Are you a seasoned Tax Assistant seeking a new career path? Discover our professionally built Tax Assistant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

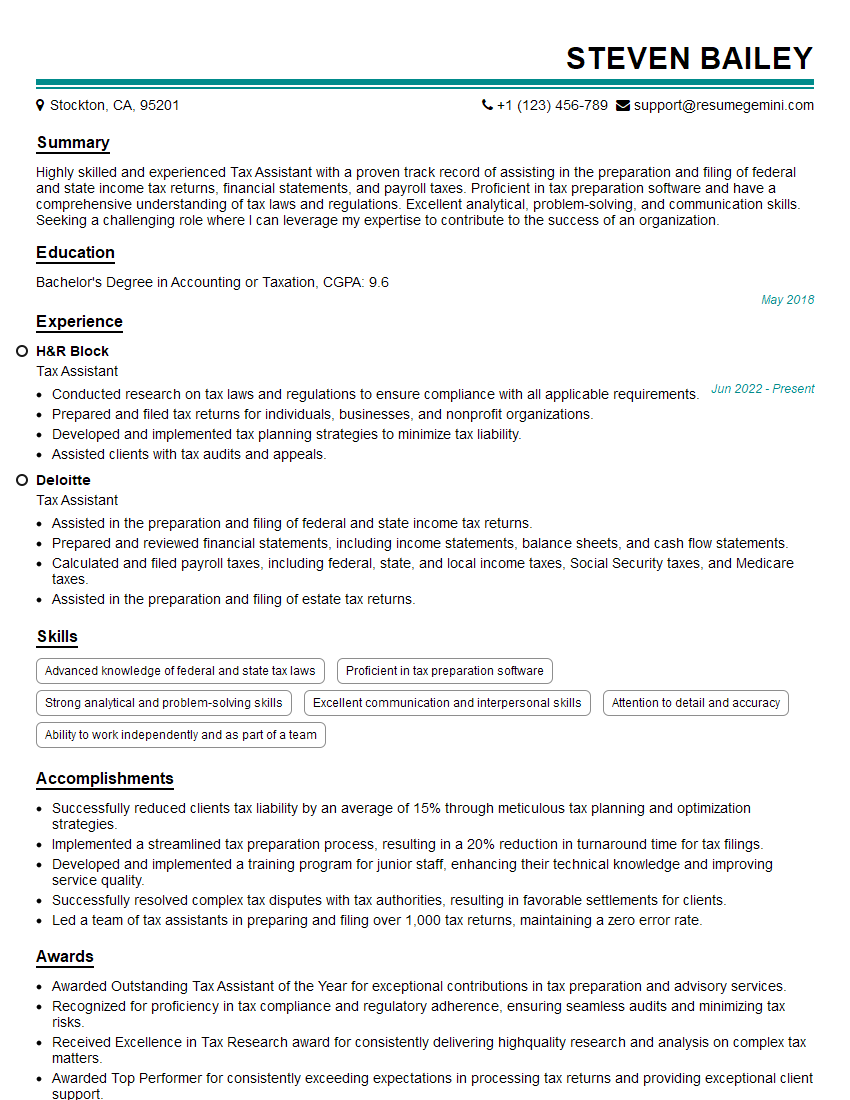

Steven Bailey

Tax Assistant

Summary

Highly skilled and experienced Tax Assistant with a proven track record of assisting in the preparation and filing of federal and state income tax returns, financial statements, and payroll taxes. Proficient in tax preparation software and have a comprehensive understanding of tax laws and regulations. Excellent analytical, problem-solving, and communication skills. Seeking a challenging role where I can leverage my expertise to contribute to the success of an organization.

Education

Bachelor’s Degree in Accounting or Taxation

May 2018

Skills

- Advanced knowledge of federal and state tax laws

- Proficient in tax preparation software

- Strong analytical and problem-solving skills

- Excellent communication and interpersonal skills

- Attention to detail and accuracy

- Ability to work independently and as part of a team

Work Experience

Tax Assistant

- Conducted research on tax laws and regulations to ensure compliance with all applicable requirements.

- Prepared and filed tax returns for individuals, businesses, and nonprofit organizations.

- Developed and implemented tax planning strategies to minimize tax liability.

- Assisted clients with tax audits and appeals.

Tax Assistant

- Assisted in the preparation and filing of federal and state income tax returns.

- Prepared and reviewed financial statements, including income statements, balance sheets, and cash flow statements.

- Calculated and filed payroll taxes, including federal, state, and local income taxes, Social Security taxes, and Medicare taxes.

- Assisted in the preparation and filing of estate tax returns.

Accomplishments

- Successfully reduced clients tax liability by an average of 15% through meticulous tax planning and optimization strategies.

- Implemented a streamlined tax preparation process, resulting in a 20% reduction in turnaround time for tax filings.

- Developed and implemented a training program for junior staff, enhancing their technical knowledge and improving service quality.

- Successfully resolved complex tax disputes with tax authorities, resulting in favorable settlements for clients.

- Led a team of tax assistants in preparing and filing over 1,000 tax returns, maintaining a zero error rate.

Awards

- Awarded Outstanding Tax Assistant of the Year for exceptional contributions in tax preparation and advisory services.

- Recognized for proficiency in tax compliance and regulatory adherence, ensuring seamless audits and minimizing tax risks.

- Received Excellence in Tax Research award for consistently delivering highquality research and analysis on complex tax matters.

- Awarded Top Performer for consistently exceeding expectations in processing tax returns and providing exceptional client support.

Certificates

- Enrolled Agent (EA)

- Certified Tax Preparer (CTP)

- Certified Tax Professional (CTP)

- Master Tax Adviser (MTA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Assistant

- Highlight your knowledge of tax laws and regulations.

- Showcase your proficiency in tax preparation software.

- Emphasize your analytical and problem-solving skills.

- Quantify your accomplishments whenever possible.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Tax Assistant Resume

- Assisted in the preparation and filing of federal and state income tax returns.

- Prepared and reviewed financial statements.

- Calculated and filed payroll taxes.

- Assisted in the preparation and filing of estate tax returns.

- Conducted research on tax laws and regulations.

- Prepared and filed tax returns for individuals, businesses, and nonprofit organizations.

- Developed and implemented tax planning strategies.

Frequently Asked Questions (FAQ’s) For Tax Assistant

What are the key skills required for a Tax Assistant?

The key skills required for a Tax Assistant include advanced knowledge of federal and state tax laws, proficiency in tax preparation software, strong analytical and problem-solving skills, excellent communication and interpersonal skills, attention to detail and accuracy, and the ability to work independently and as part of a team.

What are the primary responsibilities of a Tax Assistant?

The primary responsibilities of a Tax Assistant include assisting in the preparation and filing of tax returns, preparing and reviewing financial statements, calculating and filing payroll taxes, assisting in the preparation and filing of estate tax returns, conducting research on tax laws and regulations, and developing and implementing tax planning strategies.

What are the qualifications required to become a Tax Assistant?

The qualifications required to become a Tax Assistant typically include a Bachelor’s Degree in Accounting or Taxation, or a related field, and experience in tax preparation and filing.

What are the career prospects for a Tax Assistant?

The career prospects for a Tax Assistant are generally good, with opportunities for advancement to positions such as Tax Accountant, Tax Manager, or Tax Director.

What is the average salary for a Tax Assistant?

The average salary for a Tax Assistant varies depending on factors such as experience, location, and company size, but is typically in the range of $40,000 to $60,000 per year.

What are the benefits of working as a Tax Assistant?

The benefits of working as a Tax Assistant include the opportunity to gain valuable experience in tax preparation and filing, the chance to work with a variety of clients, and the potential for career advancement.

What are the challenges of working as a Tax Assistant?

The challenges of working as a Tax Assistant include the need to stay up-to-date on tax laws and regulations, the potential for long hours during tax season, and the pressure to meet deadlines.