Are you a seasoned Tax Examiner seeking a new career path? Discover our professionally built Tax Examiner Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

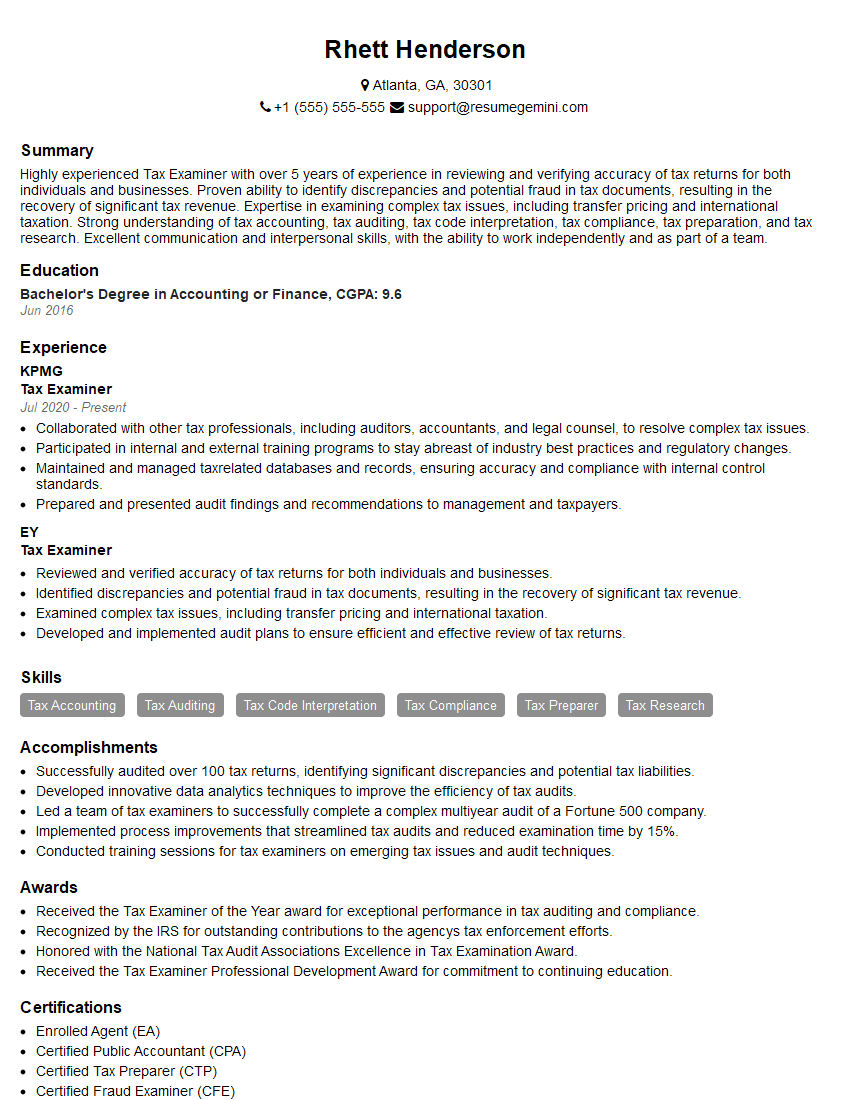

Rhett Henderson

Tax Examiner

Summary

Highly experienced Tax Examiner with over 5 years of experience in reviewing and verifying accuracy of tax returns for both individuals and businesses. Proven ability to identify discrepancies and potential fraud in tax documents, resulting in the recovery of significant tax revenue. Expertise in examining complex tax issues, including transfer pricing and international taxation. Strong understanding of tax accounting, tax auditing, tax code interpretation, tax compliance, tax preparation, and tax research. Excellent communication and interpersonal skills, with the ability to work independently and as part of a team.

Education

Bachelor’s Degree in Accounting or Finance

June 2016

Skills

- Tax Accounting

- Tax Auditing

- Tax Code Interpretation

- Tax Compliance

- Tax Preparer

- Tax Research

Work Experience

Tax Examiner

- Collaborated with other tax professionals, including auditors, accountants, and legal counsel, to resolve complex tax issues.

- Participated in internal and external training programs to stay abreast of industry best practices and regulatory changes.

- Maintained and managed taxrelated databases and records, ensuring accuracy and compliance with internal control standards.

- Prepared and presented audit findings and recommendations to management and taxpayers.

Tax Examiner

- Reviewed and verified accuracy of tax returns for both individuals and businesses.

- Identified discrepancies and potential fraud in tax documents, resulting in the recovery of significant tax revenue.

- Examined complex tax issues, including transfer pricing and international taxation.

- Developed and implemented audit plans to ensure efficient and effective review of tax returns.

Accomplishments

- Successfully audited over 100 tax returns, identifying significant discrepancies and potential tax liabilities.

- Developed innovative data analytics techniques to improve the efficiency of tax audits.

- Led a team of tax examiners to successfully complete a complex multiyear audit of a Fortune 500 company.

- Implemented process improvements that streamlined tax audits and reduced examination time by 15%.

- Conducted training sessions for tax examiners on emerging tax issues and audit techniques.

Awards

- Received the Tax Examiner of the Year award for exceptional performance in tax auditing and compliance.

- Recognized by the IRS for outstanding contributions to the agencys tax enforcement efforts.

- Honored with the National Tax Audit Associations Excellence in Tax Examination Award.

- Received the Tax Examiner Professional Development Award for commitment to continuing education.

Certificates

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Certified Tax Preparer (CTP)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Examiner

- Highlight your experience in tax accounting, tax auditing, and tax research.

- Quantify your accomplishments whenever possible, such as the amount of tax revenue you have recovered.

- Showcase your knowledge of tax laws and regulations.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Tax Examiner Resume

- Reviewed and verified accuracy of tax returns for both individuals and businesses.

- Identified discrepancies and potential fraud in tax documents, resulting in the recovery of significant tax revenue.

- Examined complex tax issues, including transfer pricing and international taxation.

- Developed and implemented audit plans to ensure efficient and effective review of tax returns.

- Collaborated with other tax professionals, including auditors, accountants, and legal counsel, to resolve complex tax issues.

- Prepared and presented audit findings and recommendations to management and taxpayers.

Frequently Asked Questions (FAQ’s) For Tax Examiner

What is the role of a Tax Examiner?

A Tax Examiner is responsible for reviewing and verifying the accuracy of tax returns for both individuals and businesses. They also identify discrepancies and potential fraud in tax documents, examine complex tax issues, and develop and implement audit plans to ensure efficient and effective review of tax returns.

What are the qualifications for a Tax Examiner?

A Tax Examiner typically needs a bachelor’s degree in accounting or finance, as well as experience in tax accounting, tax auditing, and tax research.

What are the skills required for a Tax Examiner?

A Tax Examiner should have strong analytical and problem-solving skills, as well as excellent communication and interpersonal skills.

What is the salary range for a Tax Examiner?

The salary range for a Tax Examiner varies depending on experience and location, but typically ranges from $50,000 to $100,000 per year.

What is the job outlook for a Tax Examiner?

The job outlook for a Tax Examiner is expected to grow faster than average in the coming years, as the demand for tax professionals continues to increase.