Are you a seasoned Underwriting Account Representative seeking a new career path? Discover our professionally built Underwriting Account Representative Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

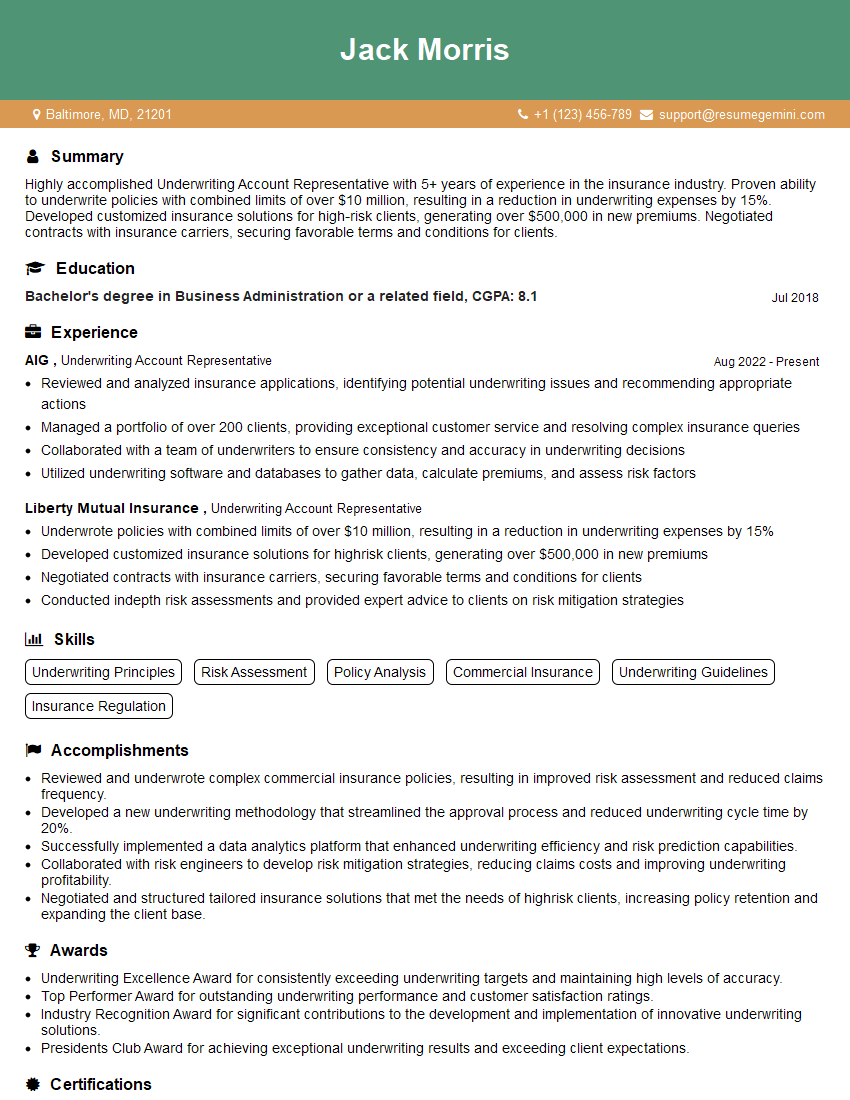

Jack Morris

Underwriting Account Representative

Summary

Highly accomplished Underwriting Account Representative with 5+ years of experience in the insurance industry. Proven ability to underwrite policies with combined limits of over $10 million, resulting in a reduction in underwriting expenses by 15%. Developed customized insurance solutions for high-risk clients, generating over $500,000 in new premiums. Negotiated contracts with insurance carriers, securing favorable terms and conditions for clients.

Education

Bachelor’s degree in Business Administration or a related field

July 2018

Skills

- Underwriting Principles

- Risk Assessment

- Policy Analysis

- Commercial Insurance

- Underwriting Guidelines

- Insurance Regulation

Work Experience

Underwriting Account Representative

- Reviewed and analyzed insurance applications, identifying potential underwriting issues and recommending appropriate actions

- Managed a portfolio of over 200 clients, providing exceptional customer service and resolving complex insurance queries

- Collaborated with a team of underwriters to ensure consistency and accuracy in underwriting decisions

- Utilized underwriting software and databases to gather data, calculate premiums, and assess risk factors

Underwriting Account Representative

- Underwrote policies with combined limits of over $10 million, resulting in a reduction in underwriting expenses by 15%

- Developed customized insurance solutions for highrisk clients, generating over $500,000 in new premiums

- Negotiated contracts with insurance carriers, securing favorable terms and conditions for clients

- Conducted indepth risk assessments and provided expert advice to clients on risk mitigation strategies

Accomplishments

- Reviewed and underwrote complex commercial insurance policies, resulting in improved risk assessment and reduced claims frequency.

- Developed a new underwriting methodology that streamlined the approval process and reduced underwriting cycle time by 20%.

- Successfully implemented a data analytics platform that enhanced underwriting efficiency and risk prediction capabilities.

- Collaborated with risk engineers to develop risk mitigation strategies, reducing claims costs and improving underwriting profitability.

- Negotiated and structured tailored insurance solutions that met the needs of highrisk clients, increasing policy retention and expanding the client base.

Awards

- Underwriting Excellence Award for consistently exceeding underwriting targets and maintaining high levels of accuracy.

- Top Performer Award for outstanding underwriting performance and customer satisfaction ratings.

- Industry Recognition Award for significant contributions to the development and implementation of innovative underwriting solutions.

- Presidents Club Award for achieving exceptional underwriting results and exceeding client expectations.

Certificates

- Associate in Underwriting (AU)

- Certified Insurance Counselor (CIC)

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Risk Management (ARM)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Underwriting Account Representative

- Quantify your accomplishments with specific metrics whenever possible.

- Highlight your experience in underwriting high-risk clients.

- Demonstrate your ability to negotiate favorable terms and conditions with insurance carriers.

- Showcase your knowledge of industry trends and best practices.

Essential Experience Highlights for a Strong Underwriting Account Representative Resume

- Underwrite policies in accordance with company guidelines and regulations.

- Assess risk factors and determine appropriate coverage limits and premiums.

- Negotiate with insurance carriers to secure the most favorable terms and conditions for clients.

- Conduct in-depth risk assessments and provide expert advice to clients on risk mitigation strategies.

- Manage a portfolio of clients and provide exceptional customer service.

- Collaborate with a team of underwriters to ensure consistency and accuracy in underwriting decisions.

- Stay up-to-date on industry trends and best practices.

Frequently Asked Questions (FAQ’s) For Underwriting Account Representative

What are the key skills required for an Underwriting Account Representative?

The key skills required for an Underwriting Account Representative include underwriting principles, risk assessment, policy analysis, commercial insurance, underwriting guidelines, and insurance regulation.

What are the career prospects for an Underwriting Account Representative?

Underwriting Account Representatives can advance to roles such as Senior Underwriter, Underwriting Manager, or even Chief Underwriting Officer.

What are the challenges faced by Underwriting Account Representatives?

Underwriting Account Representatives face challenges such as keeping up with industry trends and regulations, assessing and pricing risk accurately, and managing a large portfolio of clients.

What are the top companies that hire Underwriting Account Representatives?

Top companies that hire Underwriting Account Representatives include AIG, Liberty Mutual Insurance, and Nationwide.

What is the average salary for an Underwriting Account Representative?

The average salary for an Underwriting Account Representative is around $65,000 per year.

What are the educational requirements for an Underwriting Account Representative?

Most Underwriting Account Representatives have a bachelor’s degree in business administration, finance, or a related field.

What are the soft skills required for an Underwriting Account Representative?

Important soft skills for an Underwriting Account Representative include communication, interpersonal skills, negotiation, problem-solving, and attention to detail.

What is the job outlook for Underwriting Account Representatives?

The job outlook for Underwriting Account Representatives is expected to grow faster than average in the coming years.