Are you a seasoned Tax Examining Technician seeking a new career path? Discover our professionally built Tax Examining Technician Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

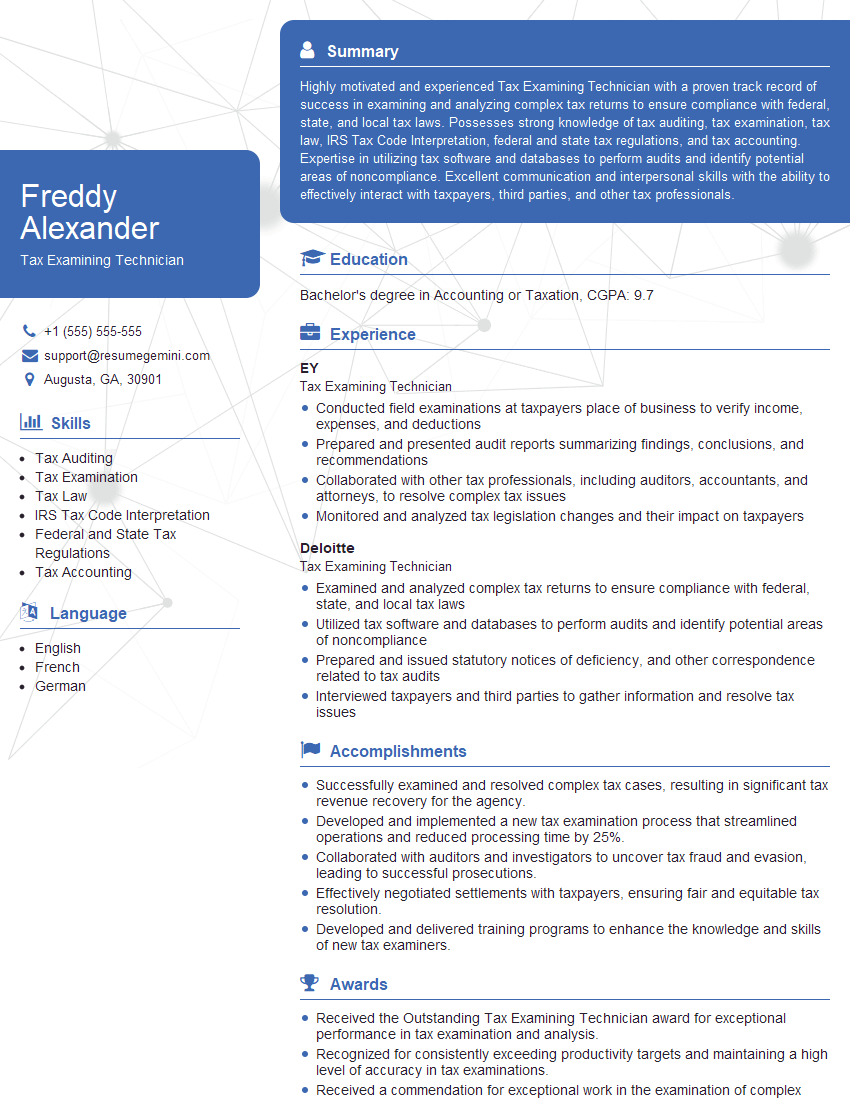

Freddy Alexander

Tax Examining Technician

Summary

Highly motivated and experienced Tax Examining Technician with a proven track record of success in examining and analyzing complex tax returns to ensure compliance with federal, state, and local tax laws. Possesses strong knowledge of tax auditing, tax examination, tax law, IRS Tax Code Interpretation, federal and state tax regulations, and tax accounting. Expertise in utilizing tax software and databases to perform audits and identify potential areas of noncompliance. Excellent communication and interpersonal skills with the ability to effectively interact with taxpayers, third parties, and other tax professionals.

Education

Bachelor’s degree in Accounting or Taxation

May 2015

Skills

- Tax Auditing

- Tax Examination

- Tax Law

- IRS Tax Code Interpretation

- Federal and State Tax Regulations

- Tax Accounting

Work Experience

Tax Examining Technician

- Conducted field examinations at taxpayers place of business to verify income, expenses, and deductions

- Prepared and presented audit reports summarizing findings, conclusions, and recommendations

- Collaborated with other tax professionals, including auditors, accountants, and attorneys, to resolve complex tax issues

- Monitored and analyzed tax legislation changes and their impact on taxpayers

Tax Examining Technician

- Examined and analyzed complex tax returns to ensure compliance with federal, state, and local tax laws

- Utilized tax software and databases to perform audits and identify potential areas of noncompliance

- Prepared and issued statutory notices of deficiency, and other correspondence related to tax audits

- Interviewed taxpayers and third parties to gather information and resolve tax issues

Accomplishments

- Successfully examined and resolved complex tax cases, resulting in significant tax revenue recovery for the agency.

- Developed and implemented a new tax examination process that streamlined operations and reduced processing time by 25%.

- Collaborated with auditors and investigators to uncover tax fraud and evasion, leading to successful prosecutions.

- Effectively negotiated settlements with taxpayers, ensuring fair and equitable tax resolution.

- Developed and delivered training programs to enhance the knowledge and skills of new tax examiners.

Awards

- Received the Outstanding Tax Examining Technician award for exceptional performance in tax examination and analysis.

- Recognized for consistently exceeding productivity targets and maintaining a high level of accuracy in tax examinations.

- Received a commendation for exceptional work in the examination of complex corporate tax returns.

- Recognized for developing innovative techniques to improve the efficiency and accuracy of tax examinations.

Certificates

- Enrolled Agent (EA)

- Certified Tax Advisor (CTA)

- Certified Tax Preparer (CTP)

- Certified Internal Auditor (CIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Examining Technician

- Highlight your relevant skills and experience in tax auditing, examination, and tax law.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Showcase your ability to work independently and as part of a team.

- Proofread your resume carefully for any errors before submitting it.

Essential Experience Highlights for a Strong Tax Examining Technician Resume

- Examined and analyzed complex tax returns to ensure compliance with federal, state, and local tax laws.

- Utilized tax software and databases to perform audits and identify potential areas of noncompliance.

- Prepared and issued statutory notices of deficiency, and other correspondence related to tax audits.

- Interviewed taxpayers and third parties to gather information and resolve tax issues.

- Conducted field examinations at taxpayers place of business to verify income, expenses, and deductions.

- Prepared and presented audit reports summarizing findings, conclusions, and recommendations.

Frequently Asked Questions (FAQ’s) For Tax Examining Technician

What is the difference between a Tax Examining Technician and an Auditor?

A Tax Examining Technician typically focuses on examining tax returns for compliance with tax laws, while an Auditor may have a broader scope of responsibilities, including examining financial statements and other accounting records.

What are the qualifications to become a Tax Examining Technician?

A Bachelor’s degree in Accounting or Taxation is typically required, along with strong knowledge of tax auditing, examination, and tax law.

What is the career path for a Tax Examining Technician?

Tax Examining Technicians can advance to positions such as Tax Auditor, Tax Manager, or Tax Director.

What are the key skills for a successful Tax Examining Technician?

Strong analytical skills, attention to detail, and knowledge of tax laws and regulations are essential.

What is the job outlook for Tax Examining Technicians?

The job outlook for Tax Examining Technicians is expected to grow in the coming years due to increasing demand for tax compliance services.