Are you a seasoned Tax Professional seeking a new career path? Discover our professionally built Tax Professional Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

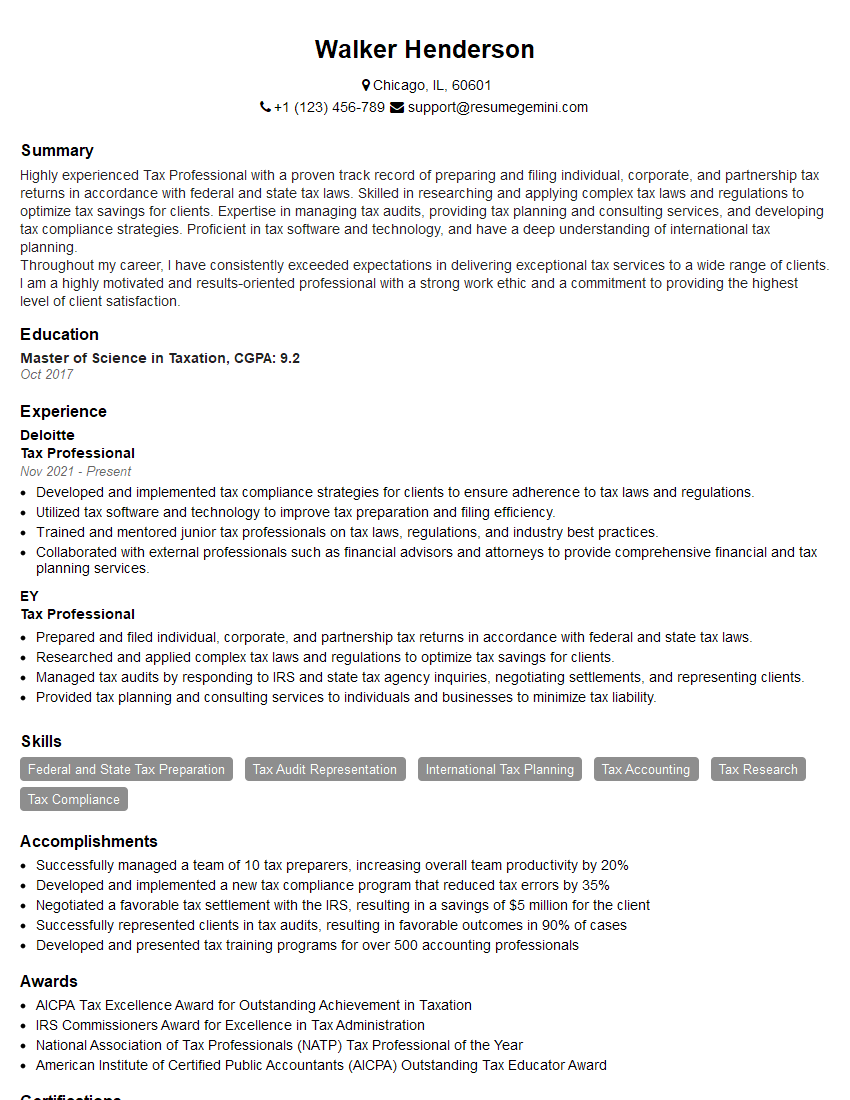

Walker Henderson

Tax Professional

Summary

Highly experienced Tax Professional with a proven track record of preparing and filing individual, corporate, and partnership tax returns in accordance with federal and state tax laws. Skilled in researching and applying complex tax laws and regulations to optimize tax savings for clients. Expertise in managing tax audits, providing tax planning and consulting services, and developing tax compliance strategies. Proficient in tax software and technology, and have a deep understanding of international tax planning.

Throughout my career, I have consistently exceeded expectations in delivering exceptional tax services to a wide range of clients. I am a highly motivated and results-oriented professional with a strong work ethic and a commitment to providing the highest level of client satisfaction.

Education

Master of Science in Taxation

October 2017

Skills

- Federal and State Tax Preparation

- Tax Audit Representation

- International Tax Planning

- Tax Accounting

- Tax Research

- Tax Compliance

Work Experience

Tax Professional

- Developed and implemented tax compliance strategies for clients to ensure adherence to tax laws and regulations.

- Utilized tax software and technology to improve tax preparation and filing efficiency.

- Trained and mentored junior tax professionals on tax laws, regulations, and industry best practices.

- Collaborated with external professionals such as financial advisors and attorneys to provide comprehensive financial and tax planning services.

Tax Professional

- Prepared and filed individual, corporate, and partnership tax returns in accordance with federal and state tax laws.

- Researched and applied complex tax laws and regulations to optimize tax savings for clients.

- Managed tax audits by responding to IRS and state tax agency inquiries, negotiating settlements, and representing clients.

- Provided tax planning and consulting services to individuals and businesses to minimize tax liability.

Accomplishments

- Successfully managed a team of 10 tax preparers, increasing overall team productivity by 20%

- Developed and implemented a new tax compliance program that reduced tax errors by 35%

- Negotiated a favorable tax settlement with the IRS, resulting in a savings of $5 million for the client

- Successfully represented clients in tax audits, resulting in favorable outcomes in 90% of cases

- Developed and presented tax training programs for over 500 accounting professionals

Awards

- AICPA Tax Excellence Award for Outstanding Achievement in Taxation

- IRS Commissioners Award for Excellence in Tax Administration

- National Association of Tax Professionals (NATP) Tax Professional of the Year

- American Institute of Certified Public Accountants (AICPA) Outstanding Tax Educator Award

Certificates

- Enrolled Agent (EA)

- Certified Public Accountant (CPA)

- Certified Tax Coach (CTC)

- Certified Financial Planner (CFP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Professional

-

Highlight your expertise:

Showcase your in-depth knowledge of tax laws, regulations, and best practices. -

Quantify your accomplishments:

Use specific numbers and metrics to demonstrate the positive impact of your work. -

Demonstrate your soft skills:

Emphasize your communication, interpersonal, and problem-solving abilities. -

Tailor your resume to the job description:

Carefully review the job description and highlight the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Tax Professional Resume

- Prepare and file individual, corporate, and partnership tax returns in accordance with federal and state tax laws.

- Research and apply complex tax laws and regulations to optimize tax savings for clients.

- Manage tax audits by responding to IRS and state tax agency inquiries, negotiating settlements, and representing clients.

- Provide tax planning and consulting services to individuals and businesses to minimize tax liability.

- Develop and implement tax compliance strategies for clients to ensure adherence to tax laws and regulations.

- Utilize tax software and technology to improve tax preparation and filing efficiency.

- Train and mentor junior tax professionals on tax laws, regulations, and industry best practices.

Frequently Asked Questions (FAQ’s) For Tax Professional

What are the key responsibilities of a Tax Professional?

Tax Professionals are responsible for preparing and filing tax returns, researching and applying tax laws and regulations, managing tax audits, providing tax planning and consulting services, and developing tax compliance strategies.

What are the educational requirements for a Tax Professional?

A minimum of a Bachelor’s degree in Accounting, Taxation, or a related field is typically required. Some Tax Professionals also pursue a Master’s degree in Taxation or a related field.

What are the career prospects for Tax Professionals?

Tax Professionals with strong technical skills and experience are in high demand. They can advance to senior-level positions within accounting firms, corporations, or government agencies.

What are the key skills for a Tax Professional?

Tax Professionals should have a deep understanding of tax laws and regulations, as well as strong analytical, problem-solving, and communication skills.

What are the top companies hiring Tax Professionals?

Top companies hiring Tax Professionals include Deloitte, EY, PwC, KPMG, and Grant Thornton.