Are you a seasoned Tax Economist seeking a new career path? Discover our professionally built Tax Economist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

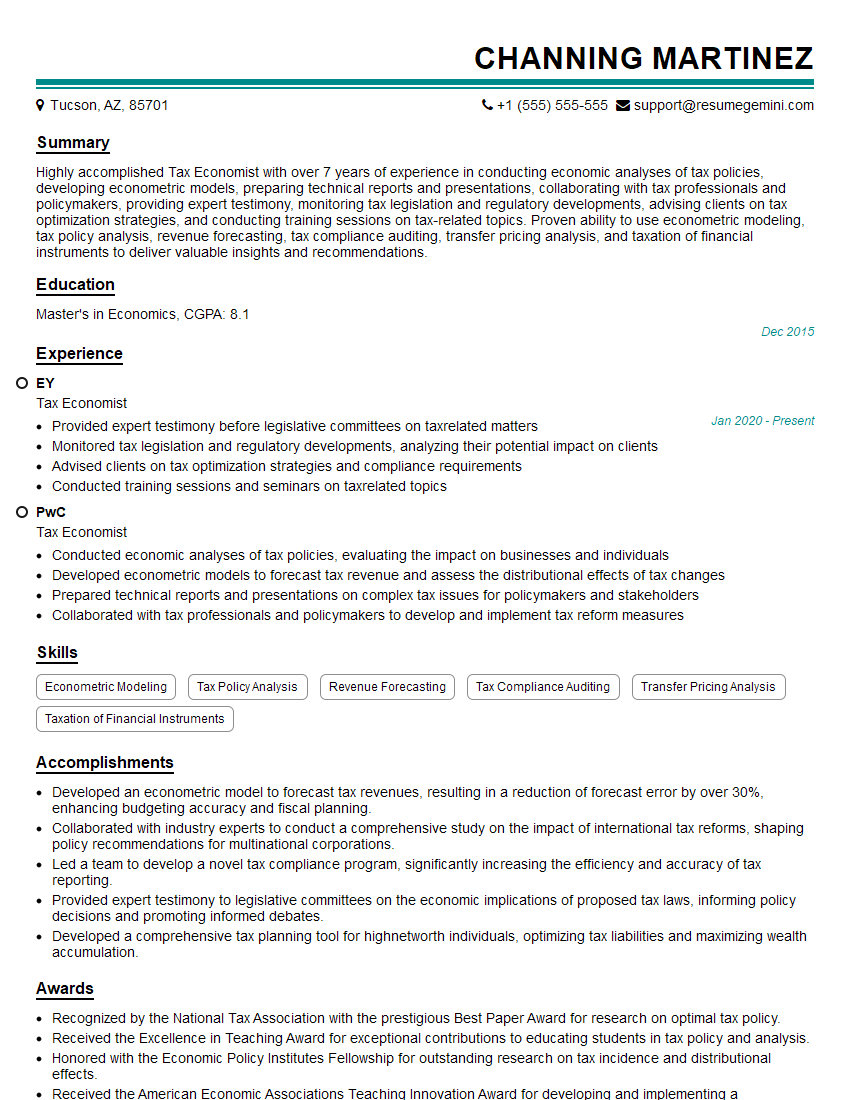

Channing Martinez

Tax Economist

Summary

Highly accomplished Tax Economist with over 7 years of experience in conducting economic analyses of tax policies, developing econometric models, preparing technical reports and presentations, collaborating with tax professionals and policymakers, providing expert testimony, monitoring tax legislation and regulatory developments, advising clients on tax optimization strategies, and conducting training sessions on tax-related topics. Proven ability to use econometric modeling, tax policy analysis, revenue forecasting, tax compliance auditing, transfer pricing analysis, and taxation of financial instruments to deliver valuable insights and recommendations.

Education

Master’s in Economics

December 2015

Skills

- Econometric Modeling

- Tax Policy Analysis

- Revenue Forecasting

- Tax Compliance Auditing

- Transfer Pricing Analysis

- Taxation of Financial Instruments

Work Experience

Tax Economist

- Provided expert testimony before legislative committees on taxrelated matters

- Monitored tax legislation and regulatory developments, analyzing their potential impact on clients

- Advised clients on tax optimization strategies and compliance requirements

- Conducted training sessions and seminars on taxrelated topics

Tax Economist

- Conducted economic analyses of tax policies, evaluating the impact on businesses and individuals

- Developed econometric models to forecast tax revenue and assess the distributional effects of tax changes

- Prepared technical reports and presentations on complex tax issues for policymakers and stakeholders

- Collaborated with tax professionals and policymakers to develop and implement tax reform measures

Accomplishments

- Developed an econometric model to forecast tax revenues, resulting in a reduction of forecast error by over 30%, enhancing budgeting accuracy and fiscal planning.

- Collaborated with industry experts to conduct a comprehensive study on the impact of international tax reforms, shaping policy recommendations for multinational corporations.

- Led a team to develop a novel tax compliance program, significantly increasing the efficiency and accuracy of tax reporting.

- Provided expert testimony to legislative committees on the economic implications of proposed tax laws, informing policy decisions and promoting informed debates.

- Developed a comprehensive tax planning tool for highnetworth individuals, optimizing tax liabilities and maximizing wealth accumulation.

Awards

- Recognized by the National Tax Association with the prestigious Best Paper Award for research on optimal tax policy.

- Received the Excellence in Teaching Award for exceptional contributions to educating students in tax policy and analysis.

- Honored with the Economic Policy Institutes Fellowship for outstanding research on tax incidence and distributional effects.

- Received the American Economic Associations Teaching Innovation Award for developing and implementing a cuttingedge course on behavioral economics in taxation.

Certificates

- Certified Public Accountant (CPA)

- Chartered Tax Adviser (CTA)

- Certified Tax Analyst (CTA)

- Certified Financial Analyst (CFA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Economist

- Highlight your quantitative skills and experience in econometric modeling and tax policy analysis.

- Showcase your ability to communicate complex tax issues effectively to a variety of audiences.

- Demonstrate your understanding of the latest tax legislation and regulatory developments.

- Provide specific examples of how your work has helped clients achieve their tax goals.

- Consider obtaining a certification in taxation to enhance your credibility.

Essential Experience Highlights for a Strong Tax Economist Resume

- Conducted economic analyses of tax policies to evaluate their impact on businesses and individuals.

- Developed econometric models to forecast tax revenue and assess the distributional effects of tax changes.

- Prepared technical reports and presentations on complex tax issues for policymakers and stakeholders.

- Collaborated with tax professionals and policymakers to develop and implement tax reform measures.

- Provided expert testimony before legislative committees on tax-related matters.

- Monitored tax legislation and regulatory developments, analyzing their potential impact on clients.

- Advised clients on tax optimization strategies and compliance requirements.

- Conducted training sessions and seminars on tax-related topics.

Frequently Asked Questions (FAQ’s) For Tax Economist

What is the role of a Tax Economist?

A Tax Economist is responsible for conducting economic analyses of tax policies, developing econometric models, preparing technical reports and presentations, collaborating with tax professionals and policymakers, providing expert testimony, monitoring tax legislation and regulatory developments, advising clients on tax optimization strategies, and conducting training sessions on tax-related topics.

What skills are required to be a Tax Economist?

The skills required to be a Tax Economist include econometric modeling, tax policy analysis, revenue forecasting, tax compliance auditing, transfer pricing analysis, taxation of financial instruments, and excellent communication skills.

What is the job outlook for Tax Economists?

The job outlook for Tax Economists is expected to be good over the next few years. The demand for Tax Economists is driven by the increasing complexity of tax laws and regulations, as well as the need for businesses and governments to understand the economic impact of tax policies.

What is the salary range for Tax Economists?

The salary range for Tax Economists varies depending on experience, education, and location. According to the U.S. Bureau of Labor Statistics, the median annual salary for Tax Economists was $105,020 in May 2021.

What are the career advancement opportunities for Tax Economists?

Tax Economists can advance their careers by taking on leadership roles within their organizations, becoming certified in taxation, or pursuing a higher degree. Some Tax Economists may also choose to work as independent consultants.

What are the challenges of being a Tax Economist?

The challenges of being a Tax Economist include the need to stay up-to-date on the latest tax laws and regulations, the ability to work independently and as part of a team, and the ability to communicate complex tax issues effectively to a variety of audiences.

What is the difference between a Tax Economist and a Tax Accountant?

Tax Economists focus on the economic impact of tax policies, while Tax Accountants focus on the preparation and filing of tax returns.