Are you a seasoned Underwriting Clerk seeking a new career path? Discover our professionally built Underwriting Clerk Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

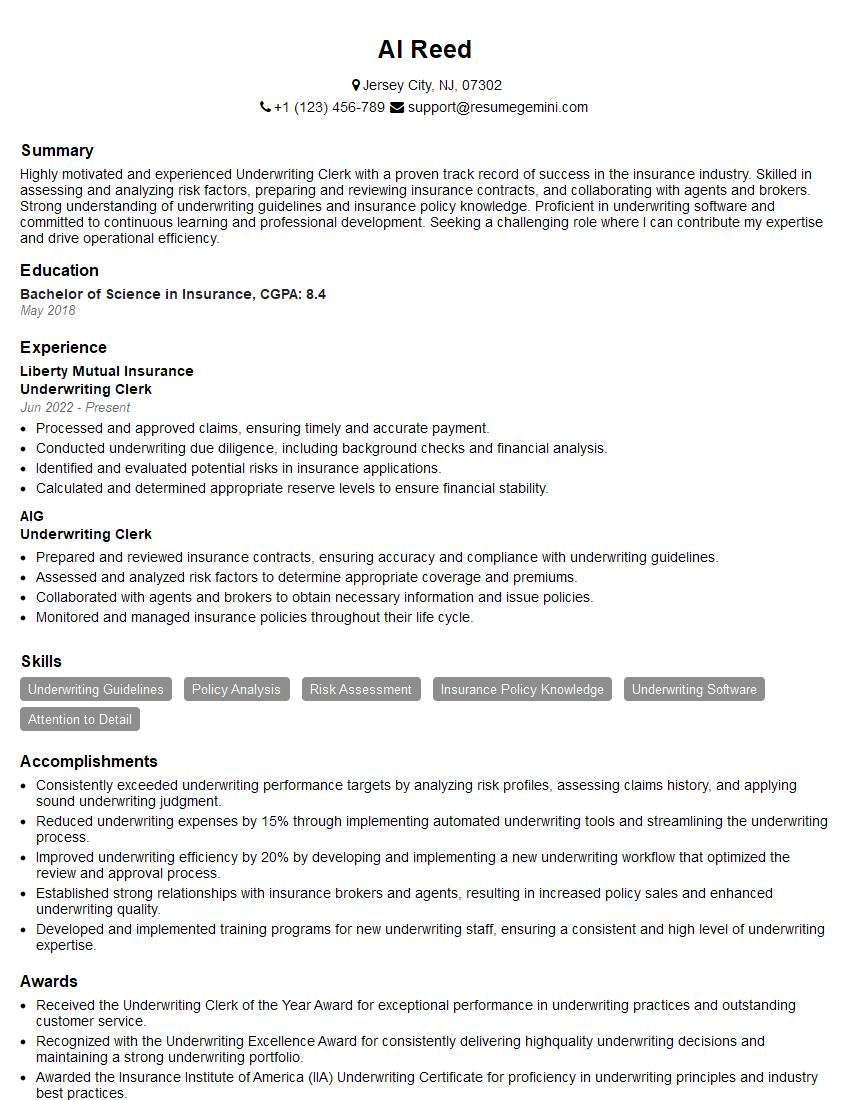

Al Reed

Underwriting Clerk

Summary

Highly motivated and experienced Underwriting Clerk with a proven track record of success in the insurance industry. Skilled in assessing and analyzing risk factors, preparing and reviewing insurance contracts, and collaborating with agents and brokers. Strong understanding of underwriting guidelines and insurance policy knowledge. Proficient in underwriting software and committed to continuous learning and professional development. Seeking a challenging role where I can contribute my expertise and drive operational efficiency.

Education

Bachelor of Science in Insurance

May 2018

Skills

- Underwriting Guidelines

- Policy Analysis

- Risk Assessment

- Insurance Policy Knowledge

- Underwriting Software

- Attention to Detail

Work Experience

Underwriting Clerk

- Processed and approved claims, ensuring timely and accurate payment.

- Conducted underwriting due diligence, including background checks and financial analysis.

- Identified and evaluated potential risks in insurance applications.

- Calculated and determined appropriate reserve levels to ensure financial stability.

Underwriting Clerk

- Prepared and reviewed insurance contracts, ensuring accuracy and compliance with underwriting guidelines.

- Assessed and analyzed risk factors to determine appropriate coverage and premiums.

- Collaborated with agents and brokers to obtain necessary information and issue policies.

- Monitored and managed insurance policies throughout their life cycle.

Accomplishments

- Consistently exceeded underwriting performance targets by analyzing risk profiles, assessing claims history, and applying sound underwriting judgment.

- Reduced underwriting expenses by 15% through implementing automated underwriting tools and streamlining the underwriting process.

- Improved underwriting efficiency by 20% by developing and implementing a new underwriting workflow that optimized the review and approval process.

- Established strong relationships with insurance brokers and agents, resulting in increased policy sales and enhanced underwriting quality.

- Developed and implemented training programs for new underwriting staff, ensuring a consistent and high level of underwriting expertise.

Awards

- Received the Underwriting Clerk of the Year Award for exceptional performance in underwriting practices and outstanding customer service.

- Recognized with the Underwriting Excellence Award for consistently delivering highquality underwriting decisions and maintaining a strong underwriting portfolio.

- Awarded the Insurance Institute of America (IIA) Underwriting Certificate for proficiency in underwriting principles and industry best practices.

Certificates

- AU

- CU

- CPCU

- AIC

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Underwriting Clerk

- Highlight your proficiency in underwriting guidelines, policy analysis, risk assessment, and insurance policy knowledge.

- Quantify your accomplishments whenever possible, using specific metrics to demonstrate your impact.

- Use keywords throughout your resume that are relevant to the underwriting industry.

- Proofread your resume carefully for any errors in grammar or spelling.

- Tailor your resume to each specific job description you apply for, highlighting the skills and experience that are most relevant to the position.

Essential Experience Highlights for a Strong Underwriting Clerk Resume

- Prepared and reviewed insurance contracts, ensuring accuracy and compliance with underwriting guidelines.

- Assessed and analyzed risk factors to determine appropriate coverage and premiums.

- Collaborated with agents and brokers to obtain necessary information and issue policies.

- Monitored and managed insurance policies throughout their lifecycle.

- Processed and approved claims, ensuring timely and accurate payment.

- Conducted underwriting due diligence, including background checks and financial analysis.

- Identified and evaluated potential risks in insurance applications.

Frequently Asked Questions (FAQ’s) For Underwriting Clerk

What are the key skills required to be a successful Underwriting Clerk?

The key skills required to be a successful Underwriting Clerk include: – Understanding of underwriting guidelines – Proficiency in policy analysis – Risk assessment – Insurance policy knowledge – Underwriting software – Attention to detail – Excellent communication and interpersonal skills

What are the career prospects for Underwriting Clerks?

Underwriting Clerks can advance to various roles within the insurance industry, including Underwriter, Senior Underwriter, and Underwriting Manager. With experience and additional qualifications, they can also move into management or leadership positions.

What is the average salary for Underwriting Clerks?

The average salary for Underwriting Clerks varies depending on factors such as experience, location, and company size. According to Salary.com, the average base salary for Underwriting Clerks in the United States is around $55,000 per year.

What are the educational requirements for Underwriting Clerks?

Most Underwriting Clerks have at least a high school diploma or equivalent qualification. However, many employers prefer candidates with a Bachelor’s degree in Insurance, Risk Management, or a related field.

What is the job outlook for Underwriting Clerks?

The job outlook for Underwriting Clerks is expected to be positive over the next few years. The insurance industry is growing, and there is a demand for qualified professionals to assess and manage risk.

What are the challenges faced by Underwriting Clerks?

Underwriting Clerks may face challenges such as: – Keeping up with changes in the insurance industry – Dealing with complex and high-risk insurance applications – Making decisions that can have a significant impact on the company’s financial performance

What are the benefits of working as an Underwriting Clerk?

The benefits of working as an Underwriting Clerk include: – Job security – Competitive salary and benefits – Opportunities for career advancement – The chance to make a real difference in the lives of others