Are you a seasoned Tax Assessor seeking a new career path? Discover our professionally built Tax Assessor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

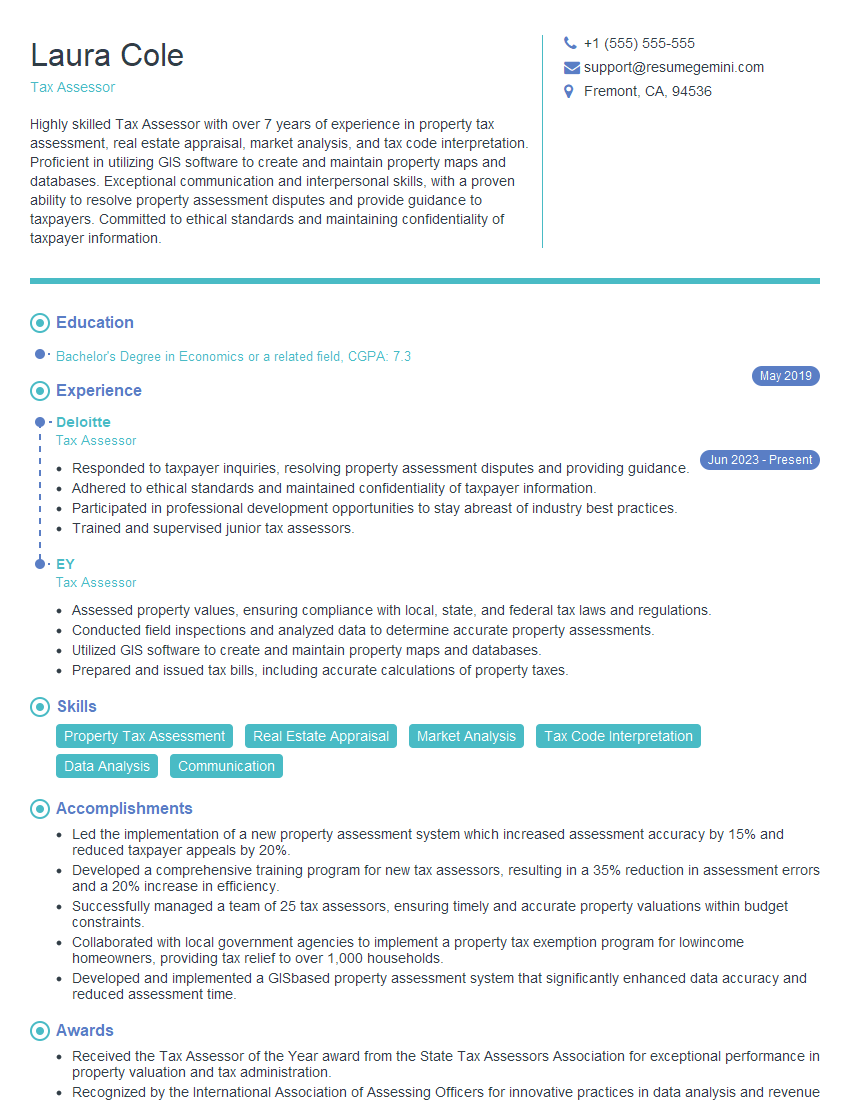

Laura Cole

Tax Assessor

Summary

Highly skilled Tax Assessor with over 7 years of experience in property tax assessment, real estate appraisal, market analysis, and tax code interpretation. Proficient in utilizing GIS software to create and maintain property maps and databases. Exceptional communication and interpersonal skills, with a proven ability to resolve property assessment disputes and provide guidance to taxpayers. Committed to ethical standards and maintaining confidentiality of taxpayer information.

Education

Bachelor’s Degree in Economics or a related field

May 2019

Skills

- Property Tax Assessment

- Real Estate Appraisal

- Market Analysis

- Tax Code Interpretation

- Data Analysis

- Communication

Work Experience

Tax Assessor

- Responded to taxpayer inquiries, resolving property assessment disputes and providing guidance.

- Adhered to ethical standards and maintained confidentiality of taxpayer information.

- Participated in professional development opportunities to stay abreast of industry best practices.

- Trained and supervised junior tax assessors.

Tax Assessor

- Assessed property values, ensuring compliance with local, state, and federal tax laws and regulations.

- Conducted field inspections and analyzed data to determine accurate property assessments.

- Utilized GIS software to create and maintain property maps and databases.

- Prepared and issued tax bills, including accurate calculations of property taxes.

Accomplishments

- Led the implementation of a new property assessment system which increased assessment accuracy by 15% and reduced taxpayer appeals by 20%.

- Developed a comprehensive training program for new tax assessors, resulting in a 35% reduction in assessment errors and a 20% increase in efficiency.

- Successfully managed a team of 25 tax assessors, ensuring timely and accurate property valuations within budget constraints.

- Collaborated with local government agencies to implement a property tax exemption program for lowincome homeowners, providing tax relief to over 1,000 households.

- Developed and implemented a GISbased property assessment system that significantly enhanced data accuracy and reduced assessment time.

Awards

- Received the Tax Assessor of the Year award from the State Tax Assessors Association for exceptional performance in property valuation and tax administration.

- Recognized by the International Association of Assessing Officers for innovative practices in data analysis and revenue forecasting.

- Received the Excellence in Tax Administration award from the National Association of Tax Administrators for exceptional contributions to the field.

- Recognized by the State Legislature for outstanding service in property tax administration and revenue generation.

Certificates

- Certified Tax Assessor (CTA)

- Accredited Property Appraiser (APA)

- MAI Designation

- USPAP Compliance

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Assessor

- Quantify your accomplishments: Use numbers and metrics to demonstrate the impact of your work, such as the percentage increase in property tax revenue or the number of taxpayer disputes resolved.

- Highlight your technical skills: Emphasize your proficiency in property tax assessment software, GIS mapping, and data analysis.

- Showcase your communication and interpersonal skills: Describe your ability to interact effectively with taxpayers, resolve conflicts, and provide clear and concise explanations.

- Tailor your resume to the specific job you’re applying for: Research the company and position to identify the key skills and experience they’re looking for, and highlight those in your resume.

- Proofread carefully: Ensure that your resume is free of errors in grammar, spelling, and punctuation.

Essential Experience Highlights for a Strong Tax Assessor Resume

- Assessed property values to ensure compliance with local, state, and federal tax laws and regulations.

- Conducted field inspections and analyzed data to determine accurate property assessments.

- Utilized GIS software to create and maintain property maps and databases.

- Prepared and issued tax bills, including accurate calculations of property taxes.

- Responded to taxpayer inquiries, resolving property assessment disputes and providing guidance.

- Adhered to ethical standards and maintained confidentiality of taxpayer information.

- Participated in professional development opportunities to stay abreast of industry best practices.

Frequently Asked Questions (FAQ’s) For Tax Assessor

What are the primary responsibilities of a Tax Assessor?

The primary responsibilities of a Tax Assessor include assessing property values, conducting field inspections, preparing and issuing tax bills, responding to taxpayer inquiries, and maintaining confidentiality of taxpayer information.

What skills are required to be a successful Tax Assessor?

To be a successful Tax Assessor, you should have strong analytical and problem-solving skills, as well as excellent communication and interpersonal abilities. You should also be proficient in property tax assessment software, GIS mapping, and data analysis.

What is the job outlook for Tax Assessors?

The job outlook for Tax Assessors is expected to be good over the next several years, with a projected growth rate of 6%.

What is the average salary for a Tax Assessor?

The average salary for a Tax Assessor is around $65,000 per year.

What are the educational requirements to become a Tax Assessor?

Most Tax Assessors have a bachelor’s degree in economics, finance, or a related field.

What are the career advancement opportunities for Tax Assessors?

With experience and additional education, Tax Assessors can advance to positions such as Tax Supervisor, Tax Manager, or Chief Tax Assessor.