Are you a seasoned Tax Revenue Officer seeking a new career path? Discover our professionally built Tax Revenue Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

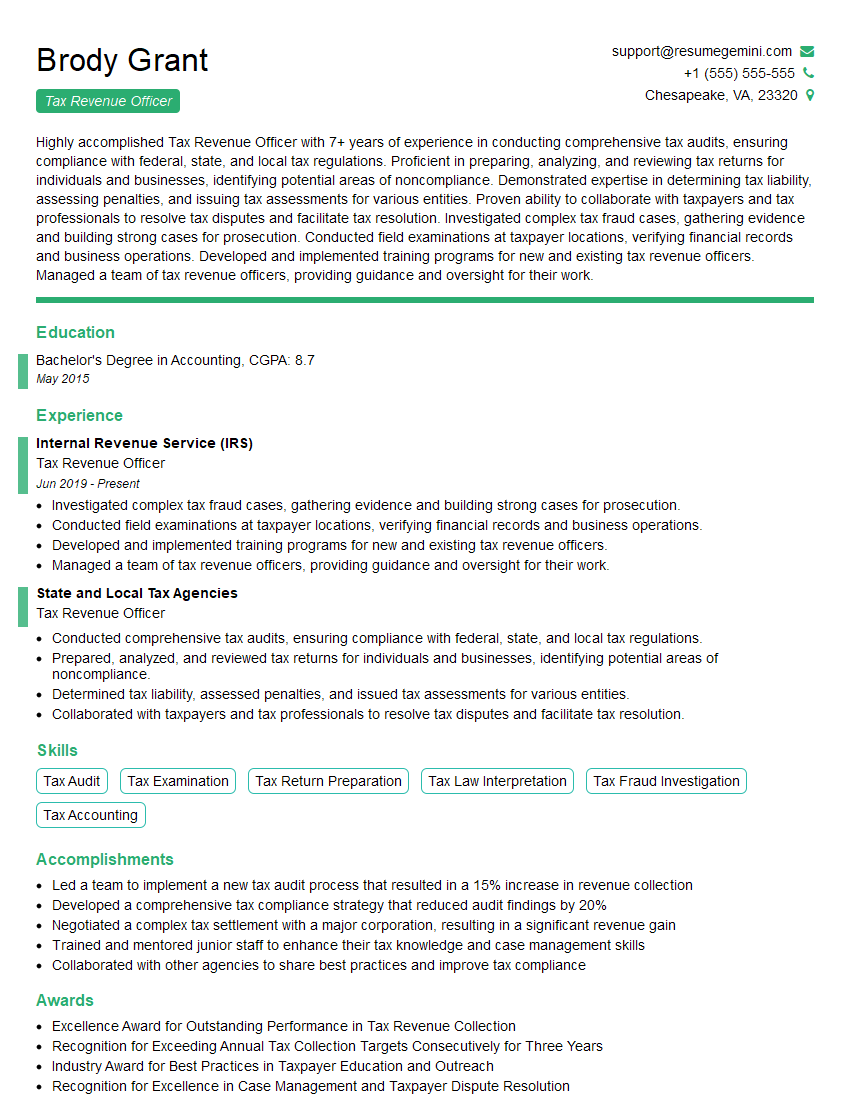

Brody Grant

Tax Revenue Officer

Summary

Highly accomplished Tax Revenue Officer with 7+ years of experience in conducting comprehensive tax audits, ensuring compliance with federal, state, and local tax regulations. Proficient in preparing, analyzing, and reviewing tax returns for individuals and businesses, identifying potential areas of noncompliance. Demonstrated expertise in determining tax liability, assessing penalties, and issuing tax assessments for various entities. Proven ability to collaborate with taxpayers and tax professionals to resolve tax disputes and facilitate tax resolution. Investigated complex tax fraud cases, gathering evidence and building strong cases for prosecution. Conducted field examinations at taxpayer locations, verifying financial records and business operations. Developed and implemented training programs for new and existing tax revenue officers. Managed a team of tax revenue officers, providing guidance and oversight for their work.

Education

Bachelor’s Degree in Accounting

May 2015

Skills

- Tax Audit

- Tax Examination

- Tax Return Preparation

- Tax Law Interpretation

- Tax Fraud Investigation

- Tax Accounting

Work Experience

Tax Revenue Officer

- Investigated complex tax fraud cases, gathering evidence and building strong cases for prosecution.

- Conducted field examinations at taxpayer locations, verifying financial records and business operations.

- Developed and implemented training programs for new and existing tax revenue officers.

- Managed a team of tax revenue officers, providing guidance and oversight for their work.

Tax Revenue Officer

- Conducted comprehensive tax audits, ensuring compliance with federal, state, and local tax regulations.

- Prepared, analyzed, and reviewed tax returns for individuals and businesses, identifying potential areas of noncompliance.

- Determined tax liability, assessed penalties, and issued tax assessments for various entities.

- Collaborated with taxpayers and tax professionals to resolve tax disputes and facilitate tax resolution.

Accomplishments

- Led a team to implement a new tax audit process that resulted in a 15% increase in revenue collection

- Developed a comprehensive tax compliance strategy that reduced audit findings by 20%

- Negotiated a complex tax settlement with a major corporation, resulting in a significant revenue gain

- Trained and mentored junior staff to enhance their tax knowledge and case management skills

- Collaborated with other agencies to share best practices and improve tax compliance

Awards

- Excellence Award for Outstanding Performance in Tax Revenue Collection

- Recognition for Exceeding Annual Tax Collection Targets Consecutively for Three Years

- Industry Award for Best Practices in Taxpayer Education and Outreach

- Recognition for Excellence in Case Management and Taxpayer Dispute Resolution

Certificates

- Certified Public Accountant (CPA)

- Enrolled Agent (EA)

- Certified Tax Auditor (CTA)

- Certified Fraud Examiner (CFE)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tax Revenue Officer

- Highlight your experience and skills in tax auditing and tax law interpretation.

- Showcase your ability to work independently and as part of a team.

- Emphasize your strong analytical and problem-solving skills.

- Quantify your accomplishments and provide specific examples of your work.

- Tailor your resume to each job you apply for, highlighting the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Tax Revenue Officer Resume

- Conduct comprehensive tax audits to ensure compliance with tax regulations

- Prepare, analyze, and review tax returns for individuals and businesses

- Determine tax liability, assess penalties, and issue tax assessments

- Collaborate with taxpayers and tax professionals to resolve tax disputes

- Investigate complex tax fraud cases and build strong cases for prosecution

- Conduct field examinations at taxpayer locations to verify financial records

- Develop and implement training programs for tax revenue officers

Frequently Asked Questions (FAQ’s) For Tax Revenue Officer

What is the role of a Tax Revenue Officer?

Tax Revenue Officers are responsible for ensuring that individuals and businesses comply with tax laws and regulations. They conduct audits, prepare and review tax returns, determine tax liability, and assess penalties. They may also investigate tax fraud cases and provide training to other tax professionals.

What are the qualifications for becoming a Tax Revenue Officer?

Most Tax Revenue Officers have a bachelor’s degree in accounting or a related field. They must also have a strong understanding of tax laws and regulations. Some experience in auditing or tax preparation is also preferred.

What are the career prospects for Tax Revenue Officers?

Tax Revenue Officers can advance to supervisory or management positions within the IRS or other tax agencies. They may also choose to work in the private sector, providing tax consulting or compliance services to businesses and individuals.

What are the challenges of being a Tax Revenue Officer?

Tax Revenue Officers often face challenging and complex tax issues. They must be able to work independently and as part of a team. They must also be able to handle the stress of dealing with taxpayers who may be resistant to audits or tax assessments.

What are the rewards of being a Tax Revenue Officer?

Tax Revenue Officers play an important role in ensuring that the tax system is fair and equitable. They also have the opportunity to make a real difference in the lives of taxpayers by helping them comply with tax laws and regulations.

How can I prepare for a career as a Tax Revenue Officer?

There are a number of things you can do to prepare for a career as a Tax Revenue Officer. You can earn a bachelor’s degree in accounting or a related field. You can also gain experience in auditing or tax preparation by working as an intern or volunteer with the IRS or another tax agency.