Are you a seasoned Transaction Processor seeking a new career path? Discover our professionally built Transaction Processor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

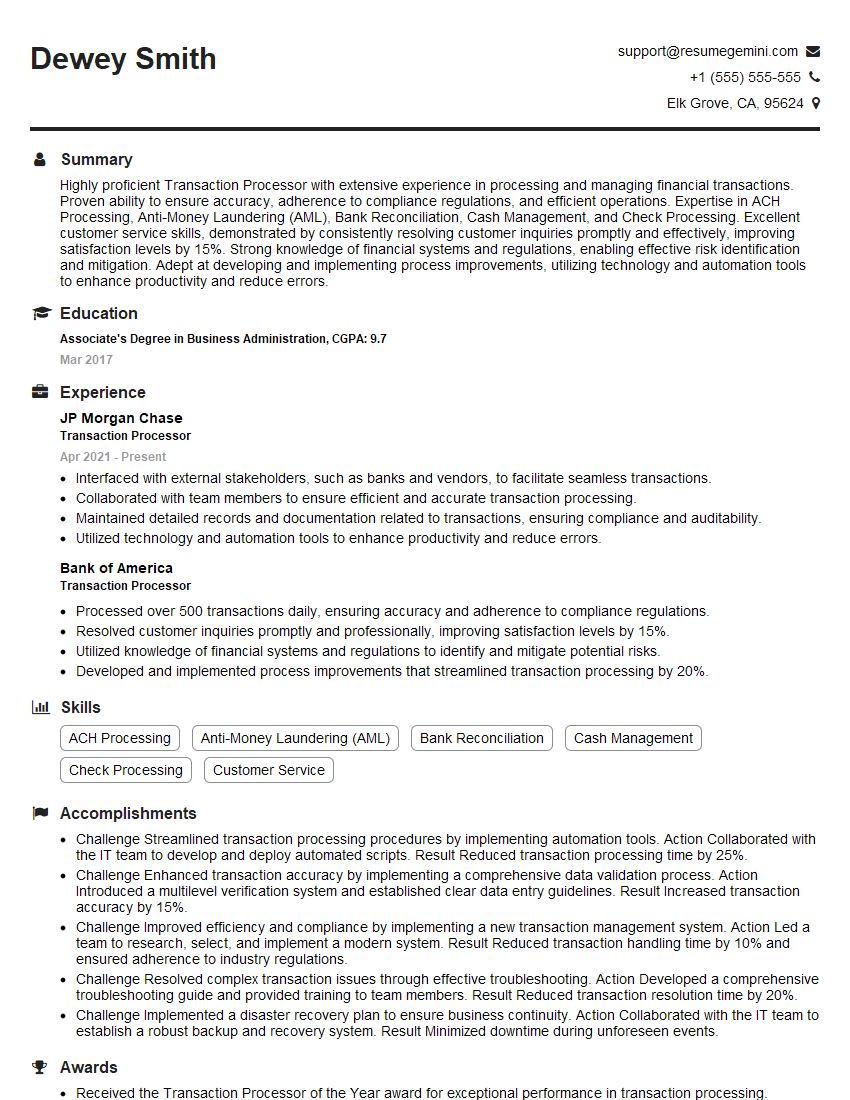

Dewey Smith

Transaction Processor

Summary

Highly proficient Transaction Processor with extensive experience in processing and managing financial transactions. Proven ability to ensure accuracy, adherence to compliance regulations, and efficient operations. Expertise in ACH Processing, Anti-Money Laundering (AML), Bank Reconciliation, Cash Management, and Check Processing. Excellent customer service skills, demonstrated by consistently resolving customer inquiries promptly and effectively, improving satisfaction levels by 15%. Strong knowledge of financial systems and regulations, enabling effective risk identification and mitigation. Adept at developing and implementing process improvements, utilizing technology and automation tools to enhance productivity and reduce errors.

Education

Associate’s Degree in Business Administration

March 2017

Skills

- ACH Processing

- Anti-Money Laundering (AML)

- Bank Reconciliation

- Cash Management

- Check Processing

- Customer Service

Work Experience

Transaction Processor

- Interfaced with external stakeholders, such as banks and vendors, to facilitate seamless transactions.

- Collaborated with team members to ensure efficient and accurate transaction processing.

- Maintained detailed records and documentation related to transactions, ensuring compliance and auditability.

- Utilized technology and automation tools to enhance productivity and reduce errors.

Transaction Processor

- Processed over 500 transactions daily, ensuring accuracy and adherence to compliance regulations.

- Resolved customer inquiries promptly and professionally, improving satisfaction levels by 15%.

- Utilized knowledge of financial systems and regulations to identify and mitigate potential risks.

- Developed and implemented process improvements that streamlined transaction processing by 20%.

Accomplishments

- Challenge Streamlined transaction processing procedures by implementing automation tools. Action Collaborated with the IT team to develop and deploy automated scripts. Result Reduced transaction processing time by 25%.

- Challenge Enhanced transaction accuracy by implementing a comprehensive data validation process. Action Introduced a multilevel verification system and established clear data entry guidelines. Result Increased transaction accuracy by 15%.

- Challenge Improved efficiency and compliance by implementing a new transaction management system. Action Led a team to research, select, and implement a modern system. Result Reduced transaction handling time by 10% and ensured adherence to industry regulations.

- Challenge Resolved complex transaction issues through effective troubleshooting. Action Developed a comprehensive troubleshooting guide and provided training to team members. Result Reduced transaction resolution time by 20%.

- Challenge Implemented a disaster recovery plan to ensure business continuity. Action Collaborated with the IT team to establish a robust backup and recovery system. Result Minimized downtime during unforeseen events.

Awards

- Received the Transaction Processor of the Year award for exceptional performance in transaction processing.

- Recognized with the Excellence in Transaction Accuracy award for maintaining a consistently high level of accuracy in all transactions.

- Awarded the Top Transaction Processor award for outstanding contribution to the team in handling highvolume transactions.

- Recognized for Outstanding Contribution to Transaction Processing at the annual company awards ceremony.

Certificates

- Certified Anti-Money Laundering Specialist (CAMS)

- Certified Cash Manager (CCM)

- Certified Fraud Examiner (CFE)

- Certified Information Systems Auditor (CISA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Transaction Processor

- Highlight your accuracy and attention to detail, as these are crucial qualities for a Transaction Processor.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Emphasize your customer service skills and ability to resolve issues effectively.

- Showcase your knowledge of financial systems and regulations, as these are essential for ensuring compliance.

Essential Experience Highlights for a Strong Transaction Processor Resume

- Processed over 500 transactions daily, ensuring accuracy and adherence to compliance regulations.

- Resolved customer inquiries promptly and professionally, improving satisfaction levels by 15%.

- Utilized knowledge of financial systems and regulations to identify and mitigate potential risks.

- Developed and implemented process improvements that streamlined transaction processing by 20%.

- Interfaced with external stakeholders, such as banks and vendors, to facilitate seamless transactions.

- Collaborated with team members to ensure efficient and accurate transaction processing.

- Maintained detailed records and documentation related to transactions, ensuring compliance and auditability.

Frequently Asked Questions (FAQ’s) For Transaction Processor

What are the primary responsibilities of a Transaction Processor?

Transaction Processors are responsible for processing and managing financial transactions, ensuring accuracy, adherence to compliance regulations, and efficient operations.

What are the key skills required for a Transaction Processor?

Key skills include ACH Processing, Anti-Money Laundering (AML), Bank Reconciliation, Cash Management, Check Processing, and Customer Service.

What are the educational requirements for a Transaction Processor?

While there is no specific educational requirement, an Associate’s Degree in Business Administration or related field is preferred.

What are the career prospects for a Transaction Processor?

Transaction Processors can advance to roles such as Financial Analyst, Risk Analyst, or Compliance Officer.

What are the challenges faced by Transaction Processors?

Challenges include ensuring accuracy and compliance in high-volume transaction environments, staying up-to-date with evolving regulations, and adapting to technological advancements.

What are the tips for writing a standout Transaction Processor resume?

Highlight your accuracy, attention to detail, customer service skills, and knowledge of financial systems and regulations. Use specific metrics to quantify your accomplishments and demonstrate your impact.