career with good earning potential. They also have the opportunity to help clients save money on taxes and plan for their financial future.

What are the key skills for a Tax Analyst?

Tax Analysts need to have strong analytical skills, attention to detail, and communication skills. They must also be able to work independently and as part of a team.