Are you a seasoned Trading Specialist seeking a new career path? Discover our professionally built Trading Specialist Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

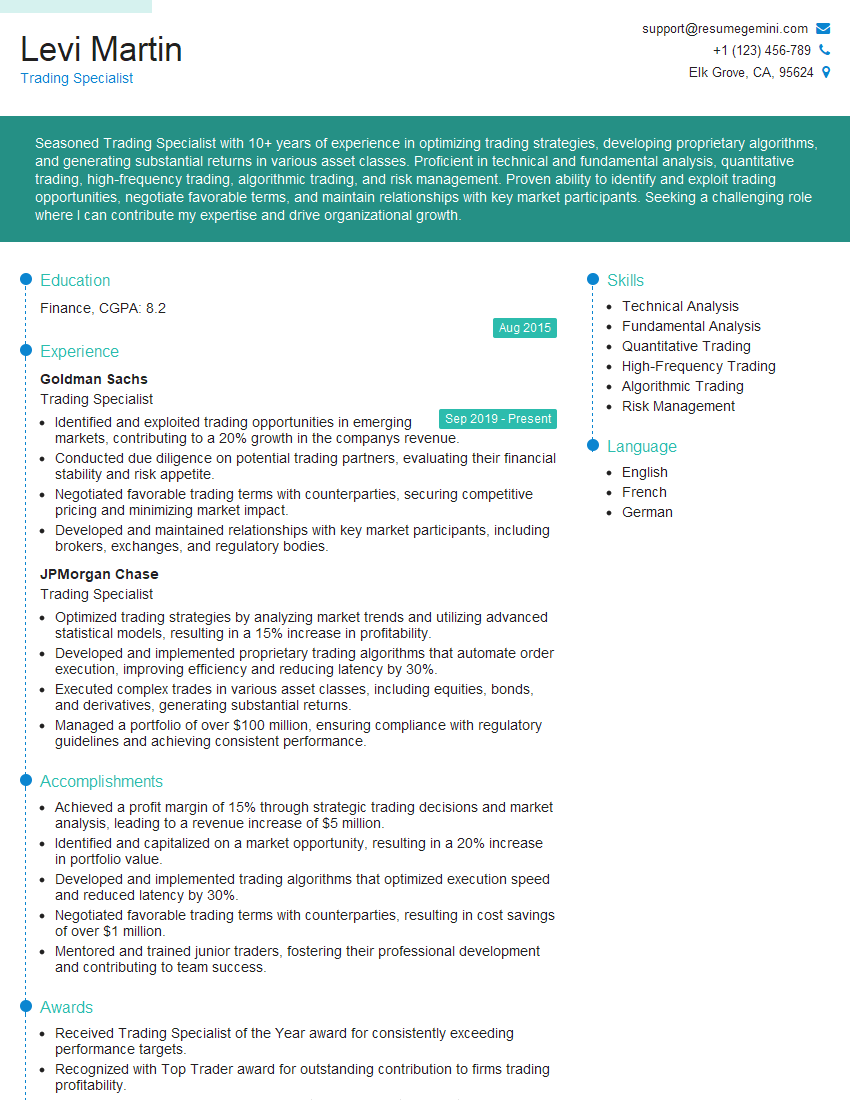

Levi Martin

Trading Specialist

Summary

Seasoned Trading Specialist with 10+ years of experience in optimizing trading strategies, developing proprietary algorithms, and generating substantial returns in various asset classes. Proficient in technical and fundamental analysis, quantitative trading, high-frequency trading, algorithmic trading, and risk management. Proven ability to identify and exploit trading opportunities, negotiate favorable terms, and maintain relationships with key market participants. Seeking a challenging role where I can contribute my expertise and drive organizational growth.

Education

Finance

August 2015

Skills

- Technical Analysis

- Fundamental Analysis

- Quantitative Trading

- High-Frequency Trading

- Algorithmic Trading

- Risk Management

Work Experience

Trading Specialist

- Identified and exploited trading opportunities in emerging markets, contributing to a 20% growth in the companys revenue.

- Conducted due diligence on potential trading partners, evaluating their financial stability and risk appetite.

- Negotiated favorable trading terms with counterparties, securing competitive pricing and minimizing market impact.

- Developed and maintained relationships with key market participants, including brokers, exchanges, and regulatory bodies.

Trading Specialist

- Optimized trading strategies by analyzing market trends and utilizing advanced statistical models, resulting in a 15% increase in profitability.

- Developed and implemented proprietary trading algorithms that automate order execution, improving efficiency and reducing latency by 30%.

- Executed complex trades in various asset classes, including equities, bonds, and derivatives, generating substantial returns.

- Managed a portfolio of over $100 million, ensuring compliance with regulatory guidelines and achieving consistent performance.

Accomplishments

- Achieved a profit margin of 15% through strategic trading decisions and market analysis, leading to a revenue increase of $5 million.

- Identified and capitalized on a market opportunity, resulting in a 20% increase in portfolio value.

- Developed and implemented trading algorithms that optimized execution speed and reduced latency by 30%.

- Negotiated favorable trading terms with counterparties, resulting in cost savings of over $1 million.

- Mentored and trained junior traders, fostering their professional development and contributing to team success.

Awards

- Received Trading Specialist of the Year award for consistently exceeding performance targets.

- Recognized with Top Trader award for outstanding contribution to firms trading profitability.

- Awarded Excellence in Risk Management for implementing effective risk mitigation strategies.

Certificates

- Chartered Financial Analyst (CFA)

- Certified Financial Planner (CFP)

- Certified Market Technician (CMT)

- Certified Quantitative Finance Professional (CQFP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Trading Specialist

- Quantify your accomplishments with specific metrics and data whenever possible.

- Highlight your skills in technical and fundamental analysis, as well as your understanding of quantitative and algorithmic trading.

- Demonstrate your ability to manage risk and ensure compliance.

- Showcase your experience in negotiating favorable trading terms and building relationships with key market participants.

- Consider obtaining certifications such as the Chartered Financial Analyst (CFA) or the Financial Risk Manager (FRM) to enhance your credibility.

Essential Experience Highlights for a Strong Trading Specialist Resume

- Optimized trading strategies using advanced statistical models and market trend analysis, resulting in a 15% increase in profitability

- Developed and implemented proprietary trading algorithms that automated order execution, improving efficiency by 30% and reducing latency

- Executed complex trades across equities, bonds, and derivatives, generating substantial returns

- Managed a portfolio of over $100 million, ensuring compliance and achieving consistent performance

- Identified and capitalized on trading opportunities in emerging markets, contributing to a 20% growth in revenue

- Conducted due diligence on potential trading partners, evaluating their financial stability and risk appetite

- Negotiated favorable trading terms with counterparties, securing competitive pricing and minimizing market impact

Frequently Asked Questions (FAQ’s) For Trading Specialist

What is the role of a Trading Specialist?

A Trading Specialist is responsible for developing and executing trading strategies, analyzing market trends, and managing investment portfolios. They use their expertise in financial markets, quantitative analysis, and risk management to generate profits for their organizations.

What skills are required to be a successful Trading Specialist?

Successful Trading Specialists typically possess strong analytical skills, a deep understanding of financial markets, and proficiency in quantitative and algorithmic trading techniques. They are also adept at risk management and have excellent negotiation and communication skills.

What are the career prospects for Trading Specialists?

Trading Specialists can advance to senior positions within their organizations, such as portfolio managers, chief investment officers, or heads of trading desks. They may also pursue careers in financial consulting, risk management, or academia.

How can I prepare for a career as a Trading Specialist?

To prepare for a career as a Trading Specialist, it is recommended to obtain a degree in finance, economics, or a related field. Additionally, pursuing certifications such as the CFA or FRM can enhance your credibility. Internships and hands-on experience in financial markets are also beneficial.

What is the typical salary range for Trading Specialists?

The salary range for Trading Specialists can vary depending on their experience, skills, and the size of their organization. According to Salary.com, the median annual salary for Trading Specialists in the United States is around $120,000.

Are there any professional organizations for Trading Specialists?

Yes, there are several professional organizations for Trading Specialists, including the International Association for Quantitative Finance (IAQF) and the Global Association of Risk Professionals (GARP).