Are you a seasoned Tax Appraiser seeking a new career path? Discover our professionally built Tax Appraiser Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

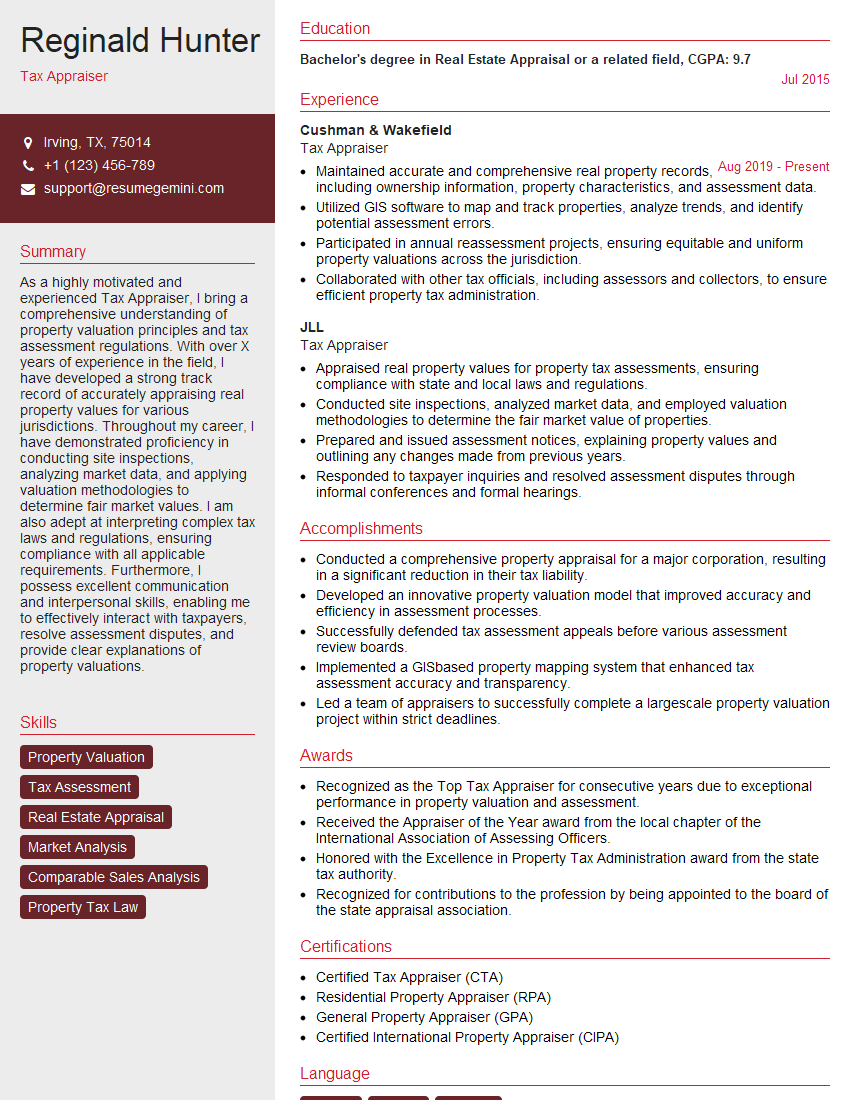

Reginald Hunter

Tax Appraiser

Summary

As a highly motivated and experienced Tax Appraiser, I bring a comprehensive understanding of property valuation principles and tax assessment regulations. With over X years of experience in the field, I have developed a strong track record of accurately appraising real property values for various jurisdictions. Throughout my career, I have demonstrated proficiency in conducting site inspections, analyzing market data, and applying valuation methodologies to determine fair market values. I am also adept at interpreting complex tax laws and regulations, ensuring compliance with all applicable requirements. Furthermore, I possess excellent communication and interpersonal skills, enabling me to effectively interact with taxpayers, resolve assessment disputes, and provide clear explanations of property valuations.

Education

Bachelor’s degree in Real Estate Appraisal or a related field

July 2015

Skills

- Property Valuation

- Tax Assessment

- Real Estate Appraisal

- Market Analysis

- Comparable Sales Analysis

- Property Tax Law

Work Experience

Tax Appraiser

- Maintained accurate and comprehensive real property records, including ownership information, property characteristics, and assessment data.

- Utilized GIS software to map and track properties, analyze trends, and identify potential assessment errors.

- Participated in annual reassessment projects, ensuring equitable and uniform property valuations across the jurisdiction.

- Collaborated with other tax officials, including assessors and collectors, to ensure efficient property tax administration.

Tax Appraiser

- Appraised real property values for property tax assessments, ensuring compliance with state and local laws and regulations.

- Conducted site inspections, analyzed market data, and employed valuation methodologies to determine the fair market value of properties.

- Prepared and issued assessment notices, explaining property values and outlining any changes made from previous years.

- Responded to taxpayer inquiries and resolved assessment disputes through informal conferences and formal hearings.

Accomplishments

- Conducted a comprehensive property appraisal for a major corporation, resulting in a significant reduction in their tax liability.

- Developed an innovative property valuation model that improved accuracy and efficiency in assessment processes.

- Successfully defended tax assessment appeals before various assessment review boards.

- Implemented a GISbased property mapping system that enhanced tax assessment accuracy and transparency.

- Led a team of appraisers to successfully complete a largescale property valuation project within strict deadlines.

Awards

- Recognized as the Top Tax Appraiser for consecutive years due to exceptional performance in property valuation and assessment.

- Received the Appraiser of the Year award from the local chapter of the International Association of Assessing Officers.

- Honored with the Excellence in Property Tax Administration award from the state tax authority.

- Recognized for contributions to the profession by being appointed to the board of the state appraisal association.

Certificates

- Certified Tax Appraiser (CTA)

- Residential Property Appraiser (RPA)

- General Property Appraiser (GPA)

- Certified International Property Appraiser (CIPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Appraiser

- Highlight your understanding of real estate appraisal principles, tax assessment laws, and valuation methodologies.

- Demonstrate your proficiency in using GIS software and data analysis techniques.

- Emphasize your communication and interpersonal skills, including the ability to resolve disputes and build relationships.

- Quantify your accomplishments, providing specific examples of how you have contributed to accuracy, equity, and efficiency in property tax administration.

Essential Experience Highlights for a Strong Tax Appraiser Resume

- Appraised real property values in accordance with established laws and regulations.

- Conducted thorough site inspections and analyzed market data to determine fair market values.

- Prepared assessment notices and responded to taxpayer inquiries, addressing concerns and resolving disputes.

- Utilized GIS software to create property maps, conduct data analysis, and identify potential assessment errors.

- Maintained accurate and up-to-date records of property ownership, characteristics, and assessment history.

- Collaborated with assessors, collectors, and other tax officials to ensure efficient tax administration.

- Participated in annual reassessment projects to ensure equitable property valuations across jurisdictions.

Frequently Asked Questions (FAQ’s) For Tax Appraiser

What are the key skills required for a Tax Appraiser?

Tax Appraisers should possess a strong foundation in real estate appraisal principles, tax assessment laws, valuation methodologies, market analysis, and GIS software. Excellent communication and interpersonal skills are also essential for effectively interacting with taxpayers and resolving disputes.

What are the career prospects for Tax Appraisers?

Tax Appraisers can find employment in various government agencies, such as county assessor’s offices or state tax commissions. They may also work for private appraisal firms or as independent contractors.

What are the challenges faced by Tax Appraisers?

Tax Appraisers may face challenges due to fluctuations in the real estate market, changes in tax laws and regulations, and the need to balance accuracy with timeliness in property valuations.

How can I prepare for a career as a Tax Appraiser?

To become a Tax Appraiser, it is recommended to obtain a Bachelor’s degree in Real Estate Appraisal or a related field, gain experience through internships or entry-level roles, and consider obtaining professional certifications to enhance credibility.

What is the importance of GIS software in property tax assessment?

GIS software plays a crucial role in property tax assessment by providing a visual representation of properties, allowing for data analysis, identifying assessment errors, and generating property maps to facilitate decision-making.