Are you a seasoned Underwriting Clerks Supervisor seeking a new career path? Discover our professionally built Underwriting Clerks Supervisor Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

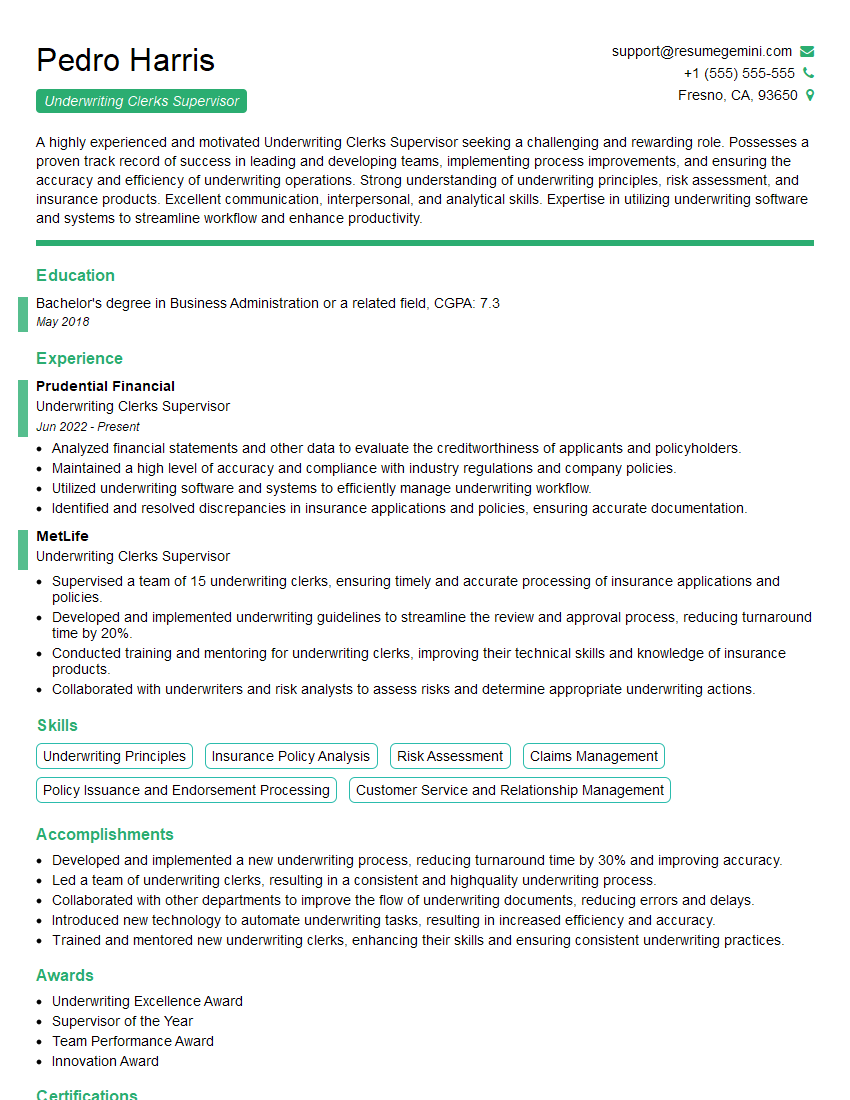

Pedro Harris

Underwriting Clerks Supervisor

Summary

A highly experienced and motivated Underwriting Clerks Supervisor seeking a challenging and rewarding role. Possesses a proven track record of success in leading and developing teams, implementing process improvements, and ensuring the accuracy and efficiency of underwriting operations. Strong understanding of underwriting principles, risk assessment, and insurance products. Excellent communication, interpersonal, and analytical skills. Expertise in utilizing underwriting software and systems to streamline workflow and enhance productivity.

Education

Bachelor’s degree in Business Administration or a related field

May 2018

Skills

- Underwriting Principles

- Insurance Policy Analysis

- Risk Assessment

- Claims Management

- Policy Issuance and Endorsement Processing

- Customer Service and Relationship Management

Work Experience

Underwriting Clerks Supervisor

- Analyzed financial statements and other data to evaluate the creditworthiness of applicants and policyholders.

- Maintained a high level of accuracy and compliance with industry regulations and company policies.

- Utilized underwriting software and systems to efficiently manage underwriting workflow.

- Identified and resolved discrepancies in insurance applications and policies, ensuring accurate documentation.

Underwriting Clerks Supervisor

- Supervised a team of 15 underwriting clerks, ensuring timely and accurate processing of insurance applications and policies.

- Developed and implemented underwriting guidelines to streamline the review and approval process, reducing turnaround time by 20%.

- Conducted training and mentoring for underwriting clerks, improving their technical skills and knowledge of insurance products.

- Collaborated with underwriters and risk analysts to assess risks and determine appropriate underwriting actions.

Accomplishments

- Developed and implemented a new underwriting process, reducing turnaround time by 30% and improving accuracy.

- Led a team of underwriting clerks, resulting in a consistent and highquality underwriting process.

- Collaborated with other departments to improve the flow of underwriting documents, reducing errors and delays.

- Introduced new technology to automate underwriting tasks, resulting in increased efficiency and accuracy.

- Trained and mentored new underwriting clerks, enhancing their skills and ensuring consistent underwriting practices.

Awards

- Underwriting Excellence Award

- Supervisor of the Year

- Team Performance Award

- Innovation Award

Certificates

- Associate in Underwriting (AU)

- Fellow of the Casualty Actuarial Society (FCAS)

- Certified Insurance Counselor (CIC)

- Accredited Customer Service Representative (ACSR)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Underwriting Clerks Supervisor

- Highlight your experience in supervising and leading teams, emphasizing your ability to motivate and develop high-performing individuals.

- Showcase your expertise in underwriting principles, risk assessment, and insurance products, demonstrating your in-depth knowledge of the industry.

- Quantify your achievements whenever possible, using specific metrics to demonstrate the impact of your contributions to the organization.

- Include keywords relevant to the insurance industry and underwriting roles, such as underwriting guidelines, risk analysis, and policy issuance.

- Proofread your resume carefully before submitting it, ensuring that there are no errors in grammar, spelling, or formatting.

Essential Experience Highlights for a Strong Underwriting Clerks Supervisor Resume

- Supervise and lead a team of underwriting clerks, providing guidance, support, and performance management.

- Develop and implement underwriting guidelines to standardize the review and approval process, reducing turnaround time and improving efficiency.

- Conduct training and mentoring for underwriting clerks, enhancing their technical skills and knowledge of insurance products and industry regulations.

- Collaborate with underwriters and risk analysts to assess risks, determine appropriate underwriting actions, and provide underwriting support.

- Analyze financial statements and other data to evaluate the creditworthiness of applicants and policyholders, ensuring sound underwriting decisions.

- Maintain a high level of accuracy and compliance with industry regulations and company policies, ensuring the integrity of underwriting operations.

- Utilize underwriting software and systems to efficiently manage underwriting workflow, track progress, and identify areas for improvement.

Frequently Asked Questions (FAQ’s) For Underwriting Clerks Supervisor

What are the primary responsibilities of an Underwriting Clerks Supervisor?

An Underwriting Clerks Supervisor is responsible for leading and managing a team of underwriting clerks, developing and implementing underwriting guidelines, conducting training and mentoring, collaborating with underwriters and risk analysts, analyzing financial data, maintaining accuracy and compliance, and utilizing underwriting software and systems.

What qualifications are typically required to become an Underwriting Clerks Supervisor?

To become an Underwriting Clerks Supervisor, a bachelor’s degree in business administration or a related field is typically required. Additionally, several years of experience in the insurance industry, particularly in underwriting, are often required.

What skills are essential for success as an Underwriting Clerks Supervisor?

Essential skills for success as an Underwriting Clerks Supervisor include strong leadership and management abilities, expertise in underwriting principles and risk assessment, excellent communication and interpersonal skills, proficiency in utilizing underwriting software and systems, and a commitment to accuracy and compliance.

What are the career advancement opportunities for an Underwriting Clerks Supervisor?

Underwriting Clerks Supervisors can advance their careers by moving into management roles, such as Underwriting Manager or Assistant Vice President of Underwriting. Additionally, they may specialize in particular areas of underwriting, such as commercial or personal lines.

What are the key challenges faced by Underwriting Clerks Supervisors?

Key challenges faced by Underwriting Clerks Supervisors include managing a team effectively, ensuring the accuracy and efficiency of underwriting operations, keeping up with industry regulations and changes, and motivating and developing their team members.

What is the job outlook for Underwriting Clerks Supervisors?

The job outlook for Underwriting Clerks Supervisors is expected to be positive, as the demand for insurance products and services continues to grow.

What are the average salary ranges for Underwriting Clerks Supervisors?

According to the U.S. Bureau of Labor Statistics, the median annual salary for Underwriting Supervisors was $74,220 in May 2021.

What professional development opportunities are available for Underwriting Clerks Supervisors?

Underwriting Clerks Supervisors can pursue professional development opportunities through industry conferences, workshops, and online courses. Additionally, they can obtain industry certifications, such as the Associate in Underwriting (AU) or Fellow, Life Management Institute (FLMI), to enhance their knowledge and credibility.