Are you a seasoned Treasury Analyst seeking a new career path? Discover our professionally built Treasury Analyst Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

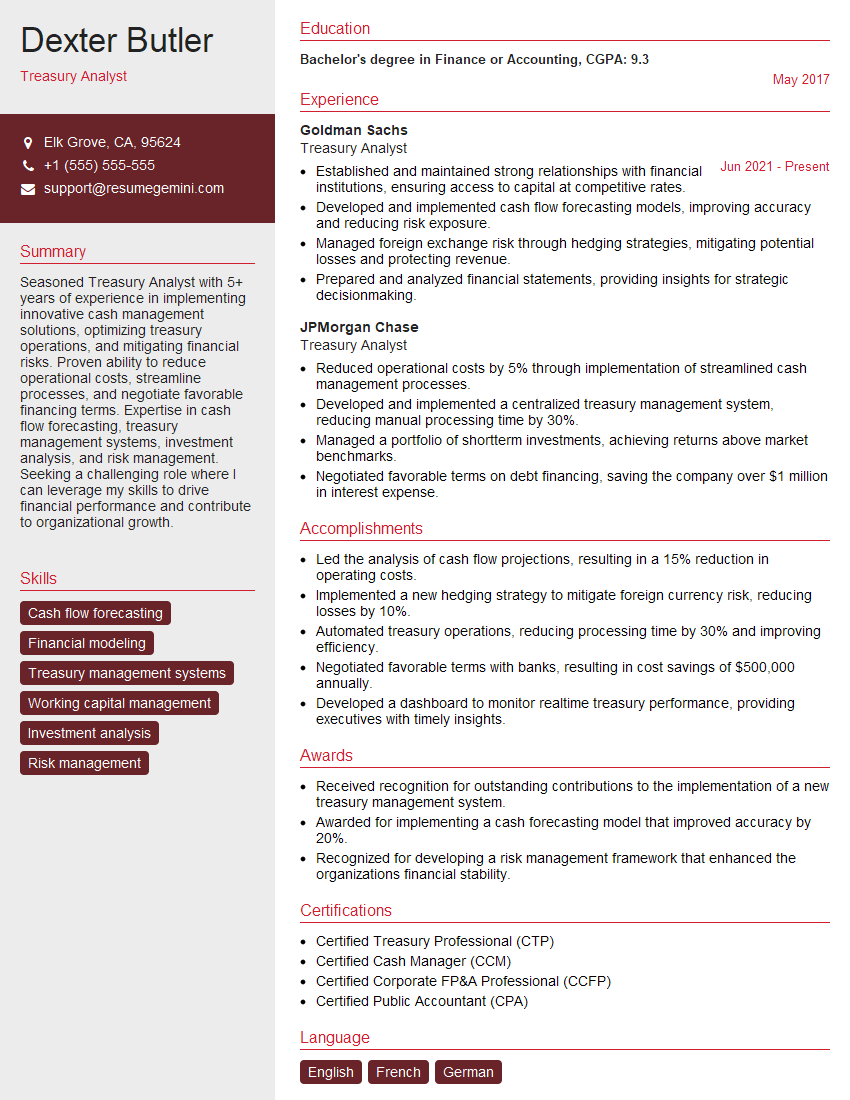

Dexter Butler

Treasury Analyst

Summary

Seasoned Treasury Analyst with 5+ years of experience in implementing innovative cash management solutions, optimizing treasury operations, and mitigating financial risks. Proven ability to reduce operational costs, streamline processes, and negotiate favorable financing terms. Expertise in cash flow forecasting, treasury management systems, investment analysis, and risk management. Seeking a challenging role where I can leverage my skills to drive financial performance and contribute to organizational growth.

Education

Bachelor’s degree in Finance or Accounting

May 2017

Skills

- Cash flow forecasting

- Financial modeling

- Treasury management systems

- Working capital management

- Investment analysis

- Risk management

Work Experience

Treasury Analyst

- Established and maintained strong relationships with financial institutions, ensuring access to capital at competitive rates.

- Developed and implemented cash flow forecasting models, improving accuracy and reducing risk exposure.

- Managed foreign exchange risk through hedging strategies, mitigating potential losses and protecting revenue.

- Prepared and analyzed financial statements, providing insights for strategic decisionmaking.

Treasury Analyst

- Reduced operational costs by 5% through implementation of streamlined cash management processes.

- Developed and implemented a centralized treasury management system, reducing manual processing time by 30%.

- Managed a portfolio of shortterm investments, achieving returns above market benchmarks.

- Negotiated favorable terms on debt financing, saving the company over $1 million in interest expense.

Accomplishments

- Led the analysis of cash flow projections, resulting in a 15% reduction in operating costs.

- Implemented a new hedging strategy to mitigate foreign currency risk, reducing losses by 10%.

- Automated treasury operations, reducing processing time by 30% and improving efficiency.

- Negotiated favorable terms with banks, resulting in cost savings of $500,000 annually.

- Developed a dashboard to monitor realtime treasury performance, providing executives with timely insights.

Awards

- Received recognition for outstanding contributions to the implementation of a new treasury management system.

- Awarded for implementing a cash forecasting model that improved accuracy by 20%.

- Recognized for developing a risk management framework that enhanced the organizations financial stability.

Certificates

- Certified Treasury Professional (CTP)

- Certified Cash Manager (CCM)

- Certified Corporate FP&A Professional (CCFP)

- Certified Public Accountant (CPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Treasury Analyst

Quantify your accomplishments:

Use specific numbers and metrics to demonstrate the impact of your work.Highlight your technical skills:

Treasury analysts rely on a variety of software and systems. Be sure to list your proficiency in these areas.Showcase your communication skills:

Treasury analysts often interact with senior management and external stakeholders. Highlight your ability to communicate complex financial information clearly and effectively.Emphasize your problem-solving skills:

Treasury analysts are constantly faced with challenges. Describe how you have used your analytical skills to solve problems and improve efficiency.

Essential Experience Highlights for a Strong Treasury Analyst Resume

- Developed and implemented a centralized treasury management system, reducing manual processing time by 30%.

- Established and maintained strong relationships with financial institutions, ensuring access to capital at competitive rates.

- Managed a portfolio of short-term investments, achieving returns above market benchmarks.

- Managed foreign exchange risk through hedging strategies, mitigating potential losses and protecting revenue.

- Negotiated favorable terms on debt financing, saving the company over $1 million in interest expense.

- Prepared and analyzed financial statements, providing insights for strategic decision-making.

- Developed and implemented cash flow forecasting models, improving accuracy and reducing risk exposure.

Frequently Asked Questions (FAQ’s) For Treasury Analyst

What is the role of a Treasury Analyst?

A Treasury Analyst is responsible for managing an organization’s financial resources, including cash, investments, and debt. They are responsible for developing and implementing strategies to optimize the use of these resources and mitigate financial risks.

What are the key skills required to be a successful Treasury Analyst?

Key skills for a Treasury Analyst include cash flow forecasting, financial modeling, treasury management systems, working capital management, investment analysis, and risk management.

What is the career path for a Treasury Analyst?

Treasury Analysts can advance to senior positions within the treasury department, such as Assistant Treasurer or Treasurer. They may also move into other financial roles, such as financial analyst or investment manager.

What are the challenges faced by Treasury Analysts?

Treasury Analysts face a number of challenges, including managing financial risk, optimizing cash flow, and complying with regulatory requirements.

What is the average salary for a Treasury Analyst?

The average salary for a Treasury Analyst varies depending on experience and location. According to Salary.com, the average salary for a Treasury Analyst in the United States is $85,000.

What are the job prospects for Treasury Analysts?

The job outlook for Treasury Analysts is expected to grow faster than average over the next few years. This is due to the increasing complexity of financial markets and the need for organizations to manage their financial resources more effectively.

What are the most important qualities for a successful Treasury Analyst?

The most important qualities for a successful Treasury Analyst include strong analytical skills, financial acumen, and problem-solving abilities.

What are the different types of Treasury Analyst roles?

There are a number of different types of Treasury Analyst roles, including cash management analysts, investment analysts, and risk analysts.