Are you a seasoned Tellers Supervisor seeking a new career path? Discover our professionally built Tellers Supervisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

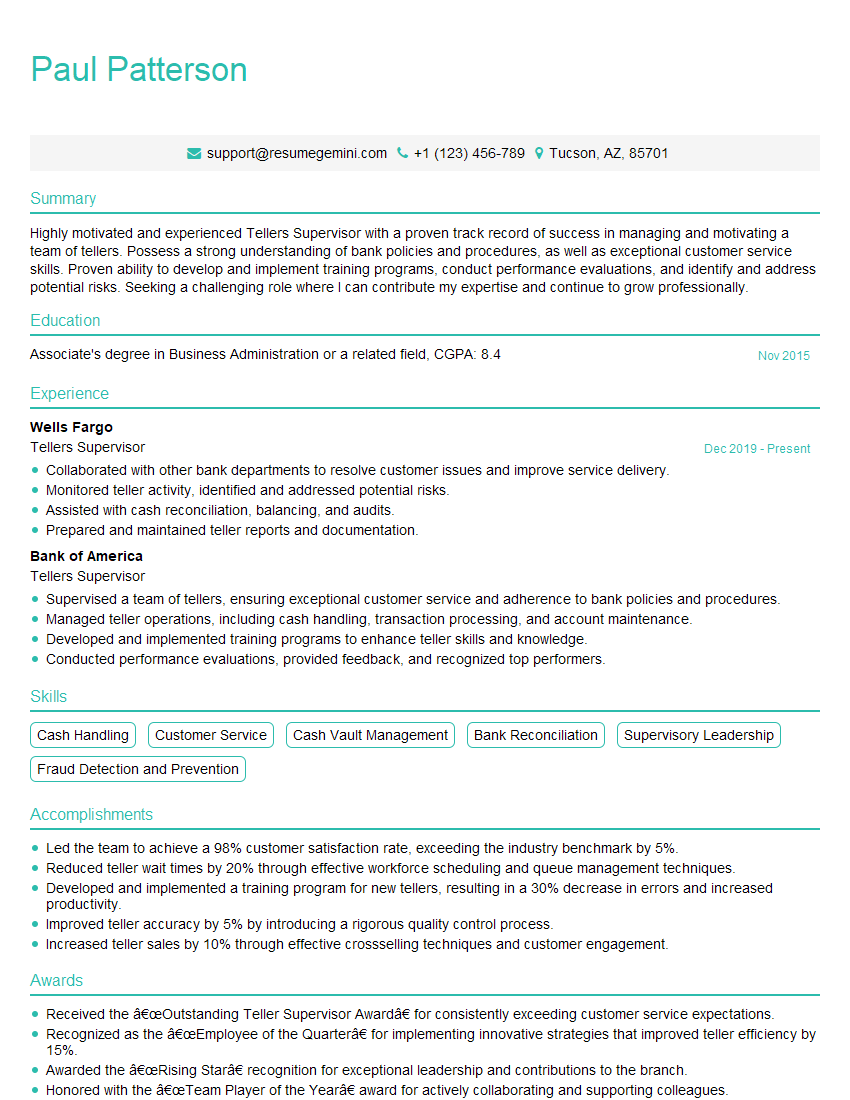

Paul Patterson

Tellers Supervisor

Summary

Highly motivated and experienced Tellers Supervisor with a proven track record of success in managing and motivating a team of tellers. Possess a strong understanding of bank policies and procedures, as well as exceptional customer service skills. Proven ability to develop and implement training programs, conduct performance evaluations, and identify and address potential risks. Seeking a challenging role where I can contribute my expertise and continue to grow professionally.

Education

Associate’s degree in Business Administration or a related field

November 2015

Skills

- Cash Handling

- Customer Service

- Cash Vault Management

- Bank Reconciliation

- Supervisory Leadership

- Fraud Detection and Prevention

Work Experience

Tellers Supervisor

- Collaborated with other bank departments to resolve customer issues and improve service delivery.

- Monitored teller activity, identified and addressed potential risks.

- Assisted with cash reconciliation, balancing, and audits.

- Prepared and maintained teller reports and documentation.

Tellers Supervisor

- Supervised a team of tellers, ensuring exceptional customer service and adherence to bank policies and procedures.

- Managed teller operations, including cash handling, transaction processing, and account maintenance.

- Developed and implemented training programs to enhance teller skills and knowledge.

- Conducted performance evaluations, provided feedback, and recognized top performers.

Accomplishments

- Led the team to achieve a 98% customer satisfaction rate, exceeding the industry benchmark by 5%.

- Reduced teller wait times by 20% through effective workforce scheduling and queue management techniques.

- Developed and implemented a training program for new tellers, resulting in a 30% decrease in errors and increased productivity.

- Improved teller accuracy by 5% by introducing a rigorous quality control process.

- Increased teller sales by 10% through effective crossselling techniques and customer engagement.

Awards

- Received the “Outstanding Teller Supervisor Award” for consistently exceeding customer service expectations.

- Recognized as the “Employee of the Quarter” for implementing innovative strategies that improved teller efficiency by 15%.

- Awarded the “Rising Star” recognition for exceptional leadership and contributions to the branch.

- Honored with the “Team Player of the Year” award for actively collaborating and supporting colleagues.

Certificates

- Certified Treasury Professional (CTP)

- Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) Certified Specialist

- Certified Cash Manager (CCM)

- Certified Anti-Money Laundering Specialist (CAMS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Tellers Supervisor

- Highlight your experience in a supervisory role, particularly in a banking environment.

- Quantify your accomplishments with specific metrics, such as the number of tellers managed, customer satisfaction ratings, or training initiatives implemented.

- Demonstrate your commitment to professional development by mentioning any certifications or training programs you have completed.

- Showcase your understanding of bank policies and procedures, as well as your ability to identify and mitigate risks.

Essential Experience Highlights for a Strong Tellers Supervisor Resume

- Supervise and manage a team of tellers, ensuring exceptional customer service and adherence to bank policies and procedures

- Manage teller operations, including cash handling, transaction processing, and account maintenance

- Develop and implement training programs to enhance teller skills and knowledge

- Conduct performance evaluations, provide feedback, and recognize top performers

- Collaborate with other bank departments to resolve customer issues and improve service delivery

- Monitor teller activity, identify and address potential risks

- Prepare and maintain teller reports and documentation

Frequently Asked Questions (FAQ’s) For Tellers Supervisor

What are the key responsibilities of a Tellers Supervisor?

Tellers Supervisors are responsible for managing and motivating a team of tellers, ensuring exceptional customer service, and adherence to bank policies and procedures. They also manage teller operations, including cash handling, transaction processing, and account maintenance, as well as develop and implement training programs, conduct performance evaluations, and collaborate with other bank departments to resolve customer issues and improve service delivery.

What skills are required to be a Tellers Supervisor?

Tellers Supervisors require a combination of hard and soft skills, including strong leadership and management skills, excellent communication and interpersonal skills, a thorough understanding of bank policies and procedures, and proficiency in cash handling and transaction processing.

What is the career path for a Tellers Supervisor?

Tellers Supervisors can advance to higher-level management positions within the banking industry, such as Branch Manager or Assistant Manager. They may also pursue specialized roles in areas such as fraud prevention or compliance.

What is the job outlook for Tellers Supervisors?

The job outlook for Tellers Supervisors is expected to be stable in the coming years, as banks continue to rely on tellers to provide essential customer service.

How can I prepare for a Tellers Supervisor interview?

To prepare for a Tellers Supervisor interview, research the bank and the specific role you are applying for, practice answering common interview questions, and dress professionally.

What are some tips for being a successful Tellers Supervisor?

To be a successful Tellers Supervisor, focus on providing excellent customer service, developing your team, and staying up-to-date on bank policies and procedures.

What are the challenges of being a Tellers Supervisor?

Tellers Supervisors may face challenges such as managing a large team, dealing with difficult customers, and ensuring compliance with bank regulations.