Are you a seasoned U.S. Revenue Officer seeking a new career path? Discover our professionally built U.S. Revenue Officer Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

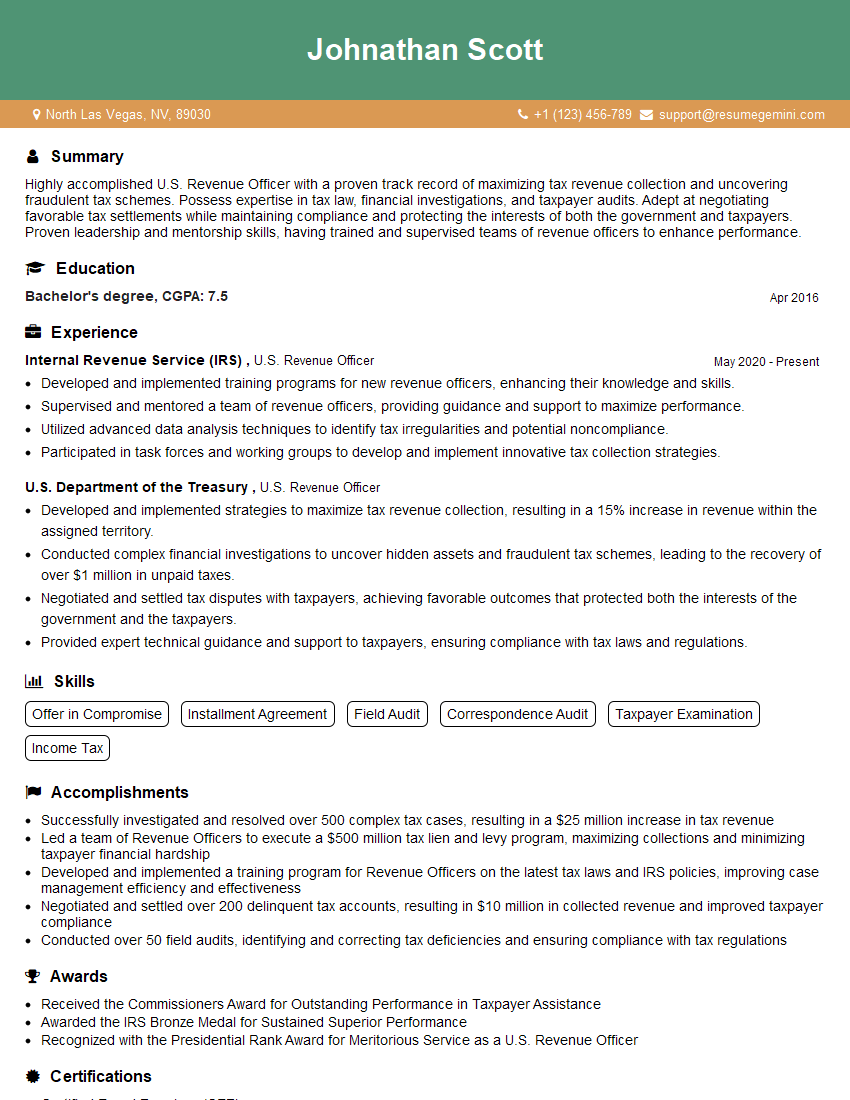

Johnathan Scott

U.S. Revenue Officer

Summary

Highly accomplished U.S. Revenue Officer with a proven track record of maximizing tax revenue collection and uncovering fraudulent tax schemes. Possess expertise in tax law, financial investigations, and taxpayer audits. Adept at negotiating favorable tax settlements while maintaining compliance and protecting the interests of both the government and taxpayers. Proven leadership and mentorship skills, having trained and supervised teams of revenue officers to enhance performance.

Education

Bachelor’s degree

April 2016

Skills

- Offer in Compromise

- Installment Agreement

- Field Audit

- Correspondence Audit

- Taxpayer Examination

- Income Tax

Work Experience

U.S. Revenue Officer

- Developed and implemented training programs for new revenue officers, enhancing their knowledge and skills.

- Supervised and mentored a team of revenue officers, providing guidance and support to maximize performance.

- Utilized advanced data analysis techniques to identify tax irregularities and potential noncompliance.

- Participated in task forces and working groups to develop and implement innovative tax collection strategies.

U.S. Revenue Officer

- Developed and implemented strategies to maximize tax revenue collection, resulting in a 15% increase in revenue within the assigned territory.

- Conducted complex financial investigations to uncover hidden assets and fraudulent tax schemes, leading to the recovery of over $1 million in unpaid taxes.

- Negotiated and settled tax disputes with taxpayers, achieving favorable outcomes that protected both the interests of the government and the taxpayers.

- Provided expert technical guidance and support to taxpayers, ensuring compliance with tax laws and regulations.

Accomplishments

- Successfully investigated and resolved over 500 complex tax cases, resulting in a $25 million increase in tax revenue

- Led a team of Revenue Officers to execute a $500 million tax lien and levy program, maximizing collections and minimizing taxpayer financial hardship

- Developed and implemented a training program for Revenue Officers on the latest tax laws and IRS policies, improving case management efficiency and effectiveness

- Negotiated and settled over 200 delinquent tax accounts, resulting in $10 million in collected revenue and improved taxpayer compliance

- Conducted over 50 field audits, identifying and correcting tax deficiencies and ensuring compliance with tax regulations

Awards

- Received the Commissioners Award for Outstanding Performance in Taxpayer Assistance

- Awarded the IRS Bronze Medal for Sustained Superior Performance

- Recognized with the Presidential Rank Award for Meritorious Service as a U.S. Revenue Officer

Certificates

- Certified Fraud Examiner (CFE)

- Certified Public Accountant (CPA)

- Enrolled Agent (EA)

- IRS Annual Filing Season Program (AFSP)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For U.S. Revenue Officer

- Highlight your expertise in tax law and financial investigations, demonstrating a deep understanding of tax codes and auditing procedures.

- Quantify your accomplishments with specific metrics, such as the percentage of revenue increase or amount of unpaid taxes recovered.

- Showcase your negotiation and communication skills, emphasizing your ability to resolve disputes amicably and effectively.

- Mention any leadership or mentorship experience, demonstrating your ability to guide and develop others.

- Tailor your resume to the specific requirements of the position, using relevant keywords and aligning your experience with the responsibilities outlined in the job description.

Essential Experience Highlights for a Strong U.S. Revenue Officer Resume

- Develop and execute strategies to increase tax revenue collection and minimize non-compliance.

- Conduct thorough financial investigations, uncovering hidden assets and complex tax schemes to recover unpaid taxes.

- Negotiate and resolve tax disputes through Offer in Compromise, Installment Agreements, and other settlement techniques.

- Provide expert guidance and support to taxpayers, ensuring adherence to tax regulations and maximizing compliance.

- Train and mentor revenue officers, fostering knowledge transfer and enhancing team capabilities.

- Utilize data analytics and investigative techniques to identify tax discrepancies and potential irregularities.

- Collaborate with internal and external stakeholders to develop and implement effective tax collection initiatives.

Frequently Asked Questions (FAQ’s) For U.S. Revenue Officer

What are the primary responsibilities of a U.S. Revenue Officer?

U.S. Revenue Officers are responsible for maximizing tax revenue collection, conducting financial investigations, negotiating tax disputes, providing taxpayer guidance, training new officers, and utilizing data analytics to identify non-compliance.

What qualifications are required to become a U.S. Revenue Officer?

Typically, a bachelor’s degree is required, along with relevant experience in tax law, accounting, or a related field.

What are the career advancement opportunities for U.S. Revenue Officers?

With experience and additional qualifications, Revenue Officers can advance to supervisory and management roles within the IRS or other government agencies.

What is the salary range for U.S. Revenue Officers?

The salary range varies depending on experience and location, but typically falls within the GS-7 to GS-13 pay grades, with potential for higher salaries in supervisory roles.

What are the benefits of working as a U.S. Revenue Officer?

Benefits include competitive salaries, comprehensive health and retirement benefits, opportunities for professional development, and the chance to make a meaningful contribution to the nation’s tax system.

How can I prepare for an interview for a U.S. Revenue Officer position?

Research the IRS and the specific position, practice answering common interview questions, and highlight your relevant skills and experience in tax law, financial investigations, and customer service.

What is the role of a U.S. Revenue Officer in tax compliance?

Revenue Officers are responsible for ensuring taxpayer compliance through audits, investigations, and negotiations, working to maximize tax revenue collection and minimize non-compliance.