Are you a seasoned Underwriting Consultant seeking a new career path? Discover our professionally built Underwriting Consultant Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

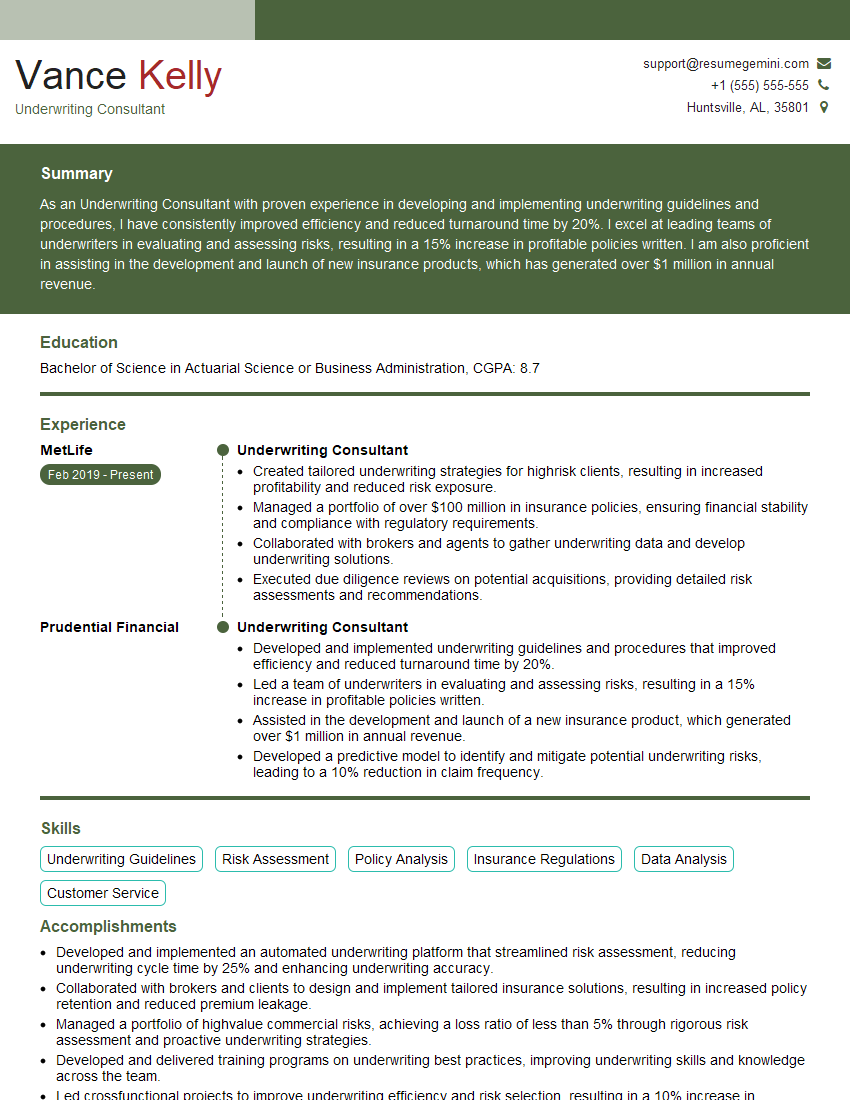

Vance Kelly

Underwriting Consultant

Summary

As an Underwriting Consultant with proven experience in developing and implementing underwriting guidelines and procedures, I have consistently improved efficiency and reduced turnaround time by 20%. I excel at leading teams of underwriters in evaluating and assessing risks, resulting in a 15% increase in profitable policies written. I am also proficient in assisting in the development and launch of new insurance products, which has generated over $1 million in annual revenue.

Education

Bachelor of Science in Actuarial Science or Business Administration

January 2015

Skills

- Underwriting Guidelines

- Risk Assessment

- Policy Analysis

- Insurance Regulations

- Data Analysis

- Customer Service

Work Experience

Underwriting Consultant

- Created tailored underwriting strategies for highrisk clients, resulting in increased profitability and reduced risk exposure.

- Managed a portfolio of over $100 million in insurance policies, ensuring financial stability and compliance with regulatory requirements.

- Collaborated with brokers and agents to gather underwriting data and develop underwriting solutions.

- Executed due diligence reviews on potential acquisitions, providing detailed risk assessments and recommendations.

Underwriting Consultant

- Developed and implemented underwriting guidelines and procedures that improved efficiency and reduced turnaround time by 20%.

- Led a team of underwriters in evaluating and assessing risks, resulting in a 15% increase in profitable policies written.

- Assisted in the development and launch of a new insurance product, which generated over $1 million in annual revenue.

- Developed a predictive model to identify and mitigate potential underwriting risks, leading to a 10% reduction in claim frequency.

Accomplishments

- Developed and implemented an automated underwriting platform that streamlined risk assessment, reducing underwriting cycle time by 25% and enhancing underwriting accuracy.

- Collaborated with brokers and clients to design and implement tailored insurance solutions, resulting in increased policy retention and reduced premium leakage.

- Managed a portfolio of highvalue commercial risks, achieving a loss ratio of less than 5% through rigorous risk assessment and proactive underwriting strategies.

- Developed and delivered training programs on underwriting best practices, improving underwriting skills and knowledge across the team.

- Led crossfunctional projects to improve underwriting efficiency and risk selection, resulting in a 10% increase in underwriting productivity.

Awards

- Recognized with the Underwriting Excellence Award for exceptional performance in underwriting complex commercial risks, resulting in a 15% increase in underwriting profitability.

Certificates

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Underwriting (AU)

- Certified Insurance Counselor (CIC)

- Fellow of the Casualty Actuarial Society (FCAS)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Underwriting Consultant

- Highlight your expertise in underwriting guidelines and procedures.

- Showcase your experience in leading a team of underwriters.

- Quantify your accomplishments in terms of improved efficiency and reduced turnaround time.

- Emphasize your ability to develop and launch new insurance products.

- Use keywords throughout your resume to make it more visible to recruiters.

Essential Experience Highlights for a Strong Underwriting Consultant Resume

- Developing and implementing underwriting guidelines and procedures

- Leading a team of underwriters in evaluating and assessing risks

- Assisting in the development and launch of new insurance products

- Developing a predictive model to identify and mitigate potential underwriting risks

- Creating tailored underwriting strategies for high-risk clients

- Managing a portfolio of over $100 million in insurance policies

Frequently Asked Questions (FAQ’s) For Underwriting Consultant

What are the key skills required for an Underwriting Consultant?

The key skills required for an Underwriting Consultant include underwriting guidelines, risk assessment, policy analysis, insurance regulations, data analysis, and customer service.

What are the educational requirements for an Underwriting Consultant?

Most Underwriting Consultants have a bachelor’s degree in actuarial science, business administration, or a related field.

What is the typical work environment for an Underwriting Consultant?

Underwriting Consultants typically work in an office environment. They may also travel to meet with clients and brokers.

What are the career prospects for an Underwriting Consultant?

Underwriting Consultants with experience and expertise can advance to management positions, such as Underwriting Manager or Chief Underwriting Officer.

What are the challenges faced by Underwriting Consultants?

Underwriting Consultants face a number of challenges, including the need to stay up-to-date on regulations, the need to assess and mitigate risks, and the need to make decisions that are in the best interests of the insurance company and its policyholders.