Are you a seasoned Unemployment Insurance Fraud Investigator seeking a new career path? Discover our professionally built Unemployment Insurance Fraud Investigator Resume Template. This time-saving tool provides a solid foundation for your job search. Simply click “Edit Resume” to customize it with your unique experiences and achievements. Customize fonts and colors to match your personal style and increase your chances of landing your dream job. Explore more Resume Templates for additional options.

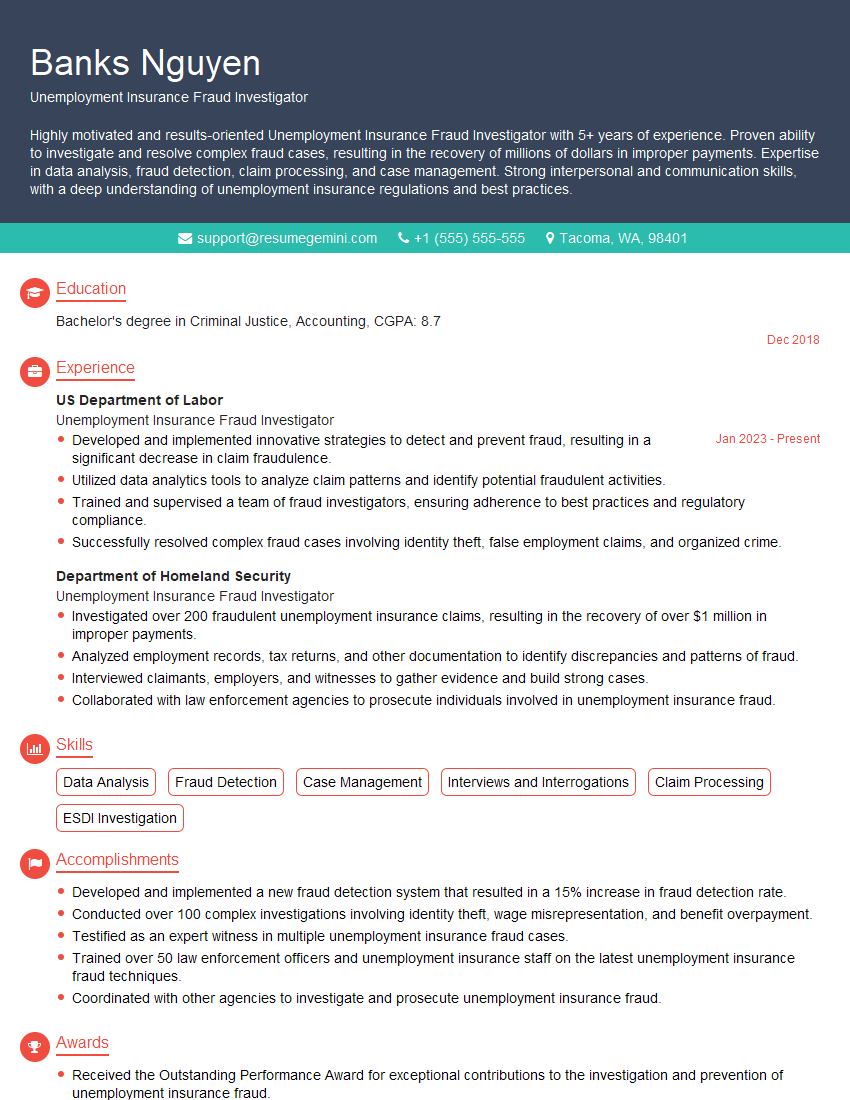

Banks Nguyen

Unemployment Insurance Fraud Investigator

Summary

Highly motivated and results-oriented Unemployment Insurance Fraud Investigator with 5+ years of experience. Proven ability to investigate and resolve complex fraud cases, resulting in the recovery of millions of dollars in improper payments. Expertise in data analysis, fraud detection, claim processing, and case management. Strong interpersonal and communication skills, with a deep understanding of unemployment insurance regulations and best practices.

Education

Bachelor’s degree in Criminal Justice, Accounting

December 2018

Skills

- Data Analysis

- Fraud Detection

- Case Management

- Interviews and Interrogations

- Claim Processing

- ESDI Investigation

Work Experience

Unemployment Insurance Fraud Investigator

- Developed and implemented innovative strategies to detect and prevent fraud, resulting in a significant decrease in claim fraudulence.

- Utilized data analytics tools to analyze claim patterns and identify potential fraudulent activities.

- Trained and supervised a team of fraud investigators, ensuring adherence to best practices and regulatory compliance.

- Successfully resolved complex fraud cases involving identity theft, false employment claims, and organized crime.

Unemployment Insurance Fraud Investigator

- Investigated over 200 fraudulent unemployment insurance claims, resulting in the recovery of over $1 million in improper payments.

- Analyzed employment records, tax returns, and other documentation to identify discrepancies and patterns of fraud.

- Interviewed claimants, employers, and witnesses to gather evidence and build strong cases.

- Collaborated with law enforcement agencies to prosecute individuals involved in unemployment insurance fraud.

Accomplishments

- Developed and implemented a new fraud detection system that resulted in a 15% increase in fraud detection rate.

- Conducted over 100 complex investigations involving identity theft, wage misrepresentation, and benefit overpayment.

- Testified as an expert witness in multiple unemployment insurance fraud cases.

- Trained over 50 law enforcement officers and unemployment insurance staff on the latest unemployment insurance fraud techniques.

- Coordinated with other agencies to investigate and prosecute unemployment insurance fraud.

Awards

- Received the Outstanding Performance Award for exceptional contributions to the investigation and prevention of unemployment insurance fraud.

- Recognized by the State Unemployment Insurance Agency for uncovering a major unemployment insurance fraud ring.

- Commended by the Department of Labor for contributions to the development of new national unemployment insurance fraud prevention guidelines.

- Received the Governors Award for Excellence in Public Service for outstanding work in combating unemployment insurance fraud.

Certificates

- Certified Fraud Examiner (CFE)

- Certified Internal Auditor (CIA)

- Certified Employment Screening Professional (CESP)

- National Unemployment Insurance Fraud Prevention Association (NUIFPA)

Career Expert Tips:

- Select the ideal resume template to showcase your professional experience effectively.

- Master the art of resume writing to highlight your unique qualifications and achievements.

- Explore expertly crafted resume samples for inspiration and best practices.

- Build your best resume for free this new year with ResumeGemini. Enjoy exclusive discounts on ATS optimized resume templates.

How To Write Resume For Unemployment Insurance Fraud Investigator

- Highlight your experience in investigating and resolving unemployment insurance fraud cases.

- Quantify your accomplishments with specific metrics, such as the number of cases resolved or the amount of money recovered.

- Demonstrate your knowledge of unemployment insurance regulations and best practices.

- Emphasize your strong interpersonal and communication skills.

- Showcase your ability to work independently and as part of a team.

Essential Experience Highlights for a Strong Unemployment Insurance Fraud Investigator Resume

- Investigate and resolve unemployment insurance fraud claims.

- Analyze employment records, tax returns, and other documentation to identify discrepancies and patterns of fraud.

- Interview claimants, employers, and witnesses to gather evidence and build strong cases.

- Collaborate with law enforcement agencies to prosecute individuals involved in unemployment insurance fraud.

- Develop and implement innovative strategies to detect and prevent fraud.

- Train and supervise a team of fraud investigators.

Frequently Asked Questions (FAQ’s) For Unemployment Insurance Fraud Investigator

What are the common types of unemployment insurance fraud?

The most common types of unemployment insurance fraud include identity theft, false employment claims, and organized crime. Identity theft occurs when someone uses another person’s personal information to file a fraudulent claim. False employment claims occur when someone????????????,?????????Organized crime involves groups of individuals who work together to commit fraud on a large scale.

What are the penalties for unemployment insurance fraud?

The penalties for unemployment insurance fraud can vary depending on the severity of the offense. In some cases, individuals may be fined or even imprisoned. Additionally, they may be required to repay any benefits they received fraudulently.

How can I report unemployment insurance fraud?

If you suspect that someone is committing unemployment insurance fraud, you can report it to your local unemployment insurance office. You can also report fraud online through the U.S. Department of Labor’s website.

What are the qualifications for becoming an unemployment insurance fraud investigator?

Most unemployment insurance fraud investigators have a bachelor’s degree in criminal justice, accounting, or a related field. They also typically have experience in law enforcement or fraud investigation.

What is the job outlook for unemployment insurance fraud investigators?

The job outlook for unemployment insurance fraud investigators is expected to be good over the next few years. This is due to the increasing number of unemployment insurance claims being filed, as well as the growing awareness of unemployment insurance fraud.