Are you a seasoned Tax Attorney seeking a new career path? Discover our professionally built Tax Attorney Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

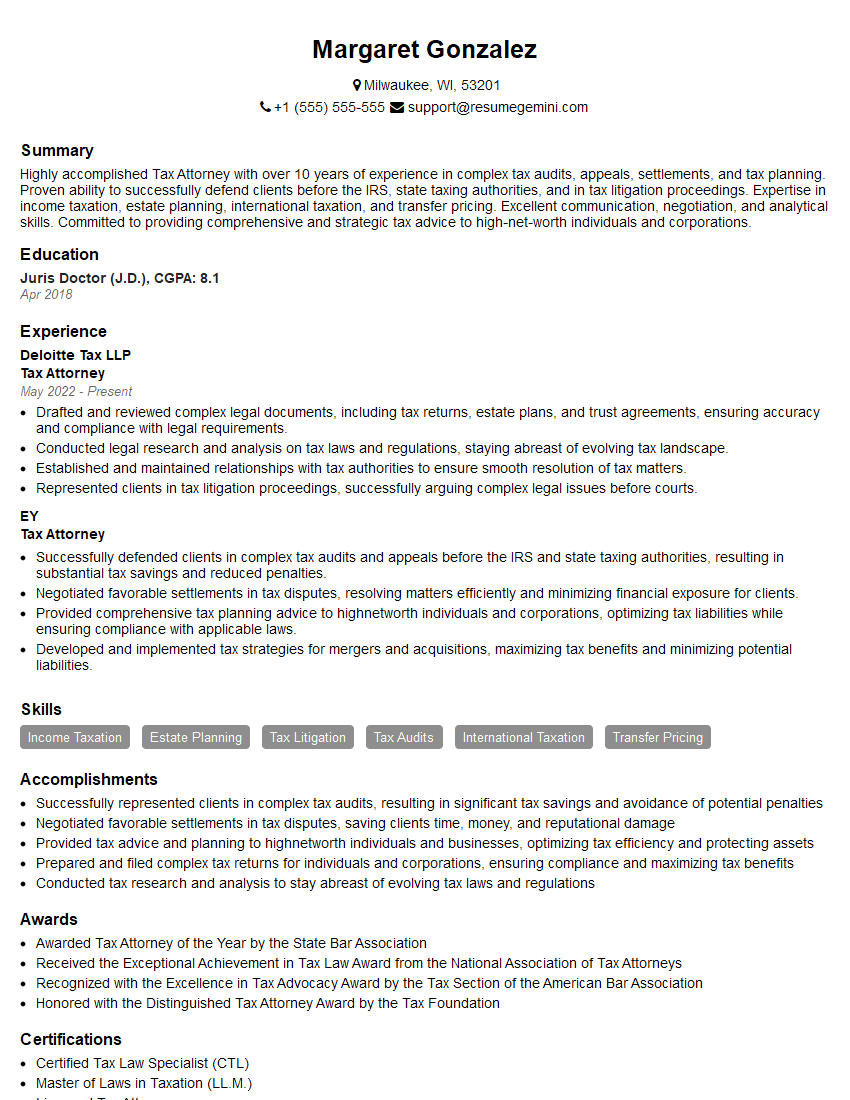

Margaret Gonzalez

Tax Attorney

Summary

Highly accomplished Tax Attorney with over 10 years of experience in complex tax audits, appeals, settlements, and tax planning. Proven ability to successfully defend clients before the IRS, state taxing authorities, and in tax litigation proceedings. Expertise in income taxation, estate planning, international taxation, and transfer pricing. Excellent communication, negotiation, and analytical skills. Committed to providing comprehensive and strategic tax advice to high-net-worth individuals and corporations.

Education

Juris Doctor (J.D.)

April 2018

Skills

- Income Taxation

- Estate Planning

- Tax Litigation

- Tax Audits

- International Taxation

- Transfer Pricing

Work Experience

Tax Attorney

- Drafted and reviewed complex legal documents, including tax returns, estate plans, and trust agreements, ensuring accuracy and compliance with legal requirements.

- Conducted legal research and analysis on tax laws and regulations, staying abreast of evolving tax landscape.

- Established and maintained relationships with tax authorities to ensure smooth resolution of tax matters.

- Represented clients in tax litigation proceedings, successfully arguing complex legal issues before courts.

Tax Attorney

- Successfully defended clients in complex tax audits and appeals before the IRS and state taxing authorities, resulting in substantial tax savings and reduced penalties.

- Negotiated favorable settlements in tax disputes, resolving matters efficiently and minimizing financial exposure for clients.

- Provided comprehensive tax planning advice to highnetworth individuals and corporations, optimizing tax liabilities while ensuring compliance with applicable laws.

- Developed and implemented tax strategies for mergers and acquisitions, maximizing tax benefits and minimizing potential liabilities.

Accomplishments

- Successfully represented clients in complex tax audits, resulting in significant tax savings and avoidance of potential penalties

- Negotiated favorable settlements in tax disputes, saving clients time, money, and reputational damage

- Provided tax advice and planning to highnetworth individuals and businesses, optimizing tax efficiency and protecting assets

- Prepared and filed complex tax returns for individuals and corporations, ensuring compliance and maximizing tax benefits

- Conducted tax research and analysis to stay abreast of evolving tax laws and regulations

Awards

- Awarded Tax Attorney of the Year by the State Bar Association

- Received the Exceptional Achievement in Tax Law Award from the National Association of Tax Attorneys

- Recognized with the Excellence in Tax Advocacy Award by the Tax Section of the American Bar Association

- Honored with the Distinguished Tax Attorney Award by the Tax Foundation

Certificates

- Certified Tax Law Specialist (CTL)

- Master of Laws in Taxation (LL.M.)

- Licensed Tax Attorney

- AICPA Advanced Tax Certificate

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Attorney

Highlight your technical expertise.

Tax attorneys need to have a deep understanding of the tax code and be able to apply it to complex legal issues. Make sure your resume showcases your knowledge of tax law and tax accounting principles.Quantify your accomplishments.

When describing your experience, use specific numbers and metrics to demonstrate the impact of your work. For example, you could say that you “successfully defended clients in complex tax audits, resulting in substantial tax savings and reduced penalties.”Demonstrate your client service skills.

Tax attorneys need to be able to build strong relationships with their clients and understand their business needs. Highlight your communication, interpersonal, and negotiation skills on your resume.Stay up-to-date on the latest tax laws and regulations.

The tax code is constantly changing, so it’s important to stay up-to-date on the latest developments. Take advantage of continuing education opportunities and read industry publications to keep your knowledge current.Get involved in professional organizations.

Joining professional organizations can help you network with other tax attorneys, stay up-to-date on the latest developments in the field, and gain access to valuable resources.

Essential Experience Highlights for a Strong Tax Attorney Resume

- Defend clients in complex tax audits and appeals before the IRS and state taxing authorities.

- Negotiate favorable settlements in tax disputes, minimizing financial exposure for clients.

- Provide comprehensive tax planning advice to high-net-worth individuals and corporations, optimizing tax liabilities.

- Develop and implement tax strategies for mergers and acquisitions, maximizing tax benefits.

- Draft and review complex legal documents, ensuring accuracy and compliance with legal requirements.

- Conduct legal research and analysis on tax laws and regulations.

- Represent clients in tax litigation proceedings.

Frequently Asked Questions (FAQ’s) For Tax Attorney

What are the key skills and qualifications for a Tax Attorney?

The key skills and qualifications for a Tax Attorney include a deep understanding of the tax code, strong analytical and problem-solving skills, excellent communication and interpersonal skills, and the ability to work independently and as part of a team.

What are the different types of Tax Attorneys?

There are many different types of Tax Attorneys, including those who specialize in corporate taxation, individual taxation, international taxation, estate planning, and tax litigation.

What is the job outlook for Tax Attorneys?

The job outlook for Tax Attorneys is expected to be good over the next few years. As the tax code becomes increasingly complex, businesses and individuals will continue to need the help of Tax Attorneys to navigate the tax laws and minimize their tax liability.

What are the salary expectations for Tax Attorneys?

The salary expectations for Tax Attorneys vary depending on their experience, location, and the size of their firm. However, Tax Attorneys can generally expect to earn a competitive salary.

What are the career advancement opportunities for Tax Attorneys?

Tax Attorneys can advance their careers by moving into management positions, specializing in a particular area of tax law, or starting their own practice.

What are the challenges of being a Tax Attorney?

The challenges of being a Tax Attorney include the need to stay up-to-date on the constantly changing tax code, the complex and often adversarial nature of tax disputes, and the pressure to meet deadlines.

What are the rewards of being a Tax Attorney?

The rewards of being a Tax Attorney include the opportunity to help clients save money on taxes, the intellectual challenge of working with complex legal issues, and the satisfaction of knowing that you are making a difference in the lives of your clients.