Are you a seasoned Teller Supervisor seeking a new career path? Discover our professionally built Teller Supervisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

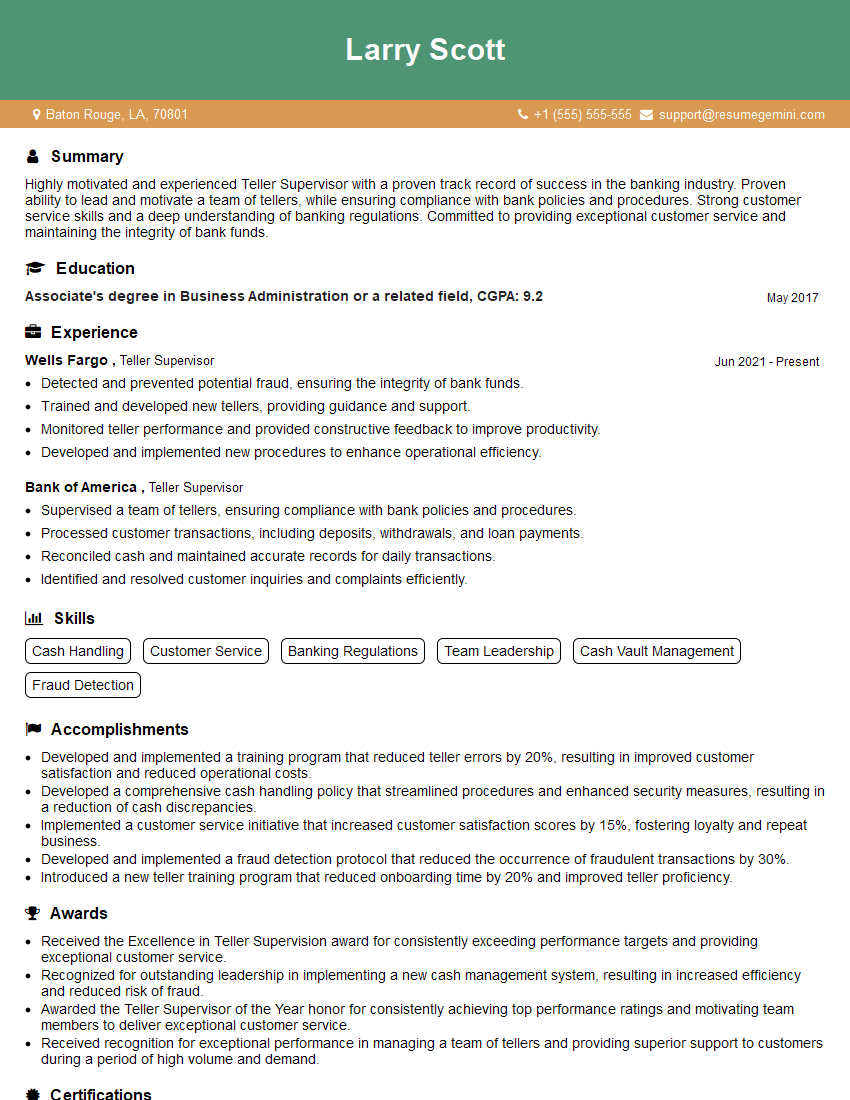

Larry Scott

Teller Supervisor

Summary

Highly motivated and experienced Teller Supervisor with a proven track record of success in the banking industry. Proven ability to lead and motivate a team of tellers, while ensuring compliance with bank policies and procedures. Strong customer service skills and a deep understanding of banking regulations. Committed to providing exceptional customer service and maintaining the integrity of bank funds.

Education

Associate’s degree in Business Administration or a related field

May 2017

Skills

- Cash Handling

- Customer Service

- Banking Regulations

- Team Leadership

- Cash Vault Management

- Fraud Detection

Work Experience

Teller Supervisor

- Detected and prevented potential fraud, ensuring the integrity of bank funds.

- Trained and developed new tellers, providing guidance and support.

- Monitored teller performance and provided constructive feedback to improve productivity.

- Developed and implemented new procedures to enhance operational efficiency.

Teller Supervisor

- Supervised a team of tellers, ensuring compliance with bank policies and procedures.

- Processed customer transactions, including deposits, withdrawals, and loan payments.

- Reconciled cash and maintained accurate records for daily transactions.

- Identified and resolved customer inquiries and complaints efficiently.

Accomplishments

- Developed and implemented a training program that reduced teller errors by 20%, resulting in improved customer satisfaction and reduced operational costs.

- Developed a comprehensive cash handling policy that streamlined procedures and enhanced security measures, resulting in a reduction of cash discrepancies.

- Implemented a customer service initiative that increased customer satisfaction scores by 15%, fostering loyalty and repeat business.

- Developed and implemented a fraud detection protocol that reduced the occurrence of fraudulent transactions by 30%.

- Introduced a new teller training program that reduced onboarding time by 20% and improved teller proficiency.

Awards

- Received the Excellence in Teller Supervision award for consistently exceeding performance targets and providing exceptional customer service.

- Recognized for outstanding leadership in implementing a new cash management system, resulting in increased efficiency and reduced risk of fraud.

- Awarded the Teller Supervisor of the Year honor for consistently achieving top performance ratings and motivating team members to deliver exceptional customer service.

- Received recognition for exceptional performance in managing a team of tellers and providing superior support to customers during a period of high volume and demand.

Certificates

- Certified Teller Supervisor (CTS)

- Certified Financial Crime Specialist (CFCS)

- Bank Secrecy Act Specialist (BSA)

- Anti-Money Laundering Specialist (AML)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Teller Supervisor

- Highlight your leadership and management skills.

- Quantify your accomplishments with specific metrics.

- Use action verbs to describe your responsibilities.

- Proofread your resume carefully for any errors.

Essential Experience Highlights for a Strong Teller Supervisor Resume

- Supervised a team of tellers, ensuring compliance with bank policies and procedures

- Processed customer transactions, including deposits, withdrawals, and loan payments

- Reconciled cash and maintained accurate records for daily transactions

- Identified and resolved customer inquiries and complaints efficiently

- Detected and prevented potential fraud, ensuring the integrity of bank funds

- Trained and developed new tellers, providing guidance and support

- Monitored teller performance and provided constructive feedback to improve productivity

Frequently Asked Questions (FAQ’s) For Teller Supervisor

What are the key responsibilities of a Teller Supervisor?

The key responsibilities of a Teller Supervisor include supervising a team of tellers, ensuring compliance with bank policies and procedures, processing customer transactions, reconciling cash, identifying and resolving customer inquiries and complaints, detecting and preventing potential fraud, training and developing new tellers, and monitoring teller performance.

What are the educational requirements for a Teller Supervisor?

Most Teller Supervisors have an Associate’s degree in Business Administration or a related field.

What are the skills required for a Teller Supervisor?

The skills required for a Teller Supervisor include cash handling, customer service, banking regulations, team leadership, cash vault management, and fraud detection.

What is the career path for a Teller Supervisor?

The career path for a Teller Supervisor typically includes promotions to Branch Manager, Assistant Manager, or Operations Manager.

What is the salary range for a Teller Supervisor?

The salary range for a Teller Supervisor varies depending on experience, location, and company size.

What are the benefits of being a Teller Supervisor?

The benefits of being a Teller Supervisor include a competitive salary, health and dental insurance, paid time off, and opportunities for advancement.

What are the challenges of being a Teller Supervisor?

The challenges of being a Teller Supervisor include managing a team of employees, dealing with difficult customers, and ensuring compliance with bank regulations.