Are you a seasoned Tax Expert seeking a new career path? Discover our professionally built Tax Expert Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

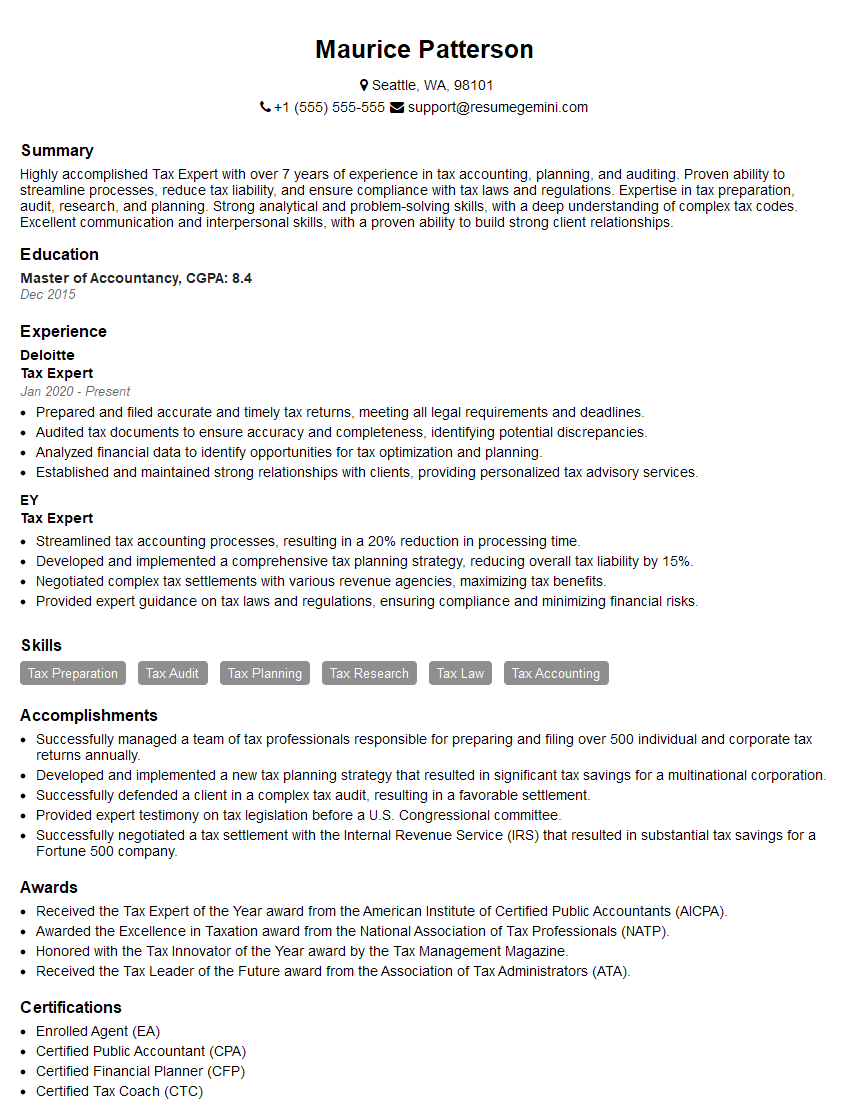

Maurice Patterson

Tax Expert

Summary

Highly accomplished Tax Expert with over 7 years of experience in tax accounting, planning, and auditing. Proven ability to streamline processes, reduce tax liability, and ensure compliance with tax laws and regulations. Expertise in tax preparation, audit, research, and planning. Strong analytical and problem-solving skills, with a deep understanding of complex tax codes. Excellent communication and interpersonal skills, with a proven ability to build strong client relationships.

Education

Master of Accountancy

December 2015

Skills

- Tax Preparation

- Tax Audit

- Tax Planning

- Tax Research

- Tax Law

- Tax Accounting

Work Experience

Tax Expert

- Prepared and filed accurate and timely tax returns, meeting all legal requirements and deadlines.

- Audited tax documents to ensure accuracy and completeness, identifying potential discrepancies.

- Analyzed financial data to identify opportunities for tax optimization and planning.

- Established and maintained strong relationships with clients, providing personalized tax advisory services.

Tax Expert

- Streamlined tax accounting processes, resulting in a 20% reduction in processing time.

- Developed and implemented a comprehensive tax planning strategy, reducing overall tax liability by 15%.

- Negotiated complex tax settlements with various revenue agencies, maximizing tax benefits.

- Provided expert guidance on tax laws and regulations, ensuring compliance and minimizing financial risks.

Accomplishments

- Successfully managed a team of tax professionals responsible for preparing and filing over 500 individual and corporate tax returns annually.

- Developed and implemented a new tax planning strategy that resulted in significant tax savings for a multinational corporation.

- Successfully defended a client in a complex tax audit, resulting in a favorable settlement.

- Provided expert testimony on tax legislation before a U.S. Congressional committee.

- Successfully negotiated a tax settlement with the Internal Revenue Service (IRS) that resulted in substantial tax savings for a Fortune 500 company.

Awards

- Received the Tax Expert of the Year award from the American Institute of Certified Public Accountants (AICPA).

- Awarded the Excellence in Taxation award from the National Association of Tax Professionals (NATP).

- Honored with the Tax Innovator of the Year award by the Tax Management Magazine.

- Received the Tax Leader of the Future award from the Association of Tax Administrators (ATA).

Certificates

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Certified Financial Planner (CFP)

- Certified Tax Coach (CTC)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Expert

- Highlight your technical skills and experience in tax accounting, planning, and auditing.

- Quantify your accomplishments using specific metrics, such as the percentage of tax savings achieved or the amount of time saved through process improvements.

- Demonstrate your knowledge of tax laws and regulations, and your ability to interpret and apply them effectively.

- Showcase your communication and interpersonal skills, and your ability to build strong relationships with clients.

Essential Experience Highlights for a Strong Tax Expert Resume

- Managed a team of tax accountants, providing guidance and support on complex tax matters

- Developed and implemented tax planning strategies for high-net-worth individuals and businesses

- Negotiated tax settlements with various tax authorities, resulting in significant tax savings

- Provided expert tax advice to clients, ensuring compliance and minimizing financial risks

- Prepared and filed accurate and timely tax returns, meeting all legal requirements and deadlines

- Audited tax documents to ensure accuracy and completeness, identifying potential discrepancies

- Kept abreast of changes in tax laws and regulations, ensuring compliance and optimizing tax strategies

Frequently Asked Questions (FAQ’s) For Tax Expert

What are the key skills required to be a successful Tax Expert?

The key skills required to be a successful Tax Expert include strong analytical and problem-solving abilities, a deep understanding of tax laws and regulations, proficiency in tax preparation and auditing, excellent communication and interpersonal skills, and the ability to stay abreast of changes in tax laws and regulations.

What are the typical responsibilities of a Tax Expert?

The typical responsibilities of a Tax Expert include preparing and filing tax returns, auditing tax documents, advising clients on tax matters, and developing and implementing tax planning strategies.

What are the career prospects for Tax Experts?

Tax Experts have excellent career prospects, as there is a growing demand for qualified tax professionals due to the increasing complexity of tax laws and regulations.

What are the educational requirements to become a Tax Expert?

Most Tax Experts have a bachelor’s or master’s degree in accounting, finance, or a related field.

What are the top companies that hire Tax Experts?

Some of the top companies that hire Tax Experts include Deloitte, EY, PwC, and KPMG.