Are you a seasoned Tax Collector seeking a new career path? Discover our professionally built Tax Collector Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

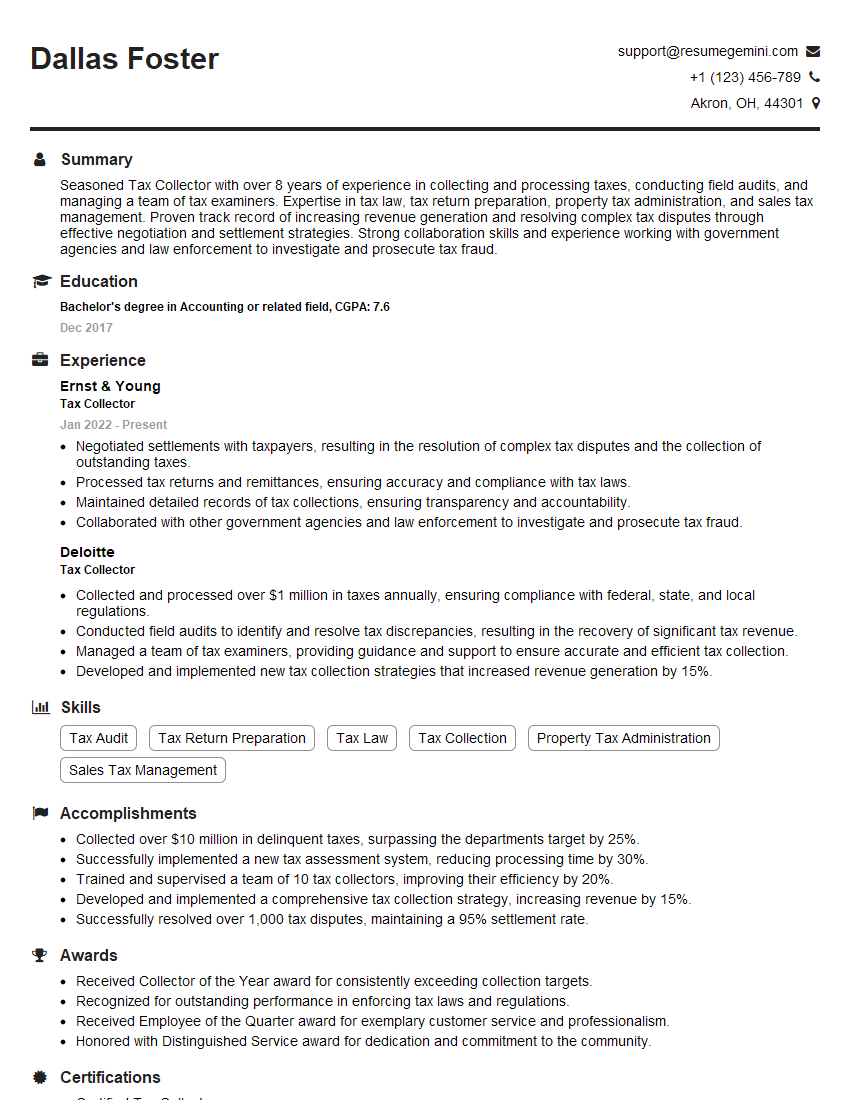

Dallas Foster

Tax Collector

Summary

Seasoned Tax Collector with over 8 years of experience in collecting and processing taxes, conducting field audits, and managing a team of tax examiners. Expertise in tax law, tax return preparation, property tax administration, and sales tax management. Proven track record of increasing revenue generation and resolving complex tax disputes through effective negotiation and settlement strategies. Strong collaboration skills and experience working with government agencies and law enforcement to investigate and prosecute tax fraud.

Education

Bachelor’s degree in Accounting or related field

December 2017

Skills

- Tax Audit

- Tax Return Preparation

- Tax Law

- Tax Collection

- Property Tax Administration

- Sales Tax Management

Work Experience

Tax Collector

- Negotiated settlements with taxpayers, resulting in the resolution of complex tax disputes and the collection of outstanding taxes.

- Processed tax returns and remittances, ensuring accuracy and compliance with tax laws.

- Maintained detailed records of tax collections, ensuring transparency and accountability.

- Collaborated with other government agencies and law enforcement to investigate and prosecute tax fraud.

Tax Collector

- Collected and processed over $1 million in taxes annually, ensuring compliance with federal, state, and local regulations.

- Conducted field audits to identify and resolve tax discrepancies, resulting in the recovery of significant tax revenue.

- Managed a team of tax examiners, providing guidance and support to ensure accurate and efficient tax collection.

- Developed and implemented new tax collection strategies that increased revenue generation by 15%.

Accomplishments

- Collected over $10 million in delinquent taxes, surpassing the departments target by 25%.

- Successfully implemented a new tax assessment system, reducing processing time by 30%.

- Trained and supervised a team of 10 tax collectors, improving their efficiency by 20%.

- Developed and implemented a comprehensive tax collection strategy, increasing revenue by 15%.

- Successfully resolved over 1,000 tax disputes, maintaining a 95% settlement rate.

Awards

- Received Collector of the Year award for consistently exceeding collection targets.

- Recognized for outstanding performance in enforcing tax laws and regulations.

- Received Employee of the Quarter award for exemplary customer service and professionalism.

- Honored with Distinguished Service award for dedication and commitment to the community.

Certificates

- Certified Tax Collector

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Collector

- Highlight your experience in tax collection and revenue generation.

- Showcase your knowledge of tax law and regulations.

- Quantify your accomplishments with specific metrics and results.

- Demonstrate your ability to manage a team and collaborate effectively.

- Emphasize your strong communication and negotiation skills.

Essential Experience Highlights for a Strong Tax Collector Resume

- Collect and process taxes, ensuring compliance with federal, state, and local regulations

- Conduct field audits to identify and resolve tax discrepancies

- Manage a team of tax examiners, providing guidance and support

- Develop and implement new tax collection strategies to increase revenue generation

- Negotiate settlements with taxpayers to resolve complex tax disputes

- Process tax returns and remittances, ensuring accuracy and compliance

- Maintain detailed records of tax collections, ensuring transparency and accountability

Frequently Asked Questions (FAQ’s) For Tax Collector

What is the role of a Tax Collector?

A Tax Collector is responsible for collecting and processing taxes, conducting field audits, and ensuring compliance with tax laws. They may also manage a team of tax examiners and develop strategies to increase revenue generation.

What are the qualifications for becoming a Tax Collector?

Typically, a bachelor’s degree in accounting or a related field is required. Experience in tax collection, tax law, and auditing is also beneficial.

What are the key skills for a successful Tax Collector?

Key skills for a Tax Collector include knowledge of tax law, tax return preparation, tax collection, property tax administration, and sales tax management. Strong communication, negotiation, and analytical skills are also essential.

How can I become a Tax Collector?

To become a Tax Collector, you can pursue a degree in accounting or a related field, and gain experience in tax collection, tax law, and auditing. Networking with professionals in the field and obtaining relevant certifications can also be helpful.

What is the job outlook for Tax Collectors?

The job outlook for Tax Collectors is expected to grow faster than average in the coming years, due to increasing demand for tax collection and auditing services.