Are you a seasoned Tax Investigator seeking a new career path? Discover our professionally built Tax Investigator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

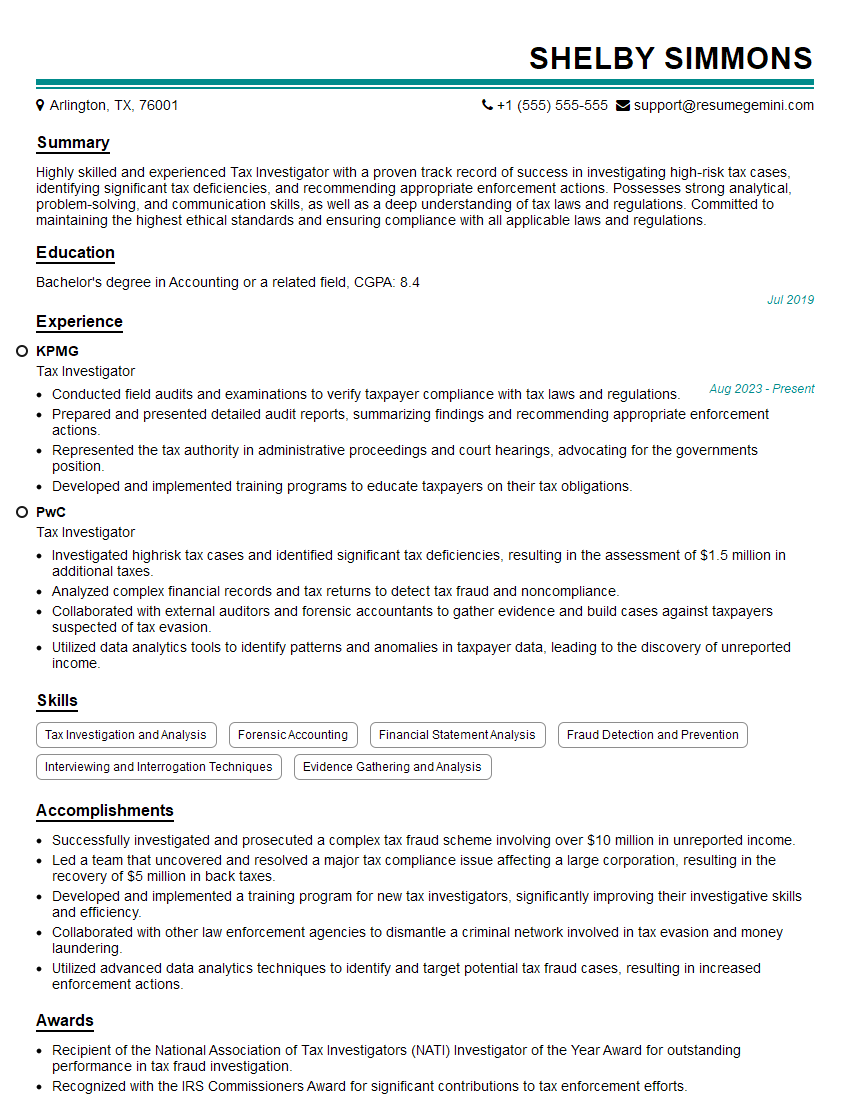

Shelby Simmons

Tax Investigator

Summary

Highly skilled and experienced Tax Investigator with a proven track record of success in investigating high-risk tax cases, identifying significant tax deficiencies, and recommending appropriate enforcement actions. Possesses strong analytical, problem-solving, and communication skills, as well as a deep understanding of tax laws and regulations. Committed to maintaining the highest ethical standards and ensuring compliance with all applicable laws and regulations.

Education

Bachelor’s degree in Accounting or a related field

July 2019

Skills

- Tax Investigation and Analysis

- Forensic Accounting

- Financial Statement Analysis

- Fraud Detection and Prevention

- Interviewing and Interrogation Techniques

- Evidence Gathering and Analysis

Work Experience

Tax Investigator

- Conducted field audits and examinations to verify taxpayer compliance with tax laws and regulations.

- Prepared and presented detailed audit reports, summarizing findings and recommending appropriate enforcement actions.

- Represented the tax authority in administrative proceedings and court hearings, advocating for the governments position.

- Developed and implemented training programs to educate taxpayers on their tax obligations.

Tax Investigator

- Investigated highrisk tax cases and identified significant tax deficiencies, resulting in the assessment of $1.5 million in additional taxes.

- Analyzed complex financial records and tax returns to detect tax fraud and noncompliance.

- Collaborated with external auditors and forensic accountants to gather evidence and build cases against taxpayers suspected of tax evasion.

- Utilized data analytics tools to identify patterns and anomalies in taxpayer data, leading to the discovery of unreported income.

Accomplishments

- Successfully investigated and prosecuted a complex tax fraud scheme involving over $10 million in unreported income.

- Led a team that uncovered and resolved a major tax compliance issue affecting a large corporation, resulting in the recovery of $5 million in back taxes.

- Developed and implemented a training program for new tax investigators, significantly improving their investigative skills and efficiency.

- Collaborated with other law enforcement agencies to dismantle a criminal network involved in tax evasion and money laundering.

- Utilized advanced data analytics techniques to identify and target potential tax fraud cases, resulting in increased enforcement actions.

Awards

- Recipient of the National Association of Tax Investigators (NATI) Investigator of the Year Award for outstanding performance in tax fraud investigation.

- Recognized with the IRS Commissioners Award for significant contributions to tax enforcement efforts.

- Honored with the State Tax Investigator Association (STIA) Distinguished Service Award for exceptional dedication to the field.

- Received the NATI Team Excellence Award for leading a highly effective investigative team that achieved exceptional results.

Certificates

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Certified Fraud Examiner (CFE)

- Certified Internal Auditor (CIA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Investigator

- Highlight your experience and skills in tax investigation and analysis.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Proofread your resume carefully for any errors.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Tax Investigator Resume

- Investigated high-risk tax cases and identified significant tax deficiencies, resulting in the assessment of $1.5 million in additional taxes.

- Analyzed complex financial records and tax returns to detect tax fraud and noncompliance.

- Collaborated with external auditors and forensic accountants to gather evidence and build cases against taxpayers suspected of tax evasion.

- Utilized data analytics tools to identify patterns and anomalies in taxpayer data, leading to the discovery of unreported income.

- Conducted field audits and examinations to verify taxpayer compliance with tax laws and regulations.

- Prepared and presented detailed audit reports, summarizing findings and recommending appropriate enforcement actions.

- Represented the tax authority in administrative proceedings and court hearings, advocating for the government’s position.

Frequently Asked Questions (FAQ’s) For Tax Investigator

What is the role of a Tax Investigator?

Tax Investigators are responsible for investigating suspected cases of tax fraud and noncompliance. They analyze financial records, conduct interviews, and gather evidence to determine whether taxpayers have complied with tax laws and regulations.

What skills are required to be a Tax Investigator?

Tax Investigators typically need a strong understanding of tax laws and regulations, as well as experience in accounting and auditing. They also need to have excellent analytical, problem-solving, and communication skills.

What is the career outlook for Tax Investigators?

The career outlook for Tax Investigators is expected to be good in the coming years. As governments around the world continue to focus on tax compliance, the demand for Tax Investigators is likely to increase.

What is the salary range for Tax Investigators?

The salary range for Tax Investigators can vary depending on their experience, skills, and location. However, according to the U.S. Bureau of Labor Statistics, the median annual salary for Tax Examiners, Auditors, and Collectors was $69,210 in May 2021.

What are the benefits of working as a Tax Investigator?

Working as a Tax Investigator can offer a number of benefits, including the opportunity to make a difference in the community by ensuring that everyone pays their fair share of taxes. Tax Investigators also typically have the opportunity to work on a variety of cases and to develop specialized skills.