Are you a seasoned Traveling Accountant seeking a new career path? Discover our professionally built Traveling Accountant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

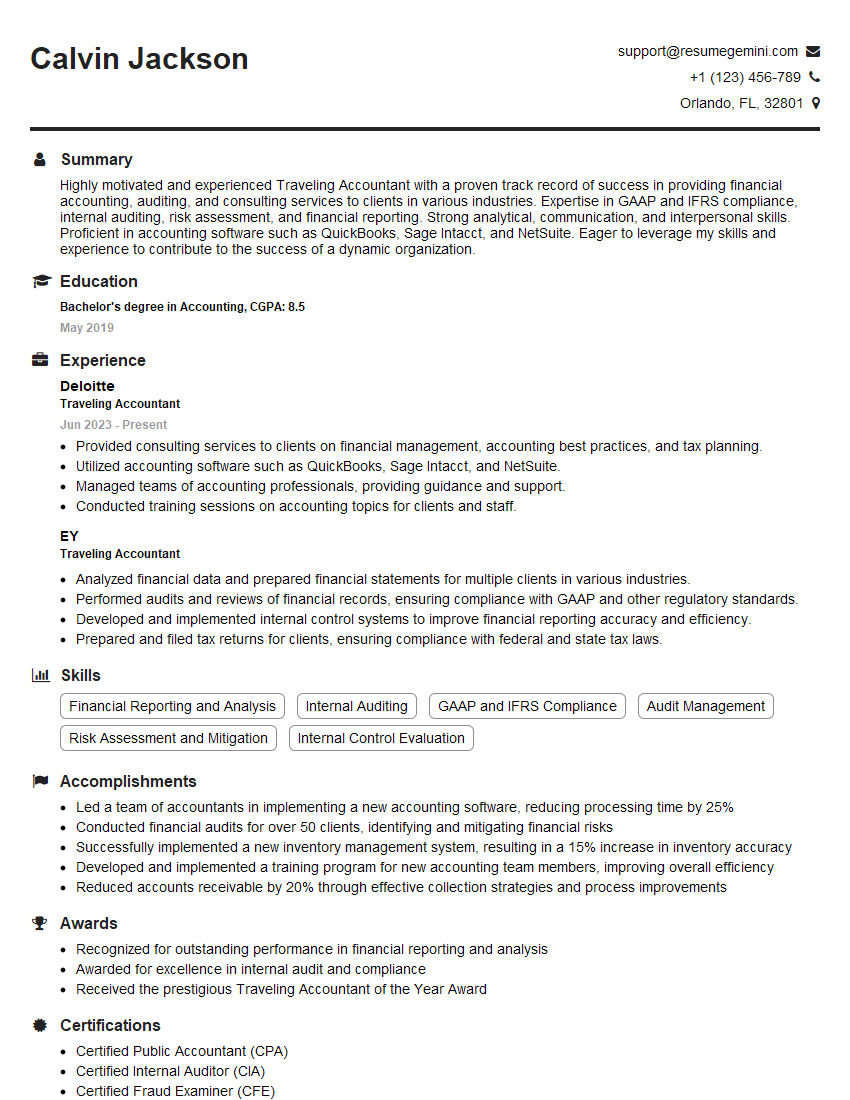

Calvin Jackson

Traveling Accountant

Summary

Highly motivated and experienced Traveling Accountant with a proven track record of success in providing financial accounting, auditing, and consulting services to clients in various industries. Expertise in GAAP and IFRS compliance, internal auditing, risk assessment, and financial reporting. Strong analytical, communication, and interpersonal skills. Proficient in accounting software such as QuickBooks, Sage Intacct, and NetSuite. Eager to leverage my skills and experience to contribute to the success of a dynamic organization.

Education

Bachelor’s degree in Accounting

May 2019

Skills

- Financial Reporting and Analysis

- Internal Auditing

- GAAP and IFRS Compliance

- Audit Management

- Risk Assessment and Mitigation

- Internal Control Evaluation

Work Experience

Traveling Accountant

- Provided consulting services to clients on financial management, accounting best practices, and tax planning.

- Utilized accounting software such as QuickBooks, Sage Intacct, and NetSuite.

- Managed teams of accounting professionals, providing guidance and support.

- Conducted training sessions on accounting topics for clients and staff.

Traveling Accountant

- Analyzed financial data and prepared financial statements for multiple clients in various industries.

- Performed audits and reviews of financial records, ensuring compliance with GAAP and other regulatory standards.

- Developed and implemented internal control systems to improve financial reporting accuracy and efficiency.

- Prepared and filed tax returns for clients, ensuring compliance with federal and state tax laws.

Accomplishments

- Led a team of accountants in implementing a new accounting software, reducing processing time by 25%

- Conducted financial audits for over 50 clients, identifying and mitigating financial risks

- Successfully implemented a new inventory management system, resulting in a 15% increase in inventory accuracy

- Developed and implemented a training program for new accounting team members, improving overall efficiency

- Reduced accounts receivable by 20% through effective collection strategies and process improvements

Awards

- Recognized for outstanding performance in financial reporting and analysis

- Awarded for excellence in internal audit and compliance

- Received the prestigious Traveling Accountant of the Year Award

Certificates

- Certified Public Accountant (CPA)

- Certified Internal Auditor (CIA)

- Certified Fraud Examiner (CFE)

- Certified Management Accountant (CMA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Traveling Accountant

- Highlight your experience in traveling and working with clients in various industries.

- Showcase your proficiency in accounting software and industry-specific regulations.

- Emphasize your ability to work independently and manage multiple projects simultaneously.

- Quantify your accomplishments and provide specific examples of how you have added value to clients.

Essential Experience Highlights for a Strong Traveling Accountant Resume

- Analyzed financial data and prepared financial statements for multiple clients in various industries.

- Performed audits and reviews of financial records, ensuring compliance with GAAP and other regulatory standards.

- Developed and implemented internal control systems to improve financial reporting accuracy and efficiency.

- Prepared and filed tax returns for clients, ensuring compliance with federal and state tax laws.

- Provided consulting services to clients on financial management, accounting best practices, and tax planning.

Frequently Asked Questions (FAQ’s) For Traveling Accountant

What are the key skills required for a Traveling Accountant?

Key skills for a Traveling Accountant include financial reporting and analysis, internal auditing, GAAP and IFRS compliance, audit management, risk assessment and mitigation, and internal control evaluation.

What are the career prospects for a Traveling Accountant?

Traveling Accountants can advance to senior positions within accounting firms or corporations. They may also specialize in a particular area, such as auditing, financial reporting, or consulting.

What is the average salary for a Traveling Accountant?

The average salary for a Traveling Accountant varies depending on experience, location, and industry. According to Indeed, the average base salary for a Traveling Accountant in the United States is around $75,000 per year.

What are the benefits of working as a Traveling Accountant?

Benefits of working as a Traveling Accountant include the opportunity to travel and experience different industries, the chance to develop a wide range of skills, and the potential for high earning potential.

What are the challenges of working as a Traveling Accountant?

Challenges of working as a Traveling Accountant include the frequent travel, the need to be adaptable and flexible, and the potential for long hours and deadlines.